So common on many issues.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“Three years ago, we were a great nation, and we will

soon be a great nation again.” - Trump at a rally in Michigan yesterday.

My cmt: Please, someone tell Donald not to campaign for

Biden. Biden was President three years ago.

JOBLESS CLAIMS (ABC News)

“The number of Americans applying for unemployment

benefits was unchanged last week and remains historically low as the labor

market continues to show resiliency in the face of high interest rates and

elevated inflation. The Labor Department reported Thursday that unemployment

claims for the week ending April 27 was 208,000...” Story at...

https://abcnews.go.com/Business/wireStory/number-americans-applying-jobless-claims-remains-historically-low-109865869

FACTORY ORDERS (RTT News)

“New orders for U.S. manufactured goods surged in line

with economist estimates in the month of March, according to a report released

by the Commerce Department on Thursday. The Commerce Department said factory

orders shot up by 1.6 percent in March...” Story at...

https://www.rttnews.com/3444454/u-s-factory-orders-surge-in-line-with-estimates-in-march.aspx

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.9% to 5064.

-VIX declined about 5% to 14.61.

-The yield on the 10-year Treasury declined to 4.583%.

MY TRADING POSITIONS:

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) improved, but it remains close to Neutral with 10 Bear-signs and 11-Bull.

(The rest are neutral. It is normal to have a lot of neutral indicators since

many of those are top or bottom indicators that will signal only at extremes.)

The chart below continues to look bullish. The 10-dMA of the 50 Indicator

Spread (Bulls minus Bears - Purple line) is still moving higher. That is associated with a

rising S&P 500.

TODAY’S COMMENT:

“[Last week McDonalds]...posted Q1 results that missed

revenue growth and same-store sales estimates across its segments, while its

earnings also came below expectations. ‘Consumers continue to be even more

discriminating with every dollar that they spend as they faced elevated prices

in their day-to-day spending, which is putting pressure on the QSR industry,’

CEO Chris Kempczinski said during a call with investors.” From...

https://finance.yahoo.com/news/mcdonalds-q1-earnings-miss-sales-expectations-as-consumers-tighten-their-wallets-110212872.html

The CNBC crowd repeated several times earlier this week that

the weak earnings by McDonalds was a sign that the economy was weakening. This led to the predictable call by some of

the regulars that we are headed for a recession. Too bad it isn’t true. Years

ago, I looked at McDonalds earnings during the Great Recession of

2008-2009. McDonalds did great while

most stocks tanked. I’d suggest that the

reason was that as people were financially stressed during the recession, they ate

at Mickey-D’s rather than Chez-expensive.

The recent McDonalds weakness could be caused by a myriad of problems,

even if Mickey D’s claims that lower income people are not dining there as

often. I don’t see a recession any time

soon and the market seems to agree with me.

Today, I added UWM (2x Russell 2000 - ETF) since the

Russell 2000 was outperforming other Indices.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: VOLUME, VIX, PRICE & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of this recent bear market, based on the bearish “Friday Rundown”

of indicators.)

BOTTOM LINE

I am bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position. This is my max % for stock allocation.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

BIDEN’S PLAN TO RATION ELECTRICITY (WSJ)

“The Biden Administration’s regulations are coming so

fast and furious that it’s hard even to keep track, but we’re trying. On

Thursday the Environmental Protection Agency proposed its latest doozy—rules

that will effectively force coal plants to shut down while banning new

natural-gas plants.... EPA is also replacing the Obama Clean Power Plan that

the Supreme Court struck down with a rule requiring that coal plants and new

gas-fired plants adopt costly and unproven carbon-capture technology by 2032...

carbon capture uses 20% to 25% of the electricity generated by a power plant,

less will be available to the grid... All of this will hit while demand for

power is surging... Meantime, China has added about 200 gigawatts of coal power

over the last five years—about as much as the entire U.S. coal fleet. The Biden

fossil-fuel onslaught will have no effect on global temperatures.” – WSJ

Editorial Staff...

https://www.wsj.com/articles/environmental-protection-agency-rules-power-plants-fossil-fuels-coal-natural-gas-b6d2ea72

FED MEETING (CNBC)

