“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

PCE (CNBC)

“The personal consumption expenditures price index increased

2.6% on a year-over-year basis in December, 0.2 percentage point higher than

the November reading and in line with the Dow Jones estimate.” Story at...

https://www.cnbc.com/2025/01/31/pce-inflation-december-2024-.html

My cmt: Yesterday’s PCE was a preliminary number.

PERSONAL INCOME (Eye on Housing)

“Personal income increased by 0.4% in December, following

a 0.3% rise in November and a 0.7% gain in October, according to the latest

data from the Bureau of Economic Analysis. The gains in personal income were

largely driven by higher wages and salaries.” Story at...

https://eyeonhousing.org/2025/01/personal-income-rises-0-4-in-december/

CHICAGO PMI (Investing.com)

“...the Chicago Purchasing Managers' Index (PMI) has

posted a new figure, reflecting the current health of the manufacturing sector

in the Chicago region. The actual number for the PMI has come in at 39.5. This

figure, although showing an improvement, falls short of the forecasted number

of 40.3.” Story at...

https://www.investing.com/news/economic-indicators/chicago-pmi-shows-slight-recovery-still-below-forecast-93CH-3843019

TRUMP TO IMPOSE TARIFFS ON CANADA, MEXICO, AND CHINA (NBC

News)

“The White House said Friday that President Donald Trump

would impose a 25% tariff on goods coming to the U.S. from Canada and Mexico

and a 10% tariff on those from China on Saturday, a move that could drive up

prices for products coming into the U.S. from those countries... Trump said

Friday that there was nothing that the three countries could do to avoid the

tariffs, which he said were in response to the import of fentanyl into the U.S.

and because the U.S. has a trade deficit with the three countries.” Story at...

https://www.nbcnews.com/politics/donald-trump/trump-impose-tariffs-canada-mexico-china-saturday-white-house-says-rcna190221

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Friday the S&P 500 declined about 0.5% to 6041.

-VIX rose about 4% to 16.43.

-The yield on the 10-year Treasury rose (compared to

about this time, prior trading day) to 4.543%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025.

The decline in Nvidia appears to be overblown. Regarding

competition to Nvidia, Dan Ives (Managing Director and Senior Equity Research

Analyst covering the Technology sector at Wedbush Securities) says, “The

threat is minimal.” He recommended buying Nvidia. I will hold NVDA and see what

develops...

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 6 gave Bear-signs

and 13 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to +7 (7 more Bull

indicators than Bear indicators).

TODAY’S COMMENT

Today’s market action can be summed up in one word –

Tariffs. Markets looked good today, at least until the reports that Trump would

place tariffs on major US trading partners (see story above). The S&P 500 then

fell about 1% as the day progressed. I

ran some preliminary numbers before the selloff and my indicators were looking good,

but they fell sharply, too, as the markets declined.

The daily, bull-bear spread of 50-indicators is a bullish

+10, but we can’t be encouraged by the falling indicators especially the sharp

drop today on the tariff news. The 10-dMA of the spread turned down today and

that is never good.

Markets don’t like uncertainty and the tariffs are uncertainty

in spades, spades being the highest-ranking suit when playing bridge.

With the daily-indicator, bull-bear spread turning down,

and the 10-dMA of the bull-bear spread now falling, I am inclined to sell

leveraged positions. I’ll make that decision on Monday depending on market

action.

BOTTOM LINE

I am neutral – we need more information so we’ll see Monday.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

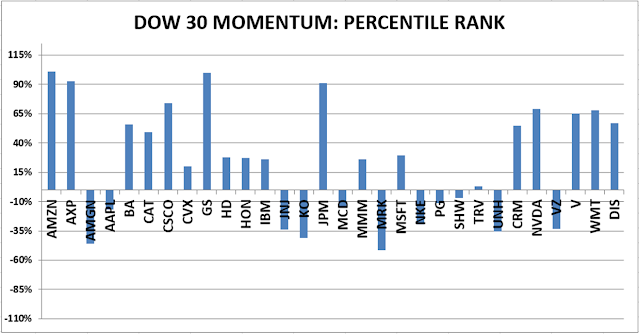

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

GDP / PCE PRICES (BEA)

“Real gross domestic product (GDP) increased at an

annual rate of 2.3 percent in the fourth quarter of 2024 (October, November,

and December), according to the advance estimate released by the U.S. Bureau of

Economic Analysis. In the third quarter, real GDP increased 3.1 percent...

