The following commentary is an excellent discussion of

the yield curve, its definition, interpretation, and the current status. I’ve just posted the bottom line; but if you

have an interest in the yield curve, it’s a good read!

FOLLOW THE CURVE (dShort.com)

The current yield curve is nowhere near inverted…despite

the bubble calls. Based on lending standards, the yield curve, and the yield

spread, there's no credit bubble here. The business cycle looks healthy to me.”

- Ryan Puplava posted at dShort.com, Advisor Perspectives, at…

http://advisorperspectives.com/dshort/guest/Ryan-Puplava-131122-Yield-Curve.php

Recession: My own comparison of S&P 500 prices to the

Morgan Stanly Cyclical Index (a basket of stocks sensitive to recession) also

shows that investors agree, but there are signs of concern. Cyclicals have been underperforming the

S&P 50 recently, but not enough to worry about.

In the following “sentiment” discussion, Tony Dwyer,

Canaccord Genuity senior managing director, says that “Taper” will not cause

problems for the market.

‘SENTIMENT IS TOO HIGH,’ STOCK MARKET BULL SAYS (CNBC)

"One of the things I want to address is: People get

so wrapped up on whether the market is overvalued, undervalued or fair. That's

not relevant," he said. "What's relevant is what changes the

direction of the underlying trend in valuations. And when you're in an uptrend

in valuations in a nonrecession environment, it's one thing: Fed policy. And

Fed policy of tapering does not change the interest expense on existing debt,

which is what crushes economic activity because we have so much variable-rate

debt." Story at…

http://www.cnbc.com/id/101218344

His view of the high sentiment was that, once again, any

pullback would be less than 4%.

We have heard from Hussman and others that the current

high corporate profits can’t be sustained and they will fall soon. Here’s another view…

THE PROFIT DEBATE (dShort.com)

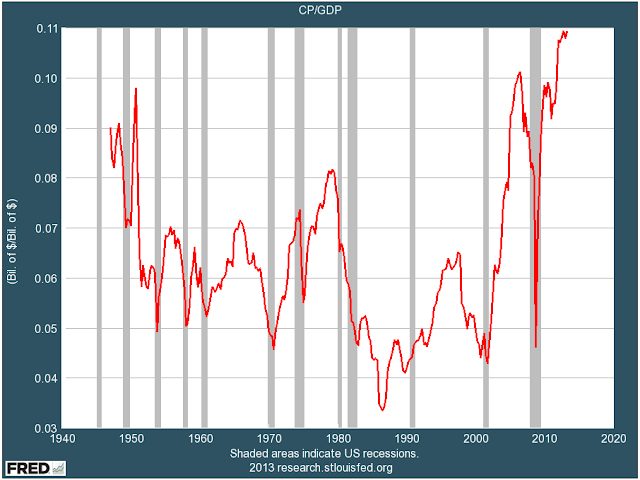

“In the second quarter of 2013…[corporate profit as a %

of GDP]…touched 9.9%, the second highest rate on record... Most analyses

mistakenly stop there, concluding that margins are unsustainably high and will

shortly fall. We need to dig a little deeper, however, to do fair justice to

the topic….Today's high after-tax profit margin is due primarily to low

interest costs and not high EBIT [earnings before interest and taxes] margins (which

are competed away in a capitalist system). Interest costs will likely rise as a

percentage of GNP over the course of the next five years. That is to say,

economy-wide profit margins should gradually fall as interest rates rise–not

collapse as some predict. I write all this to address a topic frequently

debated and to lay out a case that the most negative scenario of collapsing

margins outside a recession is a low probability event.” Full story at DShort Advisor Perspectives at…

http://advisorperspectives.com/dshort/guest/Alan-Hartley-131121-The-Profit-Debate.php

Regarding Profits:

We know from FactSet that a high percentage of companies have warned of

falling profits. Keep in mind though,

every investor knows that fact and it is already built into stock prices. So far, the market is not-concerned.

MARKET REPORT

Friday, the S&P was up 0.5% to 1805 (rounded).

VIX was down 3%

to 12.26.

An interesting indicator rarely mentioned is “unchanged

volume”. It is a measure that follows

from observation of tops and bottoms.

Tops tend to be rounded and slow to develop. As a top approaches, more stocks are likely

to remain at the same price. One can

track either unchanged issues (the number of stocks that didn’t change price)

or the volume of shares traded in unchanged issues. I prefer the volume associated with unchanged

stocks. Unchanged volume hit an extreme

level on 18 November (5-standard deviations above the norm) that has been

exceeded only twice in the past 2-years.

On both of those occasions the market dipped about 8% afterward, but

necessarily right away. (For

perspective, the unchanged volume on the 18th was about 10-times

higher than today. That is one reason I think the market will have a small

correction in the coming weeks, perhaps after the Thanksgiving Holiday

week.

In spite of my call for a pullback, I wouldn’t bet

against the markets during Thanksgiving week.

The seasonality indicator around holidays is pretty strong. The markets should be up overall, though,

perhaps not by much. (BTW - The elements of the NTSM long-term system are

designed to avoid corrections less than 10%, so the NTSM analysis may not

generate a sell during small corrections.)

MARKET INTERNALS (NYSE DATA)

The 10-day moving average of stocks advancing was 53% at

the close Thursday. (A number above 50%

for the 10-day average is generally good news for the market.)

New-highs outpaced new-lows Friday, leaving the spread

(new-hi minus new-low) at +168 (it was +83 Thursday). The 10-day moving average of change in the

spread was plus 11. In other words over

the last 10-days, on average, the spread has increased by 11 each day.

Still, the 4-measures of Market Internals that I track

for this indicator did not agree, (advancing volume was slightly negative) so

this trend following indicator is neutral.

Market Internals are a decent trend-following analysis of

current market action, but in 2013 (so far), if I had been buying the positive

ratings and selling negative ratings I would have under-performed a

buy-and-hold strategy.

NTSM ANALYSIS

Sentiment is EXTREME

negative at 74%-bulls for the 5-day indicator.

All other NTSM indicators are

neutral, but are creeping up. Overall, NTSM is neutral. That is a broken record.

(I am mostly out of the market already.)

MY INVESTED POSITION (NO CHANGE)

I remain about 20% invested in stocks as of 5 March

(S&P 500 -1540). The NTSM system

sold at 1575 on 16 April. (This is just

another reminder that I should follow the NTSM analysis and not act emotionally

– I am under-performing my own system by about 2%!) I have no problems leaving 20% or 30%

invested. If the market is cut in half

(worst case) I’d only lose 10%-15% of my investments. It also hedges the bet if I am wrong since I

will have some invested if the market goes up.

No system is perfect.

I still lean toward getting back in, after a pullback, to

speculate on a final ride to the top.

NTSM did give several buy signals over the weeks of 14 and 21 Oct, but

the market just looks too frothy to rush back in…we’ll see if the market will

pullback so I can join the insanity. If

not, cash is fine.