Northern Lights during my visit in Wisconsin taken with an I-phone.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

PHILLY FED REPORT (Philadelphia FED)

“Manufacturing activity in the region continued to expand

overall, according to the firms responding to the March Manufacturing Business Outlook Survey.

The survey’s indicator for general activity edged lower but remained positive,

while the index for shipments ticked up and the index for new orders turned

positive. The employment index remained negative, continuing to suggest a

decline in overall employment levels. Both price indexes fell and remained

below their long-run averages. Future activity indicators rose, suggesting more

widespread expectations for overall growth over the next six months.” Report

at...

https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/mbos-2024-03

HOUSING STARTS / PERMITS (Yahoo Finance)

“U.S. single-family homebuilding and permits fell in

April amid a resurgence in mortgage rates, but new construction remains

supported by an acute shortage of houses for sale. Single-family housing

starts, which account for the bulk of homebuilding, slipped 0.4% to a

seasonally adjusted annual rate of 1.031 million units last month...” Story

at...

https://finance.yahoo.com/news/us-single-family-housing-starts-132204577.html

JOBLESS CLAIMS (PYMNTS)

“The number of initial claims for unemployment insurance

dropped by 10,000 during the week ended Saturday (May 11), reversing about half

of the increase that was seen a week earlier. The total of 222,000 initial

claims filed during the week was down from the previous week’s revised figure

of 232,000...” Story at...

https://www.pymnts.com/personnel/2024/ai-startup-perplexity-adds-3-advisors-to-guide-companys-growth/

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 declined about 0.2% to 5297.

-VIX declined about 0.2% to 12.42.

-The yield on the 10-year Treasury rose to 4.377%.

MY TRADING POSITIONS:

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

CRM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

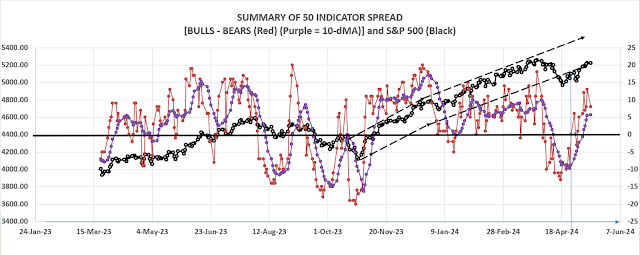

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) remained bullish and was little changed at 7 Bear-signs and 17-Bull.

(The rest are neutral. It is normal to have a lot of neutral indicators since

many of those are top or bottom indicators that will signal only at extremes.)

The 10-dMA of spread (purple line in the chart below) continues to improve, a

bullish sign.

TODAY’S COMMENT:

A new bear sign is the Overbought / Oversold Ratio that

switched to bearish. This tends to be a very short-term indicator that may suggests

a down day for tomorrow or perhaps for a few sessions.

All-in-all, things look OK for now and I am not expecting

significant declines any time soon.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained BUY: PRICE & VOLUME are bullish; VIX & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I am bullish.

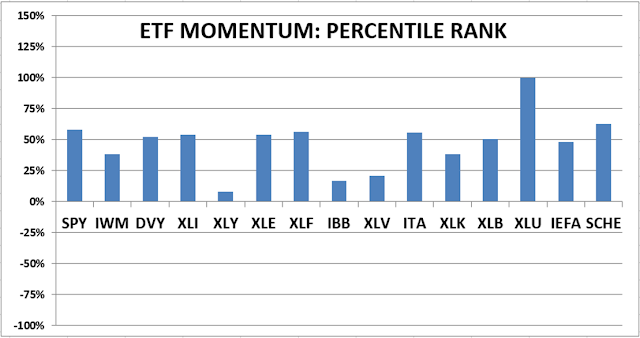

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

I forgot to update this chart

yesterday, but below is Friday’s chart. DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position. This is my max % for stock allocation.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“One of the painful signs of years of dumbed-down

education is how many people are unable to make a coherent argument. They can

vent their emotions, question other people’s motives, make bold assertions, repeat

slogans—anything except reason.” ― Thomas Sowell,

senior fellow at the Hoover Institution.