...The price index for gross domestic

purchases increased 2.2 percent in the fourth quarter, compared with an

increase of 1.9 percent in the third quarter. The personal consumption

expenditures (PCE) price index increased 2.3 percent, compared with an

increase of 1.5 percent. Excluding food and energy prices, the PCE price index

increased 2.5 percent, compared with an increase of 2.2 percent.” Press release

at...

https://www.bea.gov/news/2025/gross-domestic-product-4th-quarter-and-year-2024-advance-estimate

JOBLESS CLAIMS (Reuters)

“Initial claims for state unemployment benefits dropped

16,000 to a seasonally adjusted 207,000 for the week ended Jan. 25, the Labor

Department said on Thursday. Economists polled by Reuters had forecast 220,000

claims for the latest week.” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-decline-more-than-expected-2025-01-30/

NYSE A-D LINE DIVERGENCE (McClellan Financial

Publications)

“The SP500 on Jan. 23, 2025 was able to climb up to a new

all-time closing high. But it is not yet dragging along the rest of the

market, and this may indicate a problem. This week's chart shows a bearish

divergence evident in the NYSE's cumulative Daily Advance-Decline Line... One

important point is that a divergence represents a "condition" and not

a "signal". Just because we notice a divergence does not mean

that it has to matter right away. When they do matter, it is on their own

schedule.” – Tom McClellan.

Analysis at...

https://www.mcoscillator.com/learning_center/weekly_chart/nyse_a-dine_divergence/

NTSM ANALYSIS OF BREADTH (NTSM)

As shown in the chart above, my analysis of Breadth shows

a similar divergence in breadth, but as Tom McClellan notes, divergence is not a

signal. My signal is bearish if the 100-dMA of Issues advancing on the NYSE is

below 50%. It’s not there yet (The right x-axis in the above chart is a %). In

my system, breadth is still issuing a buy signal.

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Thursday the S&P 500 rose about 0.5% to 6071.

-VIX declined about 1.2% to 15.84.

-The yield on the 10-year Treasury was little changed

(compared to about this time, prior trading day) at 4.535%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025.

The decline in Nvidia appears to be overblown. Regarding

competition to Nvidia, Dan Ives (Managing Director and Senior Equity Research

Analyst covering the Technology sector at Wedbush Securities) says, “The

threat is minimal.” He recommended buying Nvidia. I will hold NVDA and see what

develops...

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 5 gave Bear-signs

and 15 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to +10 (10 more Bull

indicators than Bear indicators).

TODAY’S COMMENT

Overall, the daily, bull-bear spread of 50-indicators is

a bullish +10. The 10-dMA of the spread is also moving higher, another bull-sign.

Microsoft made concerning comments about future revenues

so it was down late in after-hours trading yesterday and down in today’s

trading. Other tech companies were more

optimistic – Apple was up 3% after-hours and IBM was up 13% on the day.

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals declined to HOLD. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

TRUMP ISN’T KING (WSJ – LETTERS)

“It is common today to think of our branches of

government as coequal, as Daniel Henninger writes in his column “Trump’s Imperial Presidency?” (Wonder Land, Jan. 23). But

this is incorrect. The Founders would say our branches are coordinate, that

each has its own role...