“Federal Reserve Chair Jerome Powell said it was unlikely

that the central bank’s next move will be a rate hike. The comment spurred a

rally for the three major averages, with the Dow surging more than 500 points

in its session high. Central bank policymakers kept rates steady at the

conclusion of their May meeting, holding at a range of 5.25% to 5.5%.” Story

at...

https://www.cnbc.com/2024/05/01/fed-meeting-today-live-updates-on-may-fed-rate-decision.html

My cmt: The market didn’t like the Fed comment that there

was a ‘lack of further progress’ on inflation. The Fed statement said, “The Committee does

not expect it will be appropriate to reduce the target range until it has

gained greater confidence that inflation is moving sustainably toward 2

percent,”

ADP EMPLOYMENT REPORT (ADP)

“Hiring was broad-based in April. Only the information

sector — telecommunications, media, and information technology — showed

weakness, posting job losses and the smallest pace of pay gains since August

2021.” Report at...

https://adpemploymentreport.com/

ISM MANUFACTURING PMI (ISM)

“The Manufacturing PMI® registered 49.2 percent in

April, down 1.1 percentage points from the 50.3 percent recorded in March. The

overall economy continued in expansion for the 48th month after one month of

contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over

a period of time, generally indicates an expansion of the overall economy.)”

Report at...

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/april/

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) increased by 7.3 million barrels from the

previous week. At 460.9 million barrels, U.S. crude oil inventories are about

3% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

My cmt: Rising inventories led to falling prices and we

see that reflected in the XLE today, down 1.6%.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 slipped about 0.3%% to 5018.

-VIX declined about 2% to 15.39.

-The yield on the 10-year Treasury declined to 4.641%.

MY TRADING POSITIONS:

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) slipped, but is close to Neutral with 12 Bear-signs and 9-Bull.

(The rest are neutral. It is normal to have a lot of neutral indicators since

many of those are top or bottom indicators that will signal only at extremes.)

The chart below continues to look bullish. The 10-dMA of the 50 Indicator

Spread (Bulls minus Bears) is clearly moving higher. That is associated with a

rising S&P 500.

TODAY’S COMMENT:

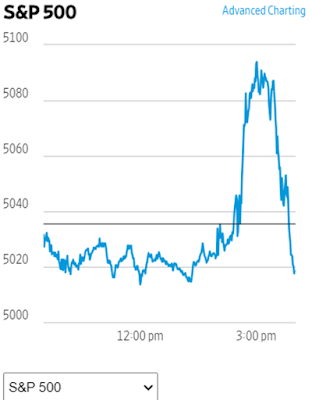

Weird day! When the FED

speaks, all Hell breaks loose? “Help me, Obi-Wan Jay Powell. You're my

only hope.” The Markets liked it when the Fed Chairman Powell said the next

move won’t be a rate hike, but then didn’t like the Fed comment on the lack of

progress on reducing inflation. Perhaps the Fed motto is “...you can't please

everyone, so you got to please yourself.”

Market internals were

bullish today. Advancing issues outpaced decliners; new-highs were well higher

than new-lows, and advancing volume was higher than declining volume. The

S&P 500 went down(?); what went up? As the numbers suggest, the small caps

were up - the Russell 2000 rose 0.3%. Usually, when small caps lead, the

S&P 500 will catch up. For that reason, I expect the S&P 500 will be up

tomorrow. Perhaps I’ll finally be right about my “correction over” call. Ihope

so, I am making it again! The pullback

is over.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: VOLUME, VIX, PRICE & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of this recent bear market, based on the bearish “Friday Rundown”

of indicators.)

