“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

NAHB HOUSING MARKET INDEX (CNBC)

“Sharply rising mortgage rates are taking their toll on

the nation’s homebuilders, as already pricey new construction becomes even less

affordable. Builder confidence in the market for new single-family homes fell 2

points to 77 in April...” Story at...

https://www.cnbc.com/2022/04/18/homebuilder-sentiment-drops-for-fourth-straight-month.html

AMERICAN RESCUE PLAN, AN EXTRAORDINARY MISTAKE (msn.com)

“Obama-era

economic advisor Stephen Rattner warned that the U.S. may be on track for a

recession just as the race for 2024 kicks off, a conundrum he blames on 'poor

economic policy' from President Biden, Congress and the Federal Reserve.” Story

at...

Steve

Rattner says American Rescue Plan was 'extraordinary mistake' (msn.com)

MARKET REPORT / ANALYSIS

-Monday the S&P 500 fell about 1point to 4392.

-VIX dipped about 2% to 22.17.

-The yield on the 10-year Treasury rose to 2.856%.

PULLBACK DATA:

If the correction has ended:

-Drop from Top: 13% (Avg.= 13% for non-crash pullbacks)

-Days from Top to Bottom: 48-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

Currently:

If the correction has not ended:

Days since top: 72 (Avg= 60 days top to bottom for

>10% non-crash pullbacks)

Drop from Top: Now 8.4%. Max at close: 13%

The S&P 500 is 2.3% BELOW its 200-dMA & 0.6%

BELOW its 50-dMA.

*We can’t call the end of the correction until the

S&P 500 makes a new high.

TODAY’S COMMENT:

Outside Reversal Pattern: “An outside reversal is a price

pattern that indicates a potential change in trend on a price chart. The

two-day pattern is observed when a security’s high and low prices for the day

exceed the high and low of the previous day’s trading session.” For more,

see....

https://www.investopedia.com/terms/o/outsidereversal.asp

Since I have seen references to this indicator, usually

by chart-guys doing candlestick analysis, I decided to investigate it to see if

I should add it into my analysis. I had

the idea that it would be a significant signal for reversals. I was surprised

to see that the indicator is very common, and sometimes the results were almost

random. Bearish signals were followed by

upturns; bullish signals happened before downturns and so forth. I did see

another site where it stated that the pattern must be very strong before the

reversal signal. It suggested that the

signal should be preceded by 4-days on one direction before the reversal signal

could be considered actionable. That’s

not very helpful since after 4 consecutive-days in one direction, a short-term reversal

would be expected anyway.

Since I already have data for the number of days up in 10

and 20-day time-periods, I decided to link the reversal indicator to it. Now my

Outside Reversal Indicator will only signal if the 10-day trend has been

opposite the reversal indication. (The 10-day seemed to work better than the

20-day.) This change seems to have made the indicator more reliable, although

that remains to be seen.

For what it’s worth, the S&P 500 experienced a Bearish

Outside Reversal Day recently, on 5 April. There had been 6 up-days prior to

the signal. For now, I’ll just keep this indicator in mind, but I am reserving

final judgement. Currently, I do not count this indicator in any of my daily or

weekly indicator totals.

Market Internals were weak today (Monday) while the

S&P 500 was up. Usually, that means

a down-day for tomorrow (Tuesday), but as I write this, Futures are pointing up

– go figure. I also note that the

overbought/oversold Index was oversold today, so that tends to suggest a short-term

bounce, but it is not guaranteed.

Today, the daily sum of 20 Indicators improved from -5 to

-3 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations declined from -36 to -44 (The trend direction

is more important than the actual number for the 10-day value.) These numbers

sometimes change after I post the blog based on data that comes in late. Most

of these 20 indicators are short-term so they tend to bounce around a lot.

The Long Term NTSM indicator

ensemble is mixed, but remained HOLD: VIX is Bullish; VOLUME is bearish; SENTIMENT

& PRICE are hold.

With the S&P 500’s failure to hold the 50-dMA last week,

I am now a Bear. That may change quickly if earnings turn out ok and the

markets turn up.

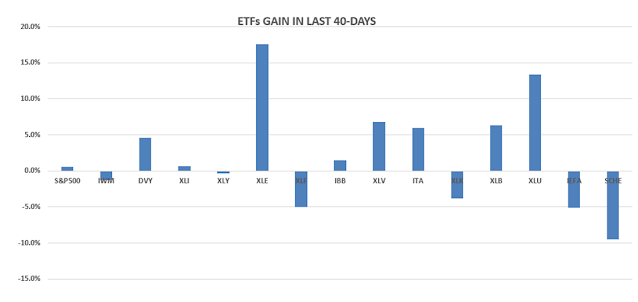

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals improved to HOLD.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now about 35% invested in stocks. This is below my “normal” fully

invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.