...Unfortunately, our government today bears little

resemblance to this constitutional vision. It is, as Mr. Henninger writes,

closer to an imperium, with the president as elected emperor. The blame for

this situation belongs to Congress, which has over the last century ceded de

facto lawmaking powers to the executive branch and its legions of unelected

bureaucrats. This violates an essential maxim of our constitutional order: that

the preservation of liberty requires that the executive, legislative and judicial

powers mostly be kept separate...

...Perhaps congressional dysfunction isn’t a consequence

of our civic malady but its cause. By divesting itself of power, Congress has

robbed the people of meaningful input into the rules that govern them. If some

wish to “Make America Great Again,” as President Trump and his supporters

proclaim, the executive should return to Congress the powers that, under the

Constitution, it never should have had in the first place.” - Jay Cost, American

Enterprise Institute. Full letter at...

https://www.wsj.com/opinion/trump-isnt-king-and-congress-isnt-coequal-trump-republic-1f7f46f1?mod=letterstoeditor_more_article_pos13

my cmt: Of course this didn’t start with Trump, Biden or

even Obama, though they all assumed powers that were not granted to the

President.

"I've officially introduced legislation to put

President Trump's face on Mount Rushmore. His remarkable accomplishments for

our country and the success he will continue to deliver deserve the highest

recognition and honor on this iconic national monument. Let's get

carving!" - Anna Paulina Luna, Florida, (R) House of Representatives.

"This is silly. I'm a Republican, but Trump's first

term wasn't impressive. He hasn't done much to earn praise, let alone

consideration for Mount Rushmore. This is when our movement feels weird."

– Mark Valley, Republican voter.

FED RATE DECISION (CNBC)

“In a widely anticipated move, the central bank’s Federal

Open Market Committee left unchanged its overnight borrowing rate in a range

between 4.25%-4.5%... The post-meeting

statement dropped a few clues about the reasoning behind the

decision to hold rates steady. It offered a somewhat more optimistic view on

the labor market while losing a key reference from the December statement that

inflation ‘has made progress toward’ the Fed’s 2% inflation goal.” Story at...

https://www.cnbc.com/2025/01/29/fed-rate-decision-january-2025.html

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) increased by 3.5 million barrels from the

previous week. At 415.1 million barrels, U.S. crude oil inventories are about

6% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Wednesday the S&P 500 declined about 0.5% to 6039.

-VIX rose about 0.9% to 16.56.

-The yield on the 10-year Treasury was unchanged

(compared to about this time, prior trading day) at 4.534%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025.

The decline in Nvidia appears to be overblown. Regarding

competition to Nvidia, Dan Ives (Managing Director and Senior Equity Research

Analyst covering the Technology sector at Wedbush Securities) says, “The

threat is minimal.” He recommended buying Nvidia. I will hold NVDA and see what

develops...

...Down 17% Monday; up 9% Tuesday; down 4% Wednesday –

whiplash!

Nvidia was up 2% after hours Wednesday so perhaps

investors were encouraged by earnings from Microsoft and Meta.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 4 gave Bear-signs

and 17 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to +13 (13 more Bull

indicators than Bear indicators).

TODAY’S COMMENT

Overall, the daily, bull-bear spread of 50-indicators is a

bullish +13. The 10-dMA of the spread is also moving higher, another bull-sign.

The decline in indicators is not particularly concerning, especially on a Fed-decision

day. There’s often angst when the Fed is talking. There were some critical

earnings due today and that may have also worried investors.

Microsoft and Meta are both up in after-hours trading as

I write this. Investors liked their

earnings and statements. Let’s hope that translates into an up-day tomorrow. Today’s

low was well above Monday’s low so it seems likely that markets will move

higher.