MISSION OF UCLA ANTI-ISRAEL RALLY – ACTUAL REVOLUTION

(FOX News)

“A watchdog organization with a focus on higher education

released video this week showing an operative from an outside communist group

taking part in an anti-Israel protest on the campus of the University of

California, Los Angeles. ‘I'm a revolutionary organizer,’ a woman named ‘Annie’

tells an undercover journalist with Accuracy in Media in a video released on

Wednesday. ‘I'm an outside agitator,’ she adds with a smile…’We're a

little bit different because we're about getting organized for an actual

revolution.’ Revcom, led by political activist Bob Avakian, is described by Influence Watch...continues to spread its

message of communist ideas and replacing the government system in the United

States." Story at...

'An

actual revolution': Communist Party organizer reveals true mission at UCLA

anti-Israel rally (msn.com)

CPI (CNBC)

"Inflation eased

slightly in April, providing at least a bit of relief for consumers while still

holding above levels that would suggest a cut in interest rates is imminent. The consumer

price index, a broad measure of how much goods and services cost at the

cash register, increased 0.3% from March... On a 12-month basis, however, the

CPI increased 3.4%, in line with expectations...” Story at...

https://www.cnbc.com/2024/05/15/cpi-inflation-april-2024-consumer-prices-rose-0point3percent-in-april.html

Core CPI came in as expected.

RETAIL SALES (Yahoo Finance)

“The US consumer showed signs of slowing in April. Retail

sales were flat in the month, according to data

from the Commerce Department, furthering concerns about the state of the

consumer amid sticky inflation and higher interest rates." Story at...

https://finance.yahoo.com/news/retail-sales-flat-in-april-falling-short-of-wall-streets-expectations-123315122.html

Sales were below expectations.

NY FED MANUFACTURING (NY FED)

“Business activity continued to decline in New York

State, according to firms responding to the May 2024 Empire State Manufacturing Survey.

The headline general business conditions index was little changed at -15.6. New

orders declined significantly, while shipments held steady. Unfilled orders

continued to decline. Delivery times shortened, and inventories were little

changed. Labor market conditions remained weak, with employment and hours

worked continuing to move lower. The pace of input and selling price increases

moderated slightly. Though firms expect conditions to improve over the next six

months, optimism was subdued.” Report at...

https://www.newyorkfed.org/survey/empire/empiresurvey_overview

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 2.5 million barrels from the

previous week. At 457.0 million barrels, U.S. crude oil inventories are about

4% below the five-year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

This report shows strong demand continues for crude

suggesting continued pricing strength.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 rose about 1.2% to 5308.

-VIX declined about 7% to 12.45.

-The yield on the 10-year Treasury declined to 4.342%.

MY TRADING POSITIONS:

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) remained bullish at 7 Bear-signs and 18-Bull. (The rest are

neutral. It is normal to have a lot of neutral indicators since many of those

are top or bottom indicators that will signal only at extremes.) The 10-dMA of

spread (purple line in the chart below) continues to improve, a bullish sign.

TODAY’S COMMENT:

It didn’t take long for the S&P 500 to make new

highs. Wednesday, the S&P 500 made an all-time high about 1% higher than

the March high. 10.1% of issues on the NYSE made new 52-week, all-time highs Wednesday.

The average number for this stat is about 6.7% so this indicates that the

advance has been healthy so far. If there were to be a correction now (and I am

not predicting one), it is likely that it would be a normal, less than a 10%

pullback.

There was a new bear sign today in the indicators. The

S&P 500 is now 12.2% above its 200-dMA. That’s a worrisome high that is will

eventually be a drag on the markets. At the prior top in March, the Index got

to 13.8% above its 200-dMA before the 5.5% “correction” that finished 19 April.

