“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

"President Trump is wrong…I had no right to overturn

the election. The presidency belongs to the American people, and the American

people alone. And frankly there is almost no idea more un-American than the

notion that any one person could choose the American president...Men and women,

if we lose faith in the Constitution, we won't just lose elections, we will

lose our country." - Mike R. Pence, VP.

“Let's face it. Let's call it what it is. Jan. 6 was a

riot that was incited by Donald Trump in an effort to intimidate Mike Pence and

the Congress into doing exactly what he said in his own words last week:

Overturn the election.” – Chris Christie, former republican Governor of NJ.

“While vital to calculating ways to survive a warming

world, climate models are hitting a wall. They are running up against the

complexity of the physics involved; the limits of scientific computing;

uncertainties around the nuances of climate behavior; and the challenge of

keeping pace with rising levels of carbon dioxide, methane and other greenhouse gases. Despite significant improvements, the new

models are still too imprecise to be taken at face value, which means

climate-change projections still require judgment calls.” - RL Holtz, WSJ

EARNINGS (FactSet)

“Overall, 56% of the companies in the S&P 500 have

reported actual results for Q4 2021 to date. Of these companies, 76% have

reported actual EPS above estimates, which is equal to the five-year average of

76%. In aggregate, companies are reporting earnings that are 8.2% above

estimates, which is slightly below the five-year average of 8.6%...The blended

(combines actual results for companies that have reported and estimated results

for companies that have yet to report) earnings growth rate for the fourth

quarter is 29.2% today... If 29.2% is the actual growth rate for the quarter,

it will mark the fourth straight quarter of earnings growth above 25% for the

index. The last time the index reported four straight quarters of earnings

growth above 25% was Q4 2009 through Q3 2010.” FactSet earnings report at...

https://insight.factset.com/sp-500-earnings-season-update-february-4-2022

GOLDMAN SAYS FOR THE FIRST TIME IN 2022 WE SEE MASSIVE

NET INFLOWS (ZeroHedge)

“So now that the bulk of earnings season has passed, and

despite some high profile tech misses - most notably Facebook - is it safe to

say that markets have finally stabilized? For the answer we go to Rubner's [Scott

Rubner, Goldman Sachs flow trader] weekly tactical flow of funds note, which

recaps where investors are putting their money to work in 2022. What is most

notable this time, is that according to Rubner, while we are still not “all

clear” after week 5, for the

first time in 2022, net demand is set to exceed net supply this coming week.”

Commentary at...

https://www.zerohedge.com/markets/goldman-first-time-2022-we-see-massive-net-inflows-stocks-week

MARKET REPORT / ANALYSIS

-Monday the S&P 500 rose about 0.4% to 4484.

-VIX declined about 1% to 22.99.

-The yield on the 10-year Treasury rose to 1.921%.

Given that most corrections retest their prior lows, I’ll

keep the pullback stats for a while.

Pullback Data:

Days since top: 24 (Avg= 30 days for corrections <10%;

60 days for larger, non-crash pullbacks)

Drop from Top: Now 6.5%; Max intraday: 12% (Avg.= 13% for

non-crash pullbacks)

The S&P 500 is 0.9% above its 200-dMA & 2.8%

below its 50-dMA.

Max Retracement from bottom: 56% Wednesday.

The slope of the 200-dMA is up.

I forgot a bullish sign in my Friday rundown of

indicators: On 31 January and 1 February there were back-to-back high volume

up-days (80% up-volume or better). That

is a bullish sign that the pullback may be over. There were a couple of

down-days afterwards so that muddies the water a little. Adding the bull-sign I

missed Friday would make the count 11-Bull to 10-Bear indicators – not much

difference. That’s a balanced indication

that shows investors are confused.

As today’s chart indicates (below), investors still haven’t

decided what to do with this market: Buy-the-dip or sell-the-rip? The Russell

2000 and the NYSE Composite were both up today while the major indices were

down. The Russell is the lowest quality index.

Seeing it lead is a bullish sign to me.

Internals were mixed.

Up-volume outpaced down-volume by about 40% and the # of stocks

advancing outpaced the decliners by about 15%. The holdout has been the

new-high/new-low data. The new-lows

outpaced new-highs by 140 issues Monday.

That was better than Friday when the spread was 193. The new-high/new-low

spread always lags, but we need to see it turn positive again soon. It was

positive Tuesday and Wednesday of last week.

I measure Sentiment as %-Bulls (Bulls/{bulls+bears})

based on the amounts invested in selected Rydex/Guggenheim mutual funds. My

Sentiment indicator is finally getting closer to a bearish, buy-zone, but it

has not given a bull signal on a 5-day basis.

I didn’t see much change in the Friday indicators as I

scanned thru my numbers today. Short-term indicators haven’t changed much

either.

The daily sum of 20 Indicators declined from +3 to +2 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations improved from +3 to +11 (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in

late. Most of these indicators are short-term so they tend to bounce around a

lot.

The Long Term NTSM indicator

ensemble remained to HOLD. Volume is bullish; VIX, Price & Sentiment are

Neutral.

I remain cautiously bullish. The S&P 500 still needs to break back

above its 50-dMA. The bulls don’t want to see the S&P 500 fall below its

200-dMA.

POSITIONS ADDED:

Wednesday, 26 January: AAPL; XLE;

Monday, 31 January: QLD; SPY

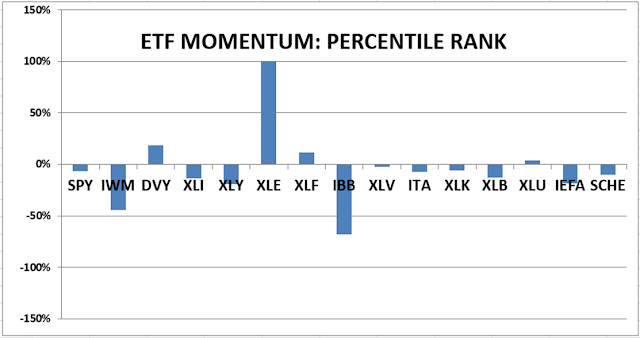

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

Market Internals remained HOLD.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is about 65% invested in stocks. This is above my “normal” fully

invested stock-allocation of 50%. I will hold this trading-position for a

while, but it will not be a long-term hold.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.