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

DURABLE GOODS (RTT News)

“A report released by the Commerce Department on Tuesday

unexpectedly showed a steep drop by new orders for U.S. manufactured durable

goods in the month of December amid a nosedive by orders for transportation

equipment. The Commerce Department said durable goods orders plunged by 2.2

percent in December after tumbling by a revised 2.0 percent in November.” Story

at...

https://www.rttnews.com/3506528/u-s-durable-goods-orders-unexpectedly-plunge-2-2-in-december.aspx

CONSUMER CONFIDENCE (AP News)

“U.S. consumer confidence dipped for the second

consecutive month in January, a business research group said Tuesday. The

Conference Board reported that its consumer confidence index retreated this

month to 104.1, from 109.5 in December.” Story at...

https://apnews.com/article/consumer-confidence-conference-board-spending-economy-31aab08b4281d3d23961c5c25fef6cca

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Tuesday the S&P 500 rose about 0.9% to 6068.

-VIX declined about 8% to 16.41.

-The yield on the 10-year Treasury was unchanged

(compared to about this time, prior trading day) at 4.534%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025.

The decline in Nvidia appears to be overblown. Regarding

competition to Nvidia, Dan Ives (Managing Director and Senior Equity Research

Analyst covering the Technology sector at Wedbush Securities) says, “The

threat is minimal.” He recommended buying Nvidia. I will hold NVDA and see what

develops...

...Down 17% yesterday; up 9% today.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 3 gave Bear-signs

and 19 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) improved to +16 (16 more Bull

indicators than Bear indicators).

TODAY’S COMMENT

Overall, the daily, bull-bear spread of 50-indicators is

a very bullish +16. The 10-dMA of the spread is also moving higher, another

bull-sign.

Improving indicators is a good sign.

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

“Of Mr. Trump’s executive orders, some were sound... But

let me tell you what happens when you pardon virtually everyone who did Jan. 6:

You get more Jan. 6ths. When people who commit crimes see that their punishment

will be minimal they are encouraged. It was a wicked act. Conservatives are

tough on crime because of the pain and disorder it causes. In that case it

pained an entire nation. Jan. 6 too shamed us in the eyes of the world. This

pardon was not a patriotic act.” Peggy Noonan, WSJ. Commentary at...

https://www.wsj.com/opinion/the-white-house-wonder-horse-donald-trump-america-inaugural-address-f4569d27?mod=opinion_recentauth_pos3&mod=opinion_recentauth_pos_3

My cmt: It was neither patriotic nor the act of a real

conservative. It was the act of a coward who may have been worried that if he

didn’t offer a pardon, some of those incarcerated may have broken their silence

and testified against him. How’s that for a conspiracy theory? Regular readers

know that I have previously noted that there have been numerous reports by

major news sources that there were phone communications between the White House

and January 6 rioters, both before, and during the riot.

“The press is reporting that Republicans in Congress are

getting nervous about spending reductions in social programs as too politically

risky. Another GOP faction wants to retain Joe Biden’s green subsidies. And

this is only week one of the new Administration. If this keeps up, why not let

Democrats run the place? ... Progressives claim that Republicans want to take

food and healthcare away from the poor and sick. But the reality is that Mr.

Biden’s welfare expansions have mostly benefited those who can support

themselves but for any number of reasons choose not to. Republicans need not

fall into the trap of talking about this like accountants. This is a moral

issue of helping people who really need it but not those who don’t.” – WSJ

Editorial Board. Commentary at...

https://www.wsj.com/opinion/biden-welfare-spending-transfer-payments-republicans-savings-tax-reform-3f10d9eb?mod=opinion_lead_pos12

CHINESE AI UPSTART SPARKS TRILLION DOLLAR MARKET ROUT

(The Daily Beast)

“A Chinese artificial

intelligence startup’s latest AI model spooked markets Monday, leaving U.S.

and European technology

stocks on track for a $1 trillion wipeout, a week after President Donald Trump threw

his weight behind a $500 billion private sector investment in AI infrastructure.

DeepSeek’s latest AI model topped Apple’s App Store charts over the weekend,

challenging the dominance of Silicon

Valley giants like ChatGPT-maker OpenAI and leading to concerns

that some of America’s largest publicly traded companies are overvalued. Chinese

AI researchers have more widely shared their work—DeepSeek is an open-source

model, meaning anyone can view, use and modify its source code. And, because of

U.S. sanctions disrupting their access to advanced semiconductor chips,

developed AI models that require far less computing power.” Story at...