Charts look OK now so I won’t worry about this indicator for now.

Regarding that April bottom, I added to stock holdings 3-sessions

after the bottom and went “all-in” 6-sessions after the bottom. So far, the

indicator that I refer to as the “Summary of 50-Indicator Spread” is proving

its worth.

As reported on CNBC, Bank of America now calling a year

end value of 5600 on the S&P 500. That’s about 5.5% higher than today’s

close. Seems to me that it can go higher than that, but I won’t hazard a guess.

We’ll just watch and see what happens.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

BUY: PRICE & VOLUME are bullish; VIX & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of this recent bear market, based on the bearish “Friday Rundown”

of indicators.)

BOTTOM LINE

I am bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

I forgot to update this chart

yesterday, but below is Friday’s chart. DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position. This is my max % for stock allocation.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

THE KIDS HAVE NO IDEA (Newsweek)

“...moral judgment runs so strongly against that of the

student divestment [of Israeli investment] demands that 14 states (including

Illinois) increased their

investments in Israel as a sign of solidarity with the country after the Oct. 7

massacre...

...Ben and Jerry's seemed to think that it could buy

itself peace by caving into demands of a small Vermont BDS organization.

[Boycott, Divestment, Sanctions (BDS) movement, whose aim is to destroy Israel

as a Jewish state.] But it only bought itself trouble. The evidence is

everywhere that the weight of moral judgment runs in Israel's favor, and that

universities divesting from Israel will face substantial pushback. The

universities are making the same mistake the ice cream maker did: vastly

overweighting the view of the protesters they happen to see every day, and

insufficiently considering the views of all their stakeholders.” Story at...

The

Kids Have No Idea What They're Talking About on Israel | Opinion (msn.com)

SORRY MR. PREZ – INFLATION ISN’T DUE TO CORPORATE GREED

(Tampa Free Press)

“The Federal Reserve Bank of San Francisco's research

shows that while there has been an increase in markups (the difference between

a product's selling price and its production cost) in select industries like

motor vehicles, the overall markup rate has remained largely in line with

previous economic recoveries. Contrary to Biden's claims, the data suggests

that fluctuations in corporate markups have not been a driving force behind the

ups and downs of inflation during the post-pandemic recovery... The report

attributes the current inflationary pressures to other factors, such as the

massive government stimulus spending [and the FED]...” Story at...

Debunking

Biden’s “Greedflation” Claim: The Fed Reveals The True Drivers Of Inflation

(msn.com)

My cmt: Yup, the Government caused the inflation, but it’s

good politics to blame it on someone else.

“You will never find a more wretched hive of scum and

villainy.” – Obi-Wan visits Washington DC.

ANOTHER FUN INTERNET LIST – ACTIVITIES TO AVOID AFTER AGE

75

[#6 & #7 were interesting.]

“6. Do Not Run for President... the rigors of

campaigning, coupled with the immense pressures and demands of the presidency,

require an extraordinary level of stamina, resilience, and mental acuity. These

challenges can be particularly daunting for individuals in their eighties,

potentially impacting their health and capacity to fulfill the role

effectively...

7. Do Not Run a Country... Similarly, running a country,

whether as a head of state or government, places immense responsibility on an

individual's shoulders. These are shoulders that aren't as strong as they once

were. It involves making critical decisions that affect millions, often in

high-pressure situations requiring quick thinking and decisiveness. For someone

in their eighties, the physical and mental demands of such a position and the

24/7 nature of the role could prove overwhelming, potentially impacting the

effectiveness of governance and personal well-being...” Commentary at...