BOTTOM LINE

This may sound familiar: The pullback is over, but the

S&P 500 could always retest its low. That’s my story and I’m sticking with

it.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

CONSUMER CONFIDENCE (Conference Board)

“The Conference Board Consumer Confidence Index® deteriorated for the third

consecutive month in April, retreating to 97.0 (1985=100) from a downwardly

revised 103.1 in March. Despite these three months of weakness, the gauge

continues to move sideways within a relatively narrow range that’s largely held

steady for more than two years.” Story at...

https://www.conference-board.org/topics/consumer-confidence

CHICAGO PMI (RTT News)

“The report said the Chicago business barometer slipped

to 46.0 in January from an upwardly revised 47.2 in December, with a reading

below 50 indicating a contraction.”

https://www.rttnews.com/3420745/chicago-business-barometer-unexpectedly-indicates-faster-contraction-in-january.aspx

EMPLOYMENT COST INDEX (CNN)

“A closely watched measure of labor costs showed that

compensation growth accelerated much faster than expected during the first

three months of the year, providing an unwelcome data point for Federal Reserve

officials looking for inflation pressures to ease. The Employment Cost Index

(ECI) rose a seasonally adjusted 1.2% last quarter, faster growth than

the 0.9%

increase the prior quarter...” Story at...

https://www.cnn.com/2024/04/30/economy/employment-cost-index-eci-wages-q1/index.html

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 fell about 1.6%% to 5036.

-VIX rose about 7% to 15.65.

-The yield on the 10-year Treasury rose to 4.682%.

MY TRADING POSITIONS:

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bulls minus Bears) slipped to

Neutral with 11 Bear-signs and 11-Bull. (The rest are neutral. It is normal to

have a lot of neutral indicators since many of those are top or bottom

indicators that will signal only at extremes.) The chart below continues to

look bullish. The 10-dMA of the 50 Indicator Spread (Bulls minus Bears - purple line) is

clearly moving higher. That is

associated with a rising S&P 500.

TODAY’S COMMENT:

Markets were weak all day

and closed very near their lows. It’s just one day though. Markets are spooked by the Fed meeting Wed

and Thursday and the weaker than expected data we’ve seen rececntly. There’s still talk about the low GDP number.

The experts have pointed out that it was low due to volitile data associated with

imports and exports. Those numbers are expected to improved and the next

GDP number should improve handily.

Tuesday was a statistically significant down-day. That

just means that the price-volume move exceeded my statistical parameters.

Statistics show that a statistically-significant, down-day is followed by an

up-day about 60% of the time. Bottoms occur on statistically-significant, down-days,

since they tend to be flush out days that shake out weak hands; but not all statistically-significant,

down-days are bottoms.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: VOLUME, VIX, PRICE & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of this recent bear market, based on the bearish “Friday Rundown”

of indicators.)

BOTTOM LINE

The pullback is over, but the S&P 500 could always

retest its low. That’s my story and I’m sticking with it.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more

money has been lost by investors in preparing for corrections, or anticipating

corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“Law enforcement officials arrested 57 protesters during

Wednesday’s event organized by the Palestine Solidarity Committee after

participants refused to disperse despite demands from authorities and the

university [of Texas at Austin]. Of those arrested, 26 were neither students

nor faculty of the university, according to officials at UT-Austin.” – Epoch

Times via ZeroHedge at...

https://www.zerohedge.com/political/nearly-half-those-arrested-ut-austin-pro-palestinian-protest-had-no-links-school

"For anyone who understands the role of the free

press in a democracy, it should be troubling that President Biden has so

actively and effectively avoided questions from independent journalists during

his term. The president occupies the most important office in our nation, and

the press plays a vital role in providing insights into his thinking and

worldview, allowing the public to assess his record and hold him to account.

Mr. Biden has granted far fewer press conferences and sit-down interviews with

independent journalists than virtually all of his predecessors.” – NY Times

Peasant Woman: Well, how’d

you become king, then?

King Arthur: The Lady of the

Lake, her arm clad in the purest shimmering samite, held aloft Excalibur from

the bosom of the water, signifying by divine providence that I, Arthur, was to

carry Excalibur. That is why I am your king.

Dennis: Listen. Strange

women lying in ponds distributing swords is no basis for a system of

government. Supreme executive power derives from a mandate from the masses, not

from some farcical aquatic ceremony.

Given the choices this election

cycle, we might be better off with a Lady of the Lake.

From Michael Ramirez, political commentary at...

https://michaelpramirez.com/index.html

CRIMINAL CASES AGAINST TRUMP (US News and World Report)

“Indictment 1: Hush Money

Trump’s first indictment on March 30, 2023, centered

around his role in reimbursing his former attorney, Michael Cohen, for paying

off porn star Stormy Daniels in 2016 to keep her quiet about what she says was

an extramarital affair she had with Trump a decade earlier...[charged with]...

falsifying business records...

