“Bottom fishing is still the most expensive sport in the

world.” Scott Minerd, Guggenheim Global Chief Investment Officer.

JOHN HUSSMAN MARKET COMMENTARY EXCERPT (Hussman Funds)

“I continue to expect the S&P 500 to lose about

two-thirds of its value over the coming years…What we’re seeing today in the

financial markets is just an initial episode of significant risk aversion…It’s

worth noting that the deepest economic decline since the Great Depression

involved a cumulative decline of 5.6% of annual real GDP. It’s difficult to

imagine that this downturn will be smaller…What’s likely to do harm to

investors over the completion of this market cycle isn’t the impact of a year

or two of lost cash flows. The likely source of actual damage is the roughly

65% loss in value (from the February high) that would be required simply to

bring the most reliable valuation measures to their run-of-the-mill historical

norms.” – John Hussman, PhD. Commentary at…

I’d quote more, but I’m getting depressed. (I am also

trying to comply with The Hussman Funds republishing policy.)

SOME GOOD ADVICE (Hussman Funds)

“One bit of advice that friends have often found helpful:

Anytime you make a portfolio change, start by accepting that you are guaranteed to

have regret. If you sell some of your holdings and the market goes up, you’ll

regret having sold anything. If you sell and the market goes down, you’ll

regret not having sold more. If you don’t sell and the market goes up, you’ll

regret not having bought. The key is to balance a careful consideration of

valuations, expected returns, potential risks, and prevailing market

conditions, along with all of those potential regrets. If you begin by accepting that there

will be regret of one form or another, you won’t feel

paralyzed, and you’ll consider more possibilities than you might otherwise.” –

John Hussman, PhD. Commentary at…

TRIPLE LEVERED SHORT OIL ETN CRASHES TO

“COMPLETE LOSS” (ZeroHedge)

“Unprecedented spikes in price along with a record

'super-contango' have left the VelocityShares Daily 3x Inverse Crude exchange-traded

notes, or DWTIF, worthless, according to

Credit Suisse. “Because the Closing Indicative Value of the ETNs will be $0

on April 2, 2020 and on all future days...

...investors who buy the ETNs at any time at any price

above $0 will likely suffer a complete loss of their investment,”

Credit Suisse said.

Just a caution to watch out for over-investing in these

leveraged ETFs and ETNs. I remember a similar leveraged VIX product that

crashed to zero a few years ago – XIV, I think.

EXPERTS SAY SPORTS WON’T BE BACK SOON (LA Times)

“As long as we’re still in a place where when a single

individual tests positive for the virus that you have to quarantine every

single person who was in contact with them in any shape, form or fashion, then

I don’t think you can begin to think about reopening a team sport,” Sills said.

“Because we’re going to have positive cases for a very long time.” - Dr. Allen

Sills, chief medical officer of the NFL.

CORONAVIRUS ISSUES ARE NOT OVER (NTSM)

The growth-rate of new virus cases is moderating in the

US and Worldwide and we saw positive moves in the markets today; however, it is

still hard to determine when we’ll see the end of economic impacts associated

with COVID19.

The very-first, confirmed-case of COVID19 in the US was on

1 March. The President declared a National emergency 11 days later. At the end

of March, there were more than 185,000 confirmed-cases. Sunday there were about

35,000 new confirmed-cases in the US. Some of these people probably had

contact with others before they had symptoms. It will be a month before those

new exposures are resolved. Additionally, as of Friday, 20-states still didn’t

have stay-at-home orders and we might guess that they are experiencing

exponential growth that is under-the-radar. If recent history is a guide, it may

not be under-the-radar for long.

The good news is that there were about 15,000 new-cases in

the US as of 4PM. That will change later today, but it looks like we may see

less cases than yesterday. Still, there’s plenty to worry about.

Dr. Fauci says that the United States will not come out of

lockdown until there are no “new cases.” I can’t hazard a guess as when that

might be. Even if we do try to get back to normal soon, as some are suggesting,

the virus is likely to re-emerge as it is now doing in China.

As a worst case, when might this crisis end? When a vaccine

is available. Could it be sooner? Probably, but I am not optimistic that we’ll

see an end before the stock market suffers more pain. Bill Gates has predicted

that it would be safe to return to work on 1 June and I am assuming he is

consulting with experts. The Governor of NJ said we can open-up “deep into May”

at the earliest.

Regardless of what I think, the trick is to follow the

indicators, not what anybody thinks. Given history, a retest of the low is still

the most likely course from here.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 dropped about 7% to 2664.

-VIX dropped about 3% to 45.24.

-The yield on the 10-year

Treasury rose to 0.678.

Today’s bounce carried the S&P 500 above the prior double-top,

rally-high around 2630. The Index moved up the 38% retracement level (the first

Fibonacci level, 2674) and pulled back.

The Index is currently down 21.3% from its all-time high.

