NAVIGATE THE STOCK MARKET FOCUSES ON: (1) Daily momentum analysis of the DOW 30 stocks and 15 ETFs across various market sectors. (2) Stock Market commentary and analysis. (3) Buy/Sell signals for major market turns. (((The blog is for information only. You assume all risk of its use; we don’t warrant the accuracy of our content. You must do your own due diligence.)))

Tuesday, October 31, 2017

Futures Bullish

Tonight, we see bullish futures ignoring my expectation

that markets will retreat. The 10-dMA of the % of stocks advancing on the NYSE

picked up from 47.4% yesterday to 49.4% Tuesday. There weren’t too many other

bullish trends in my numbers although there were neutral ones. Mr. Market may choose to postpone a pullback

again! We’ll see.

Chicago PMI … Consumer Confidence … Stock Market Analysis … ETF Trading … Dow 15 Ranking

CHICAGO PMI (Investing.com)

“Manufacturing activity in the U.S. Midwest unexpectedly

strengthened to its strongest level in three years in October...The Chicago

Purchasing Management Index rose to 66.2 from

65.2 in September. It was the highest level since October 2014…” Story at…

CONSUMER CONFIDENCE (Conference Board)

“Consumer confidence increased to its highest level in

almost 17 years in October after remaining relatively flat

in September,” said Lynn Franco, Director of Economic Indicators at The

Conference Board. “Consumers’ assessment of current conditions improved,

boosted by the job market which had not received such favorable ratings since

the summer of 2001.” Press release at…

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 was up about 0.1% to 2575.

-VIX was down about 3% to 10.18.

-The yield on the 10-year Treasury rose to 2.375%.

My Sum of 17 Indicators dropped from -2 to -6. This is subject to a lot of daily swings so I

use a smoothed 10-day value for this indicator.

My 10-day indicator is still falling sharply and that remains bearish.

See Friday’s blog post for my thoughts on the Markets –

they haven’t changed. Indicators are deteriorating. We’ll see if they keep

headed down.

A pullback in the range of 3-5% would be the norm.

Perhaps we’ll finally see a bigger (10% or more move down), but that is

anybody’s guess at this point. The

numbers suggest down; but the magnitude is unknown.

Short-term I am still leaning bearish and I made a

bearish VXX buy Friday. It’s a risky

move as I noted several times, but with VIX below 10 and other bearish

indicators I think it is a reasonable bet.

I’ll have a low tolerance for loss and I’ll sell quickly if this trade

moves against me.

I remain bullish longer-term. One wonders when this party

will end so I will worry if the numbers deteriorate, but for now I remain fully

invested.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%.

*For additional background on the ETF ranking system see

NTSM Page at…

Technology (XLK) was #1; Aerospace and Defense (ITA) remained

#2 today and Financials (XLF) weren’t far behind. I am in ITA as of 21 Sept. I

plan to sell tomorrow unless ITA puts on a big move up.

I thought it would be interesting to apply the ETF

ranking system methodology to the Dow 30.

The quick way to do it was to keep the number of stocks the same as my

ETF ranking system so here is a ranking of 15 DOW stocks.

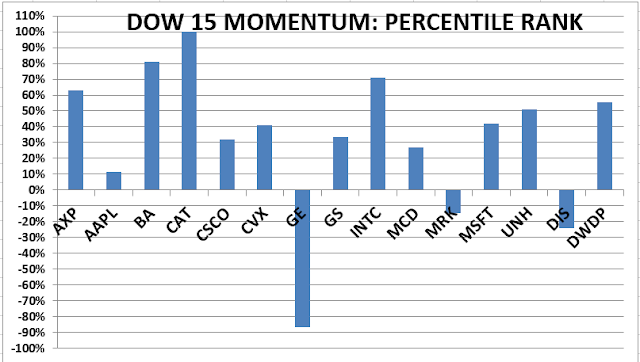

TODAY’S RANKING OF 15 DOW STOCKS (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. Avoid GE, Merck and Disney. Their 120-day

moving averages are falling.

Intel (INTC) remained #1 today. I have owned Intel for

some time.

*I rank the Dow 15 similarly to the ETF ranking system.

