“The U.S. economy posted its best six-month stretch of

growth in three years, rebounding quickly from two hurricanes and showing

momentum heading into the year’s final months. Gross domestic product—the

broadest measure of goods and services made in the U.S.—expanded at a 3% annual

rate in the third quarter…” Story at…

MICHIGAN SENTIMENT

The consumer sentiment average during the first ten

months of 2017 (96.7) has been the highest since 2000 (108.5).” Story at…

MARKET REPORT / ANALYSIS

-Friday the S&P 500 was up about 0.8% to 2581.

-VIX was down about 13% to 9.8.

-The yield on the 10-year Treasury slipped to 2.411%.

Running out of Gas:

-6% of stocks on the NYSE made new-highs today. At the

prior all-time high on 20 October, 9% of stocks made new highs.

-The 10-dMA of advancing stocks was 54% on 20 Oct. At today’s

new all-time high, only 48% of stocks were advancing on the NYSE over the last

10-days.

-Up volume was 50% of the total over the prior 10-days on

20 Oct. Today it was 47%.

Momentum is slipping. It looks like we’ll see some sort

of pullback. I don’t keep a stat on it, but while market made a new-high on the

S&P 500 Friday, two stats stand out: (1) only 48% of stocks have been

advancing over the last 10-days (2) declining volume has outpaced advancing

volume over the past 10-days. That is odd. It means the smalls aren’t participating

as they should. This isn’t unusual so it doesn’t mean there will be a crash; but

it does indicate that it is less likely that the market will continue up from

here in the short-run given other negative signs we’ve seen recently.

Last, the move Friday was statistically significant based

on the standard deviation of the price-volume when compared to recent history.

That is likely to result in a down-day Monday about 60% of the time. I wrote recently

that “…before we see any meaningful pullback, we need to put in a top. At this point another big move up, say around

1%, could mark another short-term top.” Today’s move of 0.8% didn’t quite make

my target, but I think it may be close enough. The Index is at its upper trend

line and we have certainly seen enough bearish signals for the last 6-weeks.

Bollinger Bands finally joined the bearish party with an overbought indication

today.

A pullback in the range of 3-5% would be the norm. Perhaps

we’ll finally see a bigger (10% or more move down), but that is anybody’s guess

at this point. The numbers suggest down;

but the magnitude is unknown.

Short-term I am still leaning bearish and I made a

bearish VXX buy today. It’s a risky move

as I noted several times, but with VIX below 10 and other bearish indicators I

think it is a reasonable bet. I’ll have

a low tolerance for loss and I’ll sell quickly if this trade moves against me.

I remain bullish longer-term. One wonders when this party

will end so I will worry if the numbers deteriorate, but for now I remain fully

invested.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%.

*For additional background on the ETF ranking system see

NTSM Page at…

Aerospace and Defense (ITA) remained #1 today. I am in

ITA as of 21 Sept. The Financials (XLF) picked up steam presumably based on

higher interest rates as we have noticed the 10-yr bond rising recently.

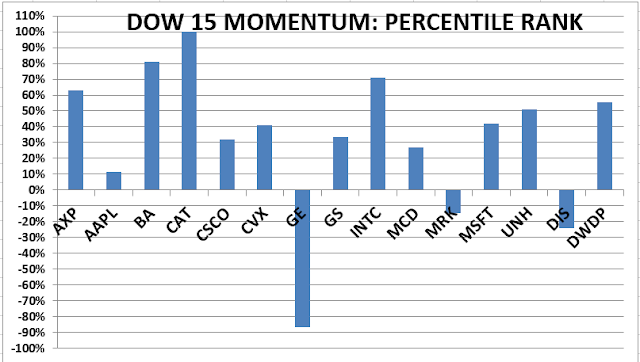

I thought it would be interesting to apply the ETF

ranking system methodology to the Dow 30.

The quick way to do it was to keep the number of stocks the same as my

ETF ranking system so here is a ranking of 15 DOW stocks.

TODAY’S RANKING OF 15 DOW STOCKS (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. Avoid GE, Merck and Disney. Their 120-day

moving averages are falling.

Caterpillar (CAT) remained #1.

*I rank the Dow 15 similarly to the ETF ranking system.

For more details, see NTSM Page at…

SHORT-TERM TRADING PORTFOLIO - 2017 (Small-% of the

total portfolio)

LONG

As noted above I did take a short-term VXX position on 27

Oct very near the close. I had intended to post it here during trading hours so

others could follow my foolishness if they wanted; but I was out working and

only noticed this set-up in the last 10-minutes of the day when I got home. This

violates the rules below, but I am eternally hopeful.

My shorting rule is as follows:

-“In a bull market, you can only be long or

neutral.” – D. Gartman

-“The best policy

is to avoid shorting unless a major bear market is underway and downside

momentum has been thoroughly established. Even then, your timing must sometimes

be perfect. In a bull market the trend is truly your friend, and trading

against the grain is usually a fool's errand.” – Clif Droke.

-“Commandment #1: “Thou Shall Not Trade Against the Trend.” - James P. Arthur Huprich

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained

Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on

Positive, out on Negative – no shorting).

LONG TERM INDICATOR

Friday, Sentiment,

Price, VIX & Volume indicators were neutral. With VIX recently below 10

for a couple of days in May, June, July, August, September and now October, VIX

may be prone to incorrect signals. Usually, a rising VIX is a bad market sign;

now it may move up, but that might just signal normalization of VIX, i.e., VIX

and the Index may both rise. As an indicator, VIX is out of the picture for a

while.

MY INVESTED STOCK POSITION:

TSP (RETIREMENT ACCOUNT – GOV EMPLOYEES) ALLOCATION

I increased

stock allocation to 50% stocks in the S&P 500 Index fund (C-Fund) 24 March

2017 in my long-term accounts, based on short-term indicators. The remainder

is 50% G-Fund (Government securities). This is a conservative retiree

allocation, but I consider it fully invested for my situation.

The previous signal was a BUY on 2 June and the last

actionable signal was a BUY (from a prior sell) on 15 November 2016.