Question: How has the market reacted during previous Government Shutdowns?

Answer: Not much.

Chart from ZeroHedge at...

http://www.zerohedge.com/news/2013-09-29/how-market-reacted-prior-government-shut-downs

DEBT LIMIT? So what?

Regarding the debt limit, on average: the S&P 500 was

down 1%, 5-days before the debt limit was raised and up 0.3%, 5-days after it

was raised. The debt limit has always

been raised. If the debt limit isn’t raised,

we could expect a lot more downside.

Chart at…http://www.zerohedge.com/news/2013-09-29/how-market-reacted-prior-government-shut-downs

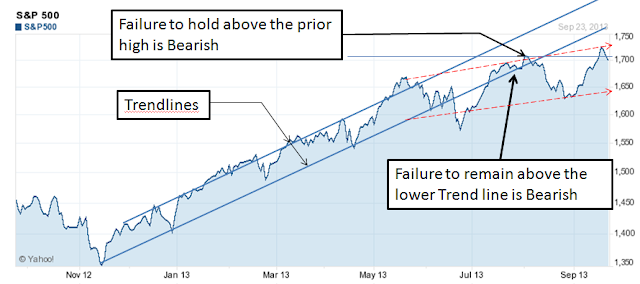

MARKET REPORT

Monday, the S&P finished down 0.6% to 1,682 (rounded) at the close.

VIX was up 7% to 16.60.Monday, the S&P finished down 0.6% to 1,682 (rounded) at the close.

MARKET INTERNALS (NYSE DATA)

The 10-day moving average of stocks advancing on the NYSE fell to 51% Friday from 53% at the close Friday. (A number above 50% for the 10-day average is generally good news for the market, but this number has been falling consistently for the last 8-sessions and that's not good.

New-highs outpaced new-lows Monday, leaving the spread (new-hi

minus new-low) at +30 (it was +45 Friday).

The 10-day moving average of change in the spread is minus 15. That just

means that over the last 10-days, the spread has been getting worse.

Market Internals are Negative on the market for this short

term indicator.

NTSM

Monday, the overall long-term NTSM analysis remains HOLD at

the close, but the numbers are so close to a Sell that I could easily just call

it a sell – no surprise there given the recent market action.

The 5-day, percent-bulls (bulls/(bulls+bears) in the

Guggenheim/Rydex funds I track remains 67%-bulls as of Friday’s close. That is

an extreme bullish value that is usually a negative for the markets.

VIX is now rising at an alarming rate suggesting the

Options crowd is finally getting worried about the market.

Still, with QE full on, if I see any signs of a

turn-around, I’ll be a buyer of stocks to bring my invested percent up to

50%. So far, there is little to suggest

that this is anything other than a normal correction, regardless of the cause.

MY INVESTED POSITION

I remain about 20% invested in stocks as of 5 March (S&P 500 -1540). The NTSM system sold at 1575 on 16 April. (This is just another reminder that I should follow the NTSM analysis and not act emotionally – I am under-performing my own system by about 2%!) I have no problems leaving 20% or 30% invested. If the market is cut in half (worst case) I’d only lose 10%-15% of my investments. It also hedges the bet if I am wrong since I will have some invested if the market goes up. No system is perfect.