Chinese

AI Upstart Sparks $1 Trillion Market Rout After Trump Hyped AI Megadeal

NEW HOME SALES (Realtor.com)

“New-home sales rose again in December to a seasonally

adjusted annual rate of 698,000, a 3.6% increase from November 2024 and a 6.7%

increase from December 2023.” Story at...

https://www.realtor.com/research/new-home-sales-december-2024/

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Monday the S&P 500 declined about 1.5% to 6012.

-VIX rose about 21% to 20.54.

-The yield on the 10-year Treasury declined (compared to

about this time, prior trading day) to 4.534%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025.

My Nvidia trade got blown up today. It had been drifting

lower before today. Now we know why. See

the article above. “A Chinese artificial

intelligence startup’s latest AI model spooked markets Monday...” CNBC

reporters congratulated themselves for being “out front” on this story. I watch a lot of CNBC and I don’t remember

hearing about this issue; the reporter today said that it was widely known in Silicon

Valley. In a different part of the story, Josh Brown said that NVDA is not held

by institutional investors, but instead, is held by “retail.” To translate, the

smart money unloaded their positions to the suckers like me - then it was

leaked to the press.

As a practical matter, this appears to be overblown. Regarding

competition to Nvidia, Dan Ives (Managing Director and Senior Equity Research

Analyst covering the Technology sector at Wedbush Securities) says, “The

threat is minimal.” He recommended buying Nvidia. I will hold NVDA and see what

develops.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 7 gave Bear-signs

and 16 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to +9 (9 more Bull

indicators than Bear indicators).

TODAY’S COMMENT

Overall, the daily, bull-bear spread of 50-indicators is

a bullish +9. The 10-dMA of the spread is also moving higher, another bull-sign.

Monday was a statistically significant down-day. That

just means that the price-volume move exceeded my statistical parameters.

Statistics show that a statistically-significant, down-day is followed by an up-day

about 60% of the time. Bottoms almost

always occur on Statistically-significant, down-days, but not all

statistically-significant, down-days occur at bottoms. The daily chart showed

that the S&P 500 bounced higher from below its 50-dMA (and lower trend-line)

suggesting that the markets will move higher from here.

I thought that my Panic Indicator would have been

triggered today, but it wasn’t. That’s probably good news. Today’s panic was not widespread and seemed

to be concentrated in chip names.

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to BUY. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

“When I saw the film, I thought it was great and that

Steve Carell was wonderful. But I thought, hey, I wasn’t that angry.

After the crash I was interviewed by the Federal Crisis Inquiry Commission, and

I saw a transcription later on. After reading it, I realized that ‘yes,’ I

really was that angry...” - Steven Eisman, discussing “The Big Short.” He was the

real Big Short investor played by Steve Carell (Mark Baum) in the “Big Short”

movie.

HOME SALES (CNN)

“Sales of previously owned homes, which make up the vast

majority of the market, totaled 4.06 million in 2024, the National Association

of Realtors said Friday. That’s the lowest level since 1995 and slightly below

2023’s similarly anemic levels.” Story at...

https://www.cnn.com/2025/01/24/economy/us-home-sales-worst-year-in-three-decades/index.html

MICHIGAN FINAL SENTIMENT (Advisor Perspectives)

“Consumer sentiment fell for the first time in six

months, according to the final January report for the Michigan Consumer

Sentiment Index, coming in at 71.1. The index dropped 2.9 points (-3.9%) from

December's final reading to 74.0 and is down 10.0% compared to one year ago.

The latest reading was lower than the 73.2 forecast.” Analysis and charts at...

https://www.advisorperspectives.com/dshort/updates/2025/01/24/michigan-consumer-sentiment-january-2025-final

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Friday the S&P 500 declined about 0.3% to 6101.