For more details, see NTSM Page at…

SHORT-TERM TRADING PORTFOLIO - 2017 (Small-% of the

total portfolio)

LONG

As noted Friday I did take a short-term VXX position on

27 Oct very near the close. This violates the rules below, but I am eternally

hopeful.

My shorting rule is as follows:

-“In a

bull market, you can only be long or neutral.” – D. Gartman

-“The best policy

is to avoid shorting unless a major bear market is underway and downside

momentum has been thoroughly established. Even then, your timing must sometimes

be perfect. In a bull market the trend is truly your friend, and trading

against the grain is usually a fool's errand.” – Clif Droke.

-“Commandment

#1: “Thou Shall Not Trade Against the Trend.” - James P. Arthur Huprich

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on

Positive, out on Negative – no shorting).

LONG TERM INDICATOR

Tuesday, Sentiment,

Price, VIX & Volume indicators were neutral. With VIX recently below 10

for a couple of days in May, June, July, August, September and now October, VIX

may be prone to incorrect signals. Usually, a rising VIX is a bad market sign;

now it may move up, but that might just signal normalization of VIX, i.e., VIX

and the Index may both rise. As an indicator, VIX is out of the picture for a

while.

MY INVESTED STOCK POSITION:

TSP (RETIREMENT ACCOUNT – GOV EMPLOYEES) ALLOCATION

I increased

stock allocation to 50% stocks in the S&P 500 Index fund (C-Fund) 24 March

2017 in my long-term accounts, based on short-term indicators. The remainder

is 50% G-Fund (Government securities). This is a conservative retiree

allocation, but I consider it fully invested for my situation.

The previous signal was a BUY on 2 June and the last

actionable signal was a BUY (from a prior sell) on 15 November 2016.

Monday, October 30, 2017

Consumer Spending … Reginal FED Manufacturing … Stock Market Analysis … ETF Trading … Dow 15 Ranking

CONSUMER SPENDING (CNBC/Reuters)

“U.S. consumer spending recorded its biggest increase in

more than eight years in September, likely as households in Texas and Florida

replaced flood-damaged motor vehicles. The Commerce Department said on Monday

consumer spending, which accounts for more than two-thirds of U.S. economic

activity, jumped 1.0 percent last month.” Story at…

REGIONAL FED MANUFACTURING (Advisor Perspectives)

“Five out of the twelve Federal Reserve Regional Districts currently

publish monthly data on regional manufacturing: Dallas, Kansas City, New York,

Richmond, and Philadelphia….The latest average of the five for October is 21.2,

up from the previous month's 17.8.” See below chart:

Charts and commentary from Advisor Perspectives at…

MARKET REPORT / ANALYSIS

-Monday the S&P 500 was down about 0.3% to 2573.

-VIX was down about 7% to 10.5.

-The yield on the 10-year Treasury slipped to 2.372%.

My Sum of 17 Indicators rose from -3 to -2. This is subject to a lot of daily swings so I

use a smoothed 10-day value for this indicator.

My 10-day indicator is falling sharply and that’s bearish.

See Friday’s blog post for my thoughts on the Markets –

they haven’t changed.

A pullback in the range of 3-5% would be the norm.

Perhaps we’ll finally see a bigger (10% or more move down), but that is

anybody’s guess at this point. The

numbers suggest down; but the magnitude is unknown.

Short-term I am still leaning bearish and I made a

bearish VXX buy Friday. It’s a risky

move as I noted several times, but with VIX below 10 and other bearish

indicators I think it is a reasonable bet.

I’ll have a low tolerance for loss and I’ll sell quickly if this trade

moves against me.

I remain bullish longer-term. One wonders when this party

will end so I will worry if the numbers deteriorate, but for now I remain fully

invested.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%.

*For additional background on the ETF ranking system see

NTSM Page at…

Technology (XLK) was #1; Aerospace and Defense (ITA) slipped

to #2 today and Financials (XLF) weren’t far behind. I am in ITA as of 21 Sept.

I thought it would be interesting to apply the ETF

ranking system methodology to the Dow 30.

The quick way to do it was to keep the number of stocks the same as my

ETF ranking system so here is a ranking of 15 DOW stocks.

TODAY’S RANKING OF 15 DOW STOCKS (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. Avoid GE, Merck and Disney. Their 120-day

moving averages are falling.

