CHICAGO PMI (Investing.com)

“Manufacturing activity in the Chicago-area accelerated

in November to a four-and-a-half year high as new orders and production boosted

confidence, although the study noted concerns over labor issues and Chinese

tariffs. In a report, the Institute for Supply Management (ISM) said its Chicago

purchasing managers’ index rose to a seasonally adjusted

66.4 this month, from 58.4 in October.” Story at…

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.8% to 2760.

-VIX dropped about 4% to 18.07.

-The yield on the 10-year Treasury dipped to 3.003% as of

4:11pm.

Correction Over:

Thursday’s headlines said “Fed chairman’s comments send

market soaring.” Perhaps, but the spread between new-highs and new-lows showed

a huge bullish positive swing a week before the Fed chair speech and we noted

then that the correction was nearly over. We saw a positive test of the prior

low on the Friday before the Fed speech. Following the retest, Monday, stock

markets were up bigley (1.6%). They were

up again Tuesday. On Wednesday they were having a big day before the Fed speech

and jumped farther after the speech. Wednesday was very positive and was a 90%

up-volume day.

Regarding 90% up-volume days, one of the oldest stock

market advisor groups, Lowry Research, noted the following: “In approximately

half the cases in the past 69 years, the 90% Upside Day…which signaled a major

market reversal, occurred within five trading days or less of the market low.”

This time the reversal was 3-trading sessions after the low. The S&P 500 is

up nearly 5% since the Friday successful re-test. I am simply pointing out that

the media’s continual reporting of why the market moves up or down is probably

wrong and rather pointless. I don’t care.

The market action since last Friday’s retest tends to confirm the

correction is over - that’s what we care about.

My daily sum of 17 Indicators improved from +3 to +5 (a

positive number is bullish; negatives are bearish) while the 10-day smoothed

version that negates the daily fluctuations rose from -53 to -41.

It is still possible that we could see a retest of the

2633 low, but it is not likely that the S&P 500 would drop significantly

farther than the prior low. It could fall farther – it’s just not very likely.

There are, of course, news events that could upset the

apple cart – all we have to do is to hear Trump’s tariff tweets repeated on the

national news – so let’s hope all is quiet on the tariff front. Impeachment?

Who knows, some might see it as a positive.

As of Tuesday, I went from 30% invested in stocks to

fully invested in stocks plus about 10% extra since I think we made a bottom

last Friday.

In summary, still - “Looking good Billy Ray! Feeling good

Lewis!”

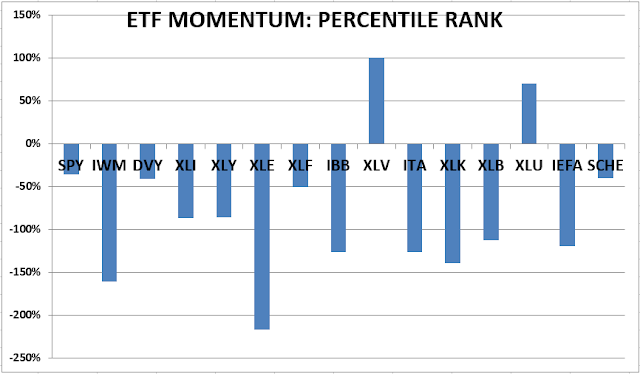

MOMENTUM ANALYSIS:

(Momentum analysis is suspect in a selloff, but since

we are coming off the bottom (I think) we might begin to use this data again. I‘d

be careful though – the only reason utilities are highly ranked among ETFs is

as an alternative to stocks in the correction.)

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the

4-months from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Neutral on the market, but they were almost positive.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

I am increasing stock allocations to 60% invested in

stocks Tuesday. For me, fully invested is a balanced 50% stock portfolio so

this is slightly higher. I will cut back to 50% if/when we reach the old highs

depending on indicators.

INTERMEDIATE / LONG-TERM INDICATOR

Friday, the Price

indicator was positive; Volume and Sentiment indicators were neutral; the VIX

indicator was negative. Overall this is a NEUTRAL indication, but improvements

to the numbers do support the belief that the bottom was Friday, 23 November.