-VIX declined about 1% to 14.85.

-The yield on the 10-year Treasury rose (compared to

about this time, prior trading day) to 4.617%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 7 gave Bear-signs

and 17 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to +10 (10 more Bull

indicators than Bear indicators).

TODAY’S COMMENT

I’ve been re-watching “The Big Short” on cable. The “can’t

lose” mentality shown in the movie is being mirrored by current stock market

action: Everyone on CNBC is bullish; Valuations are extreme by any measure; the

Government is considering establishing a bitcoin “asset stockpile” (bitcoins

have no real value); it’s been a generation (24 years) since there was a

valuation crash; Wall Street (Calamos Investments) is offering funds with 100%

downside protection.

The end could be near, but we don’t know. I bring this up

because at yesterday’s all-time S&P 500 high, the number of new 52-week

highs for issues on the NYSE was lower than I would like. They weren’t low

enough to trigger my Bear-indicator, but it was close.

In the Big Short, it was possible to predict a collapse

due to the sharply rising interest rates since the Fed was in a hiking cycle.

The mortgage-based instruments (Collateralized Mortgage Obligations) failed as interest

rates on sub-prime, adjustable-rate mortgages reset. My guess is the next crash will be a valuation

crash – markets will run out of buyers when the prices get too high. That was the

main cause of the dot.com crash although the Fed lit the fire by hiking

interest rates.

Now, markets could keep going up for another year or two,

or even longer. I’ll just keep watching indicators. Until I see more signs of

trouble, I’ll be fully invested.

Overall, the daily, bull-bear spread of 50-indicators is

a bullish +10. The 10-dMA of the spread is also moving higher, another bull-sign.

BOTTOM LINE

I remain bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals declined to HOLD. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

BIDEN INSISTED HE DIDN’T SIGN EXECUTIVE ORDER JUST WEEKS

AFTER DOING SO (NY Post)

“President Biden had no clue whether or not he signed a

critical executive order during a conversation last year with Republican House

Speaker Mike Johnson, who admitted he left the meeting fearing the nation is

in “serious trouble.” An addled Biden insisted to the Louisiana lawmaker

that he never issued the order to freeze new liquid natural gas export permits

— even though he signed off on it less than a month earlier. Johnson told the

Free Press’ Bari Weiss he didn’t believe Biden was lying, but was left to

believe the then-81-year-old leader “genuinely didn’t know what he had signed.”

Story at...

Biden

insisted he didn’t sign executive order just weeks after doing so, Speaker

Johnson reveals

My cmt: Disturbing, but not

surprising.

TRUMP EXECUTIVE ORDER ENDS BIRTHRIGHT

CITIZENSHIP – 22 STATES SUE (AP News)

“Trump’s order asserts that the

children of noncitizens [born in the U.S.] are not subject to the jurisdiction

of the United States...It goes on to bar federal agencies from recognizing the

citizenship of people in those categories. It takes effect 30 days from

Tuesday, on Feb. 19.” Story at...

https://apnews.com/article/birthright-citizenship-trump-executive-order-immigrants-fc7dd75ba1fb0a10f56b2a85b92dbe53

My cmt:

Section 1 of the 14th Amendment

states: “All persons born or naturalized in the United States, and subject to

the jurisdiction thereof, are citizens of the United States and of the State

wherein they reside.” I see no wiggle room in the language. The President does not have the authority to make

his own rules. Any real conservative would follow the constitution. King Trump

has forgotten the oath of office he took just a few days ago.