Intel (INTC) moved into #1 today. I have owned Intel

for some time.

*I rank the Dow 15 similarly to the ETF ranking system.

For more details, see NTSM Page at…

SHORT-TERM TRADING PORTFOLIO - 2017 (Small-% of the

total portfolio)

LONG

As noted Friday I did take a short-term VXX position on

27 Oct very near the close. I had intended to post it here during trading hours

so others could follow my foolishness if they wanted; but I was out working and

only noticed this set-up in the last 10-minutes of the day when I got home.

This violates the rules below, but I am eternally hopeful.

My shorting rule is as follows:

-“In a bull market, you can only be long or

neutral.” – D. Gartman

-“The best policy

is to avoid shorting unless a major bear market is underway and downside

momentum has been thoroughly established. Even then, your timing must sometimes

be perfect. In a bull market the trend is truly your friend, and trading

against the grain is usually a fool's errand.” – Clif Droke.

-“Commandment #1: “Thou Shall Not Trade Against the Trend.” - James P. Arthur Huprich

MONDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on

Positive, out on Negative – no shorting).

LONG TERM INDICATOR

Monday, Sentiment,

Price, VIX & Volume indicators were neutral. With VIX recently below 10

for a couple of days in May, June, July, August, September and now October, VIX

may be prone to incorrect signals. Usually, a rising VIX is a bad market sign;

now it may move up, but that might just signal normalization of VIX, i.e., VIX

and the Index may both rise. As an indicator, VIX is out of the picture for a

while.

MY INVESTED STOCK POSITION:

TSP (RETIREMENT ACCOUNT – GOV EMPLOYEES) ALLOCATION

I increased

stock allocation to 50% stocks in the S&P 500 Index fund (C-Fund) 24 March

2017 in my long-term accounts, based on short-term indicators. The remainder

is 50% G-Fund (Government securities). This is a conservative retiree

allocation, but I consider it fully invested for my situation.

The previous signal was a BUY on 2 June and the last

actionable signal was a BUY (from a prior sell) on 15 November 2016.

Friday, October 27, 2017

GDP … Michigan Sentiment … Stock Market Analysis … ETF Trading … Dow 15 Ranking

GDP (WSJ)

“The U.S. economy posted its best six-month stretch of

growth in three years, rebounding quickly from two hurricanes and showing

momentum heading into the year’s final months. Gross domestic product—the

broadest measure of goods and services made in the U.S.—expanded at a 3% annual

rate in the third quarter…” Story at…

MICHIGAN SENTIMENT

The consumer sentiment average during the first ten

months of 2017 (96.7) has been the highest since 2000 (108.5).” Story at…

MARKET REPORT / ANALYSIS

-Friday the S&P 500 was up about 0.8% to 2581.

-VIX was down about 13% to 9.8.

-The yield on the 10-year Treasury slipped to 2.411%.

Running out of Gas:

-6% of stocks on the NYSE made new-highs today. At the

prior all-time high on 20 October, 9% of stocks made new highs.

-The 10-dMA of advancing stocks was 54% on 20 Oct. At today’s

new all-time high, only 48% of stocks were advancing on the NYSE over the last

10-days.

-Up volume was 50% of the total over the prior 10-days on

20 Oct. Today it was 47%.

Momentum is slipping. It looks like we’ll see some sort

of pullback. I don’t keep a stat on it, but while market made a new-high on the

S&P 500 Friday, two stats stand out: (1) only 48% of stocks have been

advancing over the last 10-days (2) declining volume has outpaced advancing

volume over the past 10-days. That is odd. It means the smalls aren’t participating

as they should. This isn’t unusual so it doesn’t mean there will be a crash; but

it does indicate that it is less likely that the market will continue up from

here in the short-run given other negative signs we’ve seen recently.

Last, the move Friday was statistically significant based

on the standard deviation of the price-volume when compared to recent history.

That is likely to result in a down-day Monday about 60% of the time. I wrote recently

that “…before we see any meaningful pullback, we need to put in a top. At this point another big move up, say around

1%, could mark another short-term top.” Today’s move of 0.8% didn’t quite make

my target, but I think it may be close enough. The Index is at its upper trend

line and we have certainly seen enough bearish signals for the last 6-weeks.