Indictment 2: Classified Documents

The former president’s second indictment came on June 9,

when a grand jury accused him of illegally retaining classified information

after he left office, showing some of those documents to individuals without

proper clearance and hatching a plan to hide the materials from officials in

defiance of a federal subpoena...[charged with]... willful retention of

national defense information, conspiracy to obstruct justice, withholding a

document or record, corruptly concealing a document or record, concealing a document

in a federal investigation, scheme to conceal and making false statements...

Indictment 3: 2020 Election

A federal grand jury handed up Trump’s third indictment

on Aug. 1 in connection with what prosecutors say were efforts to overturn the

results of his 2020 election loss and undermine America’s democracy...[ charged

with]... one count of conspiracy to defraud the United States, one count of

conspiracy to obstruct an official proceeding, one count of obstruction of and

attempt to obstruct an official proceeding, and one count of conspiracy against

rights....

Indictment 4: Georgia RICO and Conspiracy

Trump’s fourth indictment came late on Aug. 14, when a

grand jury accused him and more than a dozen of his allies of orchestrating a

massive criminal enterprise to overturn the results of the 2020 presidential

election in Georgia... Trump attorneys Jenna Ellis, Sidney Powell and Kenneth

Chesebro and Atlanta-based bail bondsman Scott Hall have pleaded guilty in the

case and were given reduced sentences in exchange for their cooperation with

prosecutors... Trump faced 13 charges, including a violation of the state

racketeering law, or RICO, solicitation of violation of oath by public officer,

conspiracy to commit impersonating a public officer, conspiracy to commit

forgery, conspiracy to commit false statements and writings, committing false

statements and writings, conspiracy to commit filing false documents and filing

false documents.” Story at...

https://www.usnews.com/news/national-news/articles/2023-08-15/explainer-trumps-four-indictments

My cmt: There was a lot more detail in the interesting

read.

Trump has already been found guilty in one case (not

listed above; it’s not a criminal case).

“Judge Arthur Engoron, ruling in a civil lawsuit brought by New York Attorney General

Letitia James, found that Trump and his company deceived banks, insurers and

others by massively overvaluing his assets and exaggerating his net worth on

paperwork used in making deals and securing loans.” For details see...

https://apnews.com/article/donald-trump-letitia-james-fraud-lawsuit-1569245a9284427117b8d3ba5da74249

The MAGA crowd claims these cases are all about

“weaponizing” Government against poor, mistreated Donald.

“Never underestimate the power of stupid people in large

groups." – George Carlin

The NY cases are questionable. Any one of the other three

should put Trump in prison.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 improved about 0.3% to 5116.

-VIX declined about 2% to 14.67.

-The yield on the 10-year Treasury declined to 4.612%.

MY TRADING POSITIONS:

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bulls minus Bears) continues to improve

and Monday it turned bullish. The Summary is now 8 Bear-signs and 14-Bull. (The

rest are neutral. It is normal to have a lot of neutral indicators since many

of those are top or bottom indicators that will signal only at extremes.) The

chart below continues to look bullish. The 10-dMA of the 50 Indicator Spread

(Bulls minus Bears) has been bottoming and again today, it moved higher.

TODAY’S COMMENT:

Today, markets reacted to news in the afternoon that the

Treasury Department was going to borrow about $41B more than expected next

quarter. This is a worry – the National Debt is now impacting stock markets. As

always, I’ll be watching the markets closely.

If the National Debt begins to affect stock market sentiment, we could

be in for real trouble. For now, markets are looking ok. We are coming off a

25% bear market that ended two years ago.

It would be unusual to see a crash now, and indicators don’t support it;

I am following indicators.

As much as we’d like to pretend otherwise, Indicators don’t

predict the future. They give a snapshot of current market conditions and

trend. For now, the trend is up.