Today is day 33 of the correction. Corrections greater than 10% last (on

average) 68 days. Crashes are significantly longer; I am not sure if this is a

crash yet. It certainly has the

potential to be one.

Overall, the daily sum of 20 Indicators improved

from zero to +7 (a positive number is bullish; negatives are bearish). The

10-day smoothed sum that negates the daily fluctuations improved from +29

to +39. (These numbers sometimes change after I post the blog based on data

that comes in late.) Most of these indicators are short-term.

90% of the volume was up today, however, it wasn’t the strong

bullish sign we’d hoped for, because the Index faded at the end of the day. Volume wise, the really bullish signs were on the 3 days

after the low. It would seem that the

final bottom is not likely to be very far below the bottom we have already seen,

if we do fade that far down again.

After a big bullish day like today there are more bulls

suggesting a “V” bottom. We still need

to worry about the economy and the stock market. One of the prerequisites for

an end to the current rally was an outsized up-day. We got that. Another would be a logical

stopping point (resistance) and we got that in the form of the first Fibonacci

level. Today we retraced 38%. The average retracement is 50% after waterfall

drops greater than 15% so the rally may continue. Let’s see what happens

tomorrow.

Based on history a retest of the low is the most likely

outcome. I will wait for a successful retest before adding further to

stock holdings.

RECENT STOCK PURCHASES

-SSO. SOLD

-Biotech ETF (IBB). #1 in momentum. We’re in a health crisis

so perhaps this will be a good longer-term hold too.

-Apple. SOLD

-XLK. Technology ETF spreads some risk and gives exposure

to Microsoft, Cisco, etc.; was #1 in momentum before the crisis.

-Starbucks. SOLD

I took small losses on the stock trades.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10 (Zero is a

neutral reading.)

Today’s Reading: +4**

Most Recent Day with a value other than Zero: +4 on 6

April. (Non-Crash Sentiment is bullish; Breadth has made a bullish

divergence from the S&P 500; Money Trend is bullish; and the Fosback

New-hi/new-low Logic Indicator is bullish.)

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or higher is a Buy

Sign.

**The Top/Bottom indicator continues to give

extreme oversold readings, but as I have been saying, we won’t know when we

have a bottom until we have a successful retest, or a reversal buy-signal from

Breadth or Volume.

MOMENTUM ANALYSIS:

IBB has the highest negative momentum; IBB (iShares

Nasdaq Biotechnology ETF) is the best of the bad. IBB is down “only” 5% in the last 40-days.

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%; in this case, -100%

because the market has been so bad. The rest are then ranked based on their

momentum relative to the leading ETF. The

highest ranked are those closest to zero. While momentum isn’t stock

performance per se, momentum is closely related to stock performance. For

example, over the 4-months from Oct thru mid-February 2016, the number 1 ranked

Financials (XLF) outperformed the S&P 500 by nearly 20%. In 2017 Technology

(XLK) was ranked in the top 3 Momentum Plays for 52% of all trading days in

2017 (if I counted correctly.) XLK was up 35% on the year while the S&P 500

was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

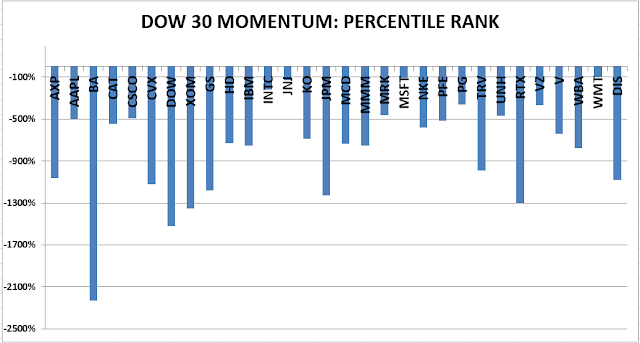

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%%; in this case, -100%

because the market has been so bad. The rest are then ranked based on their

momentum relative to the leading stock. The highest ranked are those closest to

zero.

United Technologies is now Raytheon Technologies, ticker

symbol RTX. I’ll need to do some work to

bring this up to date. For now, ignore

RTX in the momentum analysis.

For more details, see NTSM Page at…

MONDAY MARKET INTERNALS (NYSE DATA)

Market Internals improved

to BULLISH on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 35% invested in

stocks. You may wish to have a higher or lower % invested in stocks depending

on your risk tolerance. We were fortunate to recognize dangers and take a defensive posture in late January.

INTERMEDIATE / LONG-TERM INDICATOR

Monday, the VOLUME, and NON-CRASH SENTIMENT indicators

are bullish; the VIX indicator is still giving a bear signal; the PRICE indicator

is neutral.

The Long-Term Indicator remained HOLD. I sold some stocks

1 April. If we do retrace down, I’ll try to find a good buy-point. At that time, I’ll increase stock holdings

significantly.