JOBLESS CLAIMS (Reuters)

“Initial claims for state unemployment benefits increased

6,000 to a seasonally adjusted 223,000 for the week ended Jan. 18. Economists

polled by Reuters had forecast 220,000 claims for the latest week. Claims were

lifted by the wildfire in Los Angeles, with unadjusted applications increasing

in California, but falling in the majority of states.” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-marginally-2025-01-23/

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 1.0 million barrels from the

previous week. At 411.7 million barrels, U.S. crude oil inventories are about

6% below the five-year average for this time of year.” Story at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

THE RICH AND FAMOUS DON’T FEAR A BUBBLE – BUT YOU SHOULD

(Mark Hulbert on MarketWatch)

“The risk of the stock market is forming a bubble that

will soon burst is higher — especially because the rich and famous don’t think

so. I’m referring to attendees at the World Economic Forum...By almost any

objective measure, the risk of a bubble bursting is perhaps higher now than at

any time in decades. But because no major asset bubble has burst in recent

years, recency bias leads the global elite — just like the rest of us — to

underestimate the risks of such an event...

... The table above contrasts where 10 valuation

indicators stand today versus January 2009. These are the same 10 indicators on

which I focus in my periodic valuation updates, each of which has a solid track

record forecasting the stock market’s inflation-adjusted total return over the

subsequent 10 years. For comparison, the table reports each indicator’s level

relative to the distribution of its readings since 2000, with a 100% reading

meaning that it’s at its most bearish level and 0% meaning it’s at its most

bullish. Notice that each of the 10 valuation indicators was at or near the

most bullish end of the spectrum in January 2009, while just the opposite is

the case today.” Story at...

The

rich and famous don’t fear a stock market bubble. That’s why you should.

CAN’T LOSE INVESTMENTS (Yahoo News)

“Calamos Investments is targeting two of the most popular

ETF themes with a new fund that offers 100% downside protection on bitcoin

investing... [It] builds on the Chicago area firm's suite of

exchange-traded funds that offer 100% downside protection on the S&P 500

Index, the Russell 2000 Index, and the Nasdaq Composite Index.” Story at...

https://finance.yahoo.com/news/calamos-unveils-cant-lose-bitcoin-225042366.html

My cmt: These funds cap upside

potential at around 10%, but when Wall Street decides markets can’t go down, it

is time to be afraid, very afraid.

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Thursday the S&P 500 rose about 0.5% to 6119.

-VIX declined about 0.5% to 15.02.

-The yield on the 10-year Treasury rose (compared to

about this time, prior trading day) to 4.646%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 5 gave Bear-signs

and 18 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to +13 (13 more Bull

indicators than Bear indicators).

TODAY’S COMMENT

The Table in the above piece, “The Rich and Famous Don’t Fear

a Bubble,” notes how stocks are overvalued. Valuation is not a good way to time

the market. I heard Dennis Gartman

(Gartman letter, former CNBC contributor) on a local radio show this morning

and he said he has been out of the market for a year due to high valuations. This

just demonstrates the difficulty in using valuation for timing the market.

There are now fewer stocks and more investors chasing them – less supply and more

demand means that valuation-indicators are likely to be higher than past

historical extremes. I’ll be watching my 50-indicators (plus a dozen or so

others not in the system) to warn me of market dislocations. Valuation

indicators are not in my system.

Until I see signs of trouble, I’ll be fully invested. On

the other hand, I am inclined to invest in quality names and quality Indices

and avoid the small caps. Previously, I bought

small caps as interest rates came down.

I made some money and lost some money as the small cap rally didn’t materialize.

Now, avoiding small caps will avoid some

risk.

The daily, bull-bear spread of +13 is Bullish. The 10-dMA

of the spread is also moving higher, another bull-sign, but there was a

troubling sign today.

Thursday, the S&P 500 made a New All-time High. I always do a breadth check at new highs. Today, we note that on the NYSE, the number

of issues making new, 52-week highs was low, about half the 5-year average. This

indicates a narrow advance. The value was slightly above my “bear warning,” but

close enough to be a concern. I’ll watch other indicators before I take any

action. If there are declines now (and I’m

not predicting one), a correction is more likely to be greater than 10% than

not.

The S&P 500 is about 9% above its 200-dMA and that is

not particularly stretched and there are no top indicators currently warning. Markets can go higher.

BOTTOM LINE

I am bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to BUY. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.