30

Activities to Avoid After 75: The Golden Years (msn.com)

PPI (CNBC)

“Wholesale prices jumped more than expected in April,

putting up another potential roadblock to interest rate cuts anytime soon. The

producer price index, a gauge of prices received at the wholesale level,

increased 0.5% for the month... On a year-over-year basis, wholesale inflation

rose 2.2%, also the highest in a year.” Story at...

https://www.cnbc.com/2024/05/14/ppi-report-wholesale-prices-rose-0point5percent-in-april-more-than-expected.html

Last month’s reading were revised down so this wasn’t a

big a shock as it might have been.

NFIB BUSINESS OPTIMISM (Roanoke Times)

“NFIB’s

Small Business Optimism Index rose by 1.2 points in April to 89.7, marking the

first increase of this year but the 28th consecutive month below the 50-year

average of 98. Twenty-two percent of owners reported that inflation was their

single most important problem in their business, down three points from March

but still the number one problem for small business owners.” Story at...

https://www.theroanokestar.com/2024/05/14/nfib-inflation-continues-to-hinder-small-business-operations/

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.5% to 5247.

-VIX declined about 1% to 13.42.

-The yield on the 10-year Treasury declined to 4.445%.

MY TRADING POSITIONS:

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) remained bullish & improved to 6 Bear-signs and 18-Bull. (The

rest are neutral. It is normal to have a lot of neutral indicators since many

of those are top or bottom indicators that will signal only at extremes.) The

10-dMA of spread (purple line in the chart below) continues to improve, a

bullish sign.

TODAY’S COMMENT:

If today’s PPI report was a serious concern, the Russell

would not have reacted as it did today.

The Russell opened higher (gapped up) and drifted down before bottoming around

1:30. Afterward, it closed about where it opened – up 1.1%. It would appear

that investors are resigned to higher-for-longer interest rates. I suspect they are happy because interest

rates aren’t likely to go up.

The Volume on the NYSE was about 20% higher than the

monthly average. I’d call that a bullish

sign. The S&P 500 is only about 0.1% below its end of March all-time high.

LONG-TERM INDICATOR: The Long Term NTSM indicator improved

to BUY: PRICE & VOLUME are bullish; VIX & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I am bullish. The S&P 500 is headed back to all-time,

new highs.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

I forgot to update this chart

yesterday, but below is Friday’s chart. DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position. This is my max % for stock allocation.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

I was traveling Monday so the post is late. I hope you

got to see the Northern lights over the weekend. Amazing!

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 was little changed at 5221.

-VIX rose about 8% to 13.60.

-The yield on the 10-year Treasury declined to 4.490%.

MY TRADING POSITIONS:

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) remained bullish at 7 Bear-signs and 15-Bull. (The rest are

neutral. It is normal to have a lot of neutral indicators since many of those

are top or bottom indicators that will signal only at extremes.) The 10-dMA of

spread (purple line in the chart below) continues to improve, a bullish sign.

TODAY’S COMMENT:

Not much new. Markets started well, but faded to negative

for the day before finishing around unchanged. A so-so day. Internals were bullish,

but not overly so. PPI is due Tuesday at 08:30 and that may have troubled

markets Monday.

Just a reminder: I keep hearing the pundits talk about

how fast and far the rally has gone. The markets are due for trouble they say. As of Friday, the S&P 500 was only up

8.8% since January of 2022, more than 2 years ago - Doesn’t look too fast or

far to me.

LONG-TERM INDICATOR: The Long Term NTSM indicator

declined to HOLD: PRICE is bullish; VIX, VOLUME & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I am bullish. The S&P 500 is headed back to all-time,

new highs.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

I forgot to update this chart

yesterday, but below is Friday’s chart. DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position. This is my max % for stock allocation.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“Since this is an era when many people are concerned

about 'fairness' and 'social justice,' what is your 'fair share' of what

someone else has worked for?”― Thomas Sowell

PROTESTORS FAIL HISTORY TEST (Newsweek via msn.com)

“...Within a few years after the rise of Ayatollah

Khomeini to power, the Jewish population of Iran, which once stood at 100,000,

shrank to a fraction of its size. Today, of the ancient community whose

presence in Iran predates that of Muslims, only 8,000 remain. For centuries,

Iran has been home to the most sacred Jewish sites in the Middle East outside

of Israel. But those monuments have either fallen into disrepair or are targets

of regular attacks by antisemitic mobs. Only last week, the tomb of Esther and

Mordecai—the memorial to the heroine and hero from the Book of Esther who

saved the Jews from being massacred in ancient Persia, was set on fire.