Bollinger Bands finally joined the bearish party with an overbought indication

today.

A pullback in the range of 3-5% would be the norm. Perhaps

we’ll finally see a bigger (10% or more move down), but that is anybody’s guess

at this point. The numbers suggest down;

but the magnitude is unknown.

Short-term I am still leaning bearish and I made a

bearish VXX buy today. It’s a risky move

as I noted several times, but with VIX below 10 and other bearish indicators I

think it is a reasonable bet. I’ll have

a low tolerance for loss and I’ll sell quickly if this trade moves against me.

I remain bullish longer-term. One wonders when this party

will end so I will worry if the numbers deteriorate, but for now I remain fully

invested.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%.

*For additional background on the ETF ranking system see

NTSM Page at…

Aerospace and Defense (ITA) remained #1 today. I am in

ITA as of 21 Sept. The Financials (XLF) picked up steam presumably based on

higher interest rates as we have noticed the 10-yr bond rising recently.

I thought it would be interesting to apply the ETF

ranking system methodology to the Dow 30.

The quick way to do it was to keep the number of stocks the same as my

ETF ranking system so here is a ranking of 15 DOW stocks.

TODAY’S RANKING OF 15 DOW STOCKS (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. Avoid GE, Merck and Disney. Their 120-day

moving averages are falling.

Caterpillar (CAT) remained #1.

*I rank the Dow 15 similarly to the ETF ranking system.

For more details, see NTSM Page at…

SHORT-TERM TRADING PORTFOLIO - 2017 (Small-% of the

total portfolio)

LONG

As noted above I did take a short-term VXX position on 27

Oct very near the close. I had intended to post it here during trading hours so

others could follow my foolishness if they wanted; but I was out working and

only noticed this set-up in the last 10-minutes of the day when I got home. This

violates the rules below, but I am eternally hopeful.

My shorting rule is as follows:

-“In a bull market, you can only be long or

neutral.” – D. Gartman

-“The best policy

is to avoid shorting unless a major bear market is underway and downside

momentum has been thoroughly established. Even then, your timing must sometimes

be perfect. In a bull market the trend is truly your friend, and trading

against the grain is usually a fool's errand.” – Clif Droke.

-“Commandment #1: “Thou Shall Not Trade Against the Trend.” - James P. Arthur Huprich

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained

Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on

Positive, out on Negative – no shorting).

LONG TERM INDICATOR

Friday, Sentiment,

Price, VIX & Volume indicators were neutral. With VIX recently below 10

for a couple of days in May, June, July, August, September and now October, VIX

may be prone to incorrect signals. Usually, a rising VIX is a bad market sign;

now it may move up, but that might just signal normalization of VIX, i.e., VIX

and the Index may both rise. As an indicator, VIX is out of the picture for a

while.

MY INVESTED STOCK POSITION:

TSP (RETIREMENT ACCOUNT – GOV EMPLOYEES) ALLOCATION

I increased

stock allocation to 50% stocks in the S&P 500 Index fund (C-Fund) 24 March

2017 in my long-term accounts, based on short-term indicators. The remainder

is 50% G-Fund (Government securities). This is a conservative retiree

allocation, but I consider it fully invested for my situation.

The previous signal was a BUY on 2 June and the last

actionable signal was a BUY (from a prior sell) on 15 November 2016.

Thursday, October 26, 2017

Jobless Claims … Kansas City FED … Real Durable Goods Orders … Stock Market Analysis … ETF Trading … Dow 15 Ranking

JOBLESS CLAIMS

The number of Americans filing for unemployment benefits

increased less than expected last week, suggesting the labor market continued

to tighten after recent hurricane-related disruptions…Initial claims for state

unemployment benefits increased 10,000 to a seasonally adjusted 233,000 for the

week ended Oct. 21…” Story at…

KANSAS CITY FED (People’s Pundit Daily)

“The Kansas City Federal Reserve Bank said their gauge of

manufacturing activity in the Tenth District came in at 23 in October, stronger

than the 17 median forecast…“Factory activity accelerated further in our region

this month, posting its highest composite reading since 2011,” said Chad

Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas

City.” Story at…

REAL DURABLE GOODS ORDERS (Advisor

Perspectives)

“As these charts illustrate, when we study durable goods

orders in the larger context of population growth and also adjust for

inflation, the data becomes a coincident macro-indicator of a major shift in

demand within the U.S. economy. It correlates with a decline in real household

incomes, as illustrated in our analysis of the most recent Census Bureau

household income data…” Charts and analysis at…

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 was up about 0.1% to 2560.