Market indicators suggest that the pullback is over. Market action over the last 2 days is

confirming that conclusion. Could the markets reverse back down? Sure, that’s

always possible, but Indicators are bullish and more are on the verge of turning

bullish.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

HOLD: VOLUME, VIX, PRICE & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I think the pullback is over. I bought SSO and QLD.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a bullish, over-invested

position.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 22 and 23.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

"I’ve worked with Bette Davis, John Wayne, Jimmy

Stewart, Henry Fonda. Here’s the thing they all have in common: They all, even

in their 70s, worked a little harder than everyone else.” - Ron Howard

"This tells you all you need to know about today's

Republican National Committee: The person in charge of election integrity for

the GOP was just indicted in Arizona for lack of election integrity." –

Liz Cheney, former Republican Congresswoman.

ANOTHER ONE BITES THE DUST (CNN)

“The Gateway Pundit, the notorious far-right

blog and prolific publisher of conspiracy theories, said Wednesday that it had

filed for bankruptcy protection as it grapples with litigation related to its

coverage of the 2020 election. The move comes as

the staunchly pro-Donald Trump website, which promoted the false

notion that the 2020 election was stolen by President Joe Biden and his allies,

faces multiple lawsuits over its bogus claims.” Story at...

https://www.cnn.com/2024/04/24/media/gateway-pundit-declares-bankruptcy/index.html

THEY’RE SO GOOD, NO ONE WANTS TO BUY ONE

“Ford’s electric vehicle unit reported that losses soared

in the first quarter to $1.3 billion, or $132,000 for each of the 10,000

vehicles it sold in the first three months of the year, helping to drag down earnings

for the company overall.” Story at...

https://www.cnn.com/2024/04/24/business/ford-earnings-ev-losses/index.html

CORE PCE (CNBC)

“The personal consumption expenditures price index

excluding food and energy increased 2.8% from a year ago in March, the same as

in February, the Commerce Department reported Friday. That was above the 2.7%

estimate from the Dow Jones consensus.” Story at...

https://www.cnbc.com/2024/04/26/pce-inflation-march-2024-key-fed-inflation-measure-rose-2point8percent.html

My cmt: Yesterday’s number that I reported here from

Yahoo Finance was the “advance” Core PCE.

MARKET REPORT / ANALYSIS

-Friday the S&P 500 improved about 1% to 5100.

-VIX declined about 2% to 15.03.

-The yield on the 10-year Treasury declined to 4.663%.

MY TRADING POSITIONS:

QLD- Sold 4/8/2024

UWM – Sold 4/8/2024.

INTC – Sold 4/8/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022

lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500.

“The Dow Jones U.S. Completion Total Stock Market Index,

also known as the DWCPF, is a widely used financial index that provides a

comprehensive measure of the US equity market. The DWCPF includes all US stocks

that are not included in the Dow Jones US Total Stock Market Index, which

comprises large-cap and mid-cap companies. As a result, the DWCPF provides a

complete picture of the US stock market, including small-cap and micro-cap

companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bulls minus Bears) improved to

Neutral today. The Summary is now 10 Bear-signs and 10-Bull. (The rest are

neutral. It is normal to have a lot of neutral indicators since many of those

are top or bottom indicators that will signal only at extremes.) The chart

below also looks more bullish since the 10-dMA of the 50 Indicator Spread (Bulls

minus Bears) has been bottoming and again today, it turned up.

TODAY’S COMMENT:

The Fast Money crowd on CNBC was again talking about how

the advance has been narrow with only big names, Microsoft, Nvidia, Meta, etc.,

carrying the market. I don’t know about

that. Moving averages of the % of issues advancing on the NYSE for 10, 50 and

100-days are now all above 50%, i.e., more than half of the issues over those periods

have advanced. A lot of issues are participating. At the S&P 500 high at

the end of March, 13% of all issues on the NYSE made new, all-time highs – that

number suggests a broad advance and that if a decline were to occur, it would probably

be less than 10%. The max decline from the March high was 5.5%, five sessions

ago.

I’ve been saying for several days that I think the

pullback is over. Today, it looks like

the market is starting to agree with me.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: VOLUME, VIX, PRICE & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I think this pullback is over and Monday I’ll place some

more bets in that direction by adding trading positions in SSO and QLD.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 50% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is a fully-invested position.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio using an S&P 500 ETF as I did back in

October.