How is it that the 90,000-plus who left Iran, many for

Israel, are now deemed as occupiers? How do Iranian refugees fleeing

persecution become "colonizers" upon arrival in Israel?” - Roya

Hakakian. Commentary at...

Protesters

Against Israel Fail Key History Test | Opinion (msn.com)

UNIV OF MICHIGAN SENTIMENT (Univ of Michigan)

“Consumer sentiment retreated about 13% this May

following three consecutive months of very little change. This 10 index-point

decline is statistically significant and brings sentiment to its lowest reading

in about six months. This month’s trend in sentiment is characterized by a

broad consensus across consumers, with decreases across age, income, and

education groups. Consumers in western states exhibited a particularly steep

drop. While consumers had been reserving judgment for the past few months, they

now perceive negative developments on a number of dimensions. They expressed

worries that inflation, unemployment and interest rates may all be moving in an

unfavorable direction in the year ahead.” Press release at...

http://www.sca.isr.umich.edu/

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.2% to 5223.

-VIX declined about 1% to 12.55.

-The yield on the 10-year Treasury rose to 4.502%.

MY TRADING POSITIONS:

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) remained bullish at 6 Bear-signs and 17-Bull. (The rest are

neutral. It is normal to have a lot of neutral indicators since many of those

are top or bottom indicators that will signal only at extremes.) The 10-dMA of

spread (purple line in the chart below) continues to improve, a bullish sign.

TODAY’S COMMENT:

Friday Indicators giving Bear-signs are:

-Buying-Pressure minus selling-pressure.

-My Money Trend Indicator.

-The smoothed slope of the 100-dMA of Up-days, a general

trend indicator.

-Spread of Utilities vs. the S&P 500. This one looks

very bearish, though that could be due to investors anticipating falling

interest rates and looking for yields. This indicator is usually pretty good so

this one is a worry.

-Distribution Days. We haven’t had a Follow-thru Day to

cancel the bearish Distribution Days. -All the 15-ETFs I track are above their 120-day moving

averages. That tends to occur at tops,

but this hasn’t been true recently, or maybe I should say the indicator isn’t

very timely.

RSI and Bollinger Bands are close to “overbought” and I’ll

consider them if they do flip to the bear side.

Now, they are neutral.

With many of the reliable indicators giving bull signals,

I remain bullish and I expect the S&P 500 to retest its all-time highs.

LONG-TERM INDICATOR: The Long Term NTSM indicator declined

to HOLD: PRICE is bullish; VIX, VOLUME & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I am bullish. The S&P 500 is headed back to all-time,

new highs.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

I forgot to update this chart

yesterday, but below is Friday’s chart. DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position. This is my max % for stock allocation.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“It was Thomas Edison who brought us electricity, not the

Sierra Club. It was the Wright brothers who got us off the ground, not the

Federal Aviation Administration. It was Henry Ford who ended the isolation of

millions of Americans by making the automobile affordable, not Ralph Nader.

Those who have helped the poor the most have not been those who have gone

around loudly expressing 'compassion' for the poor, but those who found ways to

make industry more productive and distribution more efficient, so that the poor

of today can afford things that the affluent of yesterday could only dream

about.”

― Thomas Sowell

"No president has had the

run we’ve had in terms of creating jobs and bringing down inflation. It was 9% when I came to office -

9%." – Joe Biden, the Man Who Would be President.

My cmt: Sorry, Mr. President;

the correct answer is, there was 1.4% inflation when you took office. This is

just another case of Biden’s declining faculties. What were

others saying in the early days of Biden’s

Presidency?”