-VIX was up about 0.6% to 11.30.

-The yield on the 10-year Treasury increased to 2.465%.

My Sum of 17-Indicators rose from -2 to 0. Longer term

the Indicators are falling sharply. Indicators are not much different than

yesterday, but there are a couple of changes:

-Up-volume moved up on a 10-day basis. That’s a bullish change.

-The Smart Money Indicator (based on late day action)

turned down after a positive day yesterday.

Looks like the Pro trend is still selling after turning up for only 1-day.

I noted yesterday that “we may see a short-term dip in

the 3-5% range. Earnings will play a part in investor psychology. Google,

Amazon, Intel all report tomorrow albeit after the close, so they’ll set the

tone for Friday.” How did they do?

“Four of the most valuable tech companies in the

world—Amazon.com Inc., Google parent company Alphabet Inc., Microsoft Corp. and

Intel Corp. — destroyed expectations for profit and revenue in

third-quarter reports Thursday afternoon, collectively bringing in about $2.2

billion more profit and $19 billion more revenue than the same quarter a year

ago.” Story at…

This may be enough to avoid a pullback for a bit longer.

Short-term I am still leaning bearish, but I remain

bullish longer-term. One wonders when this party will end so I will worry if

the numbers deteriorate, but for now I remain fully invested.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%.

*For additional background on the ETF ranking system see

NTSM Page at…

Aerospace and Defense (ITA) remained #1 today. I am in

ITA as of 21 Sept.

I thought it would be interesting to apply the ETF

ranking system methodology to the Dow 30.

The quick way to do it was to keep the number of stocks the same as my

ETF ranking system so here is a ranking of 15 DOW stocks.

TODAY’S RANKING OF 15 DOW STOCKS (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. Avoid GE, Merck and Disney. Their 120-day

moving averages are falling.

Caterpillar (CAT) remained #1.

*I rank the Dow 15 similarly to the ETF ranking system.

For more details, see NTSM Page at…

SHORT-TERM TRADING PORTFOLIO - 2017 (Small-% of the

total portfolio)

LONG

We didn’t get a good signal on the Top. Looks like I’ve

missed the opportunity to short (or buy the VIX) because the signal wasn’t very

strong Friday. It’s still possible we might get a signal to take a short-term

VXX position.

My shorting rule is as follows:

-“In a bull market, you can only be long or

neutral.” – D. Gartman

-“The best policy

is to avoid shorting unless a major bear market is underway and downside

momentum has been thoroughly established. Even then, your timing must sometimes

be perfect. In a bull market the trend is truly your friend, and trading

against the grain is usually a fool's errand.” – Clif Droke.

-“Commandment #1: “Thou Shall Not Trade Against the Trend.” - James P. Arthur Huprich

THURSDAY MARKET INTERNALS (NYSE DATA)

Market Internals

switched to Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on

Positive, out on Negative – no shorting).

LONG TERM INDICATOR

Thursday,

Sentiment, Price, VIX & Volume indicators were neutral. With VIX

recently below 10 for a couple of days in May, June, July, August, September

and now October, VIX may be prone to incorrect signals. Usually, a rising VIX

is a bad market sign; now it may move up, but that might just signal

normalization of VIX, i.e., VIX and the Index may both rise. As an indicator,

VIX is out of the picture for a while.

MY INVESTED STOCK POSITION:

TSP (RETIREMENT ACCOUNT – GOV EMPLOYEES) ALLOCATION

I increased

stock allocation to 50% stocks in the S&P 500 Index fund (C-Fund) 24 March

2017 in my long-term accounts, based on short-term indicators. The remainder

is 50% G-Fund (Government securities). This is a conservative retiree

allocation, but I consider it fully invested for my situation.

The previous signal was a BUY on 2 June and the last

actionable signal was a BUY (from a prior sell) on 15 November 2016.

Subscribe to:

Comments (Atom)