"If I was Darth Vader and

I wanted to destroy the US economy, I would do aggressive spending in the

middle of an already hot economy...This is the biggest bubble I've seen in my

career." - Stanley Druckenmiller, billionaire investor. (27 July 2021,

back when the CPI was around 3.0. and before the Infrastructure Investment and Jobs Act and the Inflation Reduction Act.)

Fortunately, Mr. Druckenmiller was wrong about the overall economy – it didn’t

collapse. But the trillions in spending in

those two acts were contributors to inflation that peaked at 9% in June of

2022, well into Biden’s term.

BIDENS’ ‘GRAND BARGAN’ ILLUSION BEGINS AT RAFAH

(Jerusalem Times via msn.com)

“Biden and Secretary of State Blinken are aiming for the

diplomatic equivalent of a moon shot, the Nobel Peace Prize, and, not

incidentally, victory in the November elections... And it begins in Rafah,

through orchestrating a stalemate and ceasefire that prevents Israel from

totally defeating and uprooting Hamas as the dominant Palestinian terror

organization and the rulers of Gaza. The problem (and it is a very big

one) is that the entire scenario is built on a foundation of wishful thinking,

not history and political realism. Similarly, the triumphant 1993 Oslo “peace”

plan was based on the same illusions, and ended in the disaster known as the

Second Intifada, in which over 1000 Israelis were murdered in mass bombings,

and thousands more died on the Palestinian side....

...For Hamas, the freezing of weapons deliveries, the

wider conflict between Washington and Jerusalem, and demands for a ceasefire on

their terms are a huge gift, including continuing to use every last

brutalized Israeli hostage to squeeze out more concessions... successful

diplomacy must be based on realism, in contrast to wishful thinking and

illusions of a “grand bargain.” Peace between Israel and the Palestinians will

only come when the expectations overlap with political realism. Until then,

Israel, under Netanyahu and whoever comes next, will do what is necessary to

defend its citizens.” Commentary at...

Biden's

'Grand Bargain' illusion starts at Rafah (msn.com)

“The messaging to our enemies, in short, is clear:

however appalling your crimes, the Western public will have your backs. Fearing

confrontation, their leaders will bend to the pressure. Terrorism works, at

least when it comes to massacring Jews. God help us.” - Jake Wallis Simons, editor of the Jewish

Chronicle and author of Israelophobia.

JOBLESS CLAIMS (CNN)

“First-time applications for unemployment benefits rose

last week to 231,000, the highest level since August, in another sign that the

white-hot labor market is starting to cool off.” Story at...

https://www.cnn.com/2024/05/09/economy/jobless-claims-highest-level-since-august/index.html

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.5% to 5214.

-VIX declined about 2% to 12.69.

-The yield on the 10-year Treasury rose to 4.459%.

MY TRADING POSITIONS:

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) remained bullish at 9 Bear-signs and 15-Bull. (The rest are

neutral. It is normal to have a lot of neutral indicators since many of those

are top or bottom indicators that will signal only at extremes.) The 10-dMA of

spread (purple line in the chart below) continues to improve, a bullish sign.

TODAY’S COMMENT:

The payroll numbers were weak and today seemed to be another

case of bad news is good news.

Basic Market Internals looked good today. Advancing

volume and advancing stocks were both more than twice declining volume and

declining stocks, respectively. There

were 193 New-highs and 18 New-lows. These are bullish numbers...not much more

to say.

LONG-TERM INDICATOR: The Long Term NTSM indicator improved

to BUY: PRICE & VOLUME are bullish; VIX & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I am bullish. The S&P 500 is headed back to all-time,

new highs.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

I forgot to update this chart

yesterday, but below is Friday’s chart. DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m usually

about 50% invested in stocks, so this is a bullish, over-invested position.

This is my max % for stock allocation.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.