PAUL SCHATZ COMMENTARY EXCERPT (Heritage Capital)

…in the strongest of strong markets, stocks should pause

and then continue higher towards the old highs without any downside. I am not

so sure that’s where we are today, but I wouldn’t sell the bulls short. Another

scenario has stocks seeing some modest weakness this week and then beginning a

more meaningful assault higher next week. I don’t see an immediate collapse

right here… Option traders are just as negative now as they were at market lows

in August and June. While this is only one single indicator and doesn’t

guarantee anything, it is certainly fuel for the bulls to move prices higher

this month.” – Paul Schatz, President Heritage Capital. Commentary at…

LARRY ADAMS COMMENTARY EXCERPT (Raymond James)

“Given our expectation for continued US economic growth

over the next 12 months, we believe that the economic landscape should provide

an environment for positive US earnings growth moving forward. Valuations are

not yet stretched and may have the capacity for slight multiple expansion given

low interest rates and muted inflation. When compared to bonds, the S&P 500

dividend yield outpaces that of most other global developed market sovereign

bond yields…Since 1929, the S&P 500 has an average return of ~11% in a

president’s fourth year and is positive 91% of the time. Our year-end target

for the S&P 500 is 3,053 and our 12-month target is 3,127…with our favorite

sectors being Technology, Health Care, and Communication Services.” – Larry

Adams, CIO, Raymond James. Commentary at…

MARKET REPORT / ANALYSIS

-Monday the S&P 500 dropped about 0.5% to 2939.

-VIX fell about 11% to 17.04.

-The yield on the 10-year Treasury rose a bit to 1.563.

We didn’t learn much today, Monday. We expected some

profit taking and we got it. So, it will be interesting to see if the stock market can move

up Tuesday and confirm our increased stock positions.

My daily sum of 20 Indicators improved from -9 to

-7 (a positive number is bullish; negatives are bearish) while the 10-day

smoothed version that negates the daily fluctuations dropped from -47 to

-50. (These numbers sometimes change after I post the blog based on data that

comes in late.) A reminder: Most of these indicators are short-term. This isn’t

much of an improvement in the indicator total, still…

I am bullish now since chart trends look good.

That is counter to all the economic news that seems to be trending down,

so I will pay close attention to the market. The market may still tell us to

get bearish.

I did reset some trading positions Monday and increase

stock holdings as noted below.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10 (Zero is a

neutral reading.)

Today’s Reading: 0

Most Recent Day with a value other than Zero: +2 on 3

October.

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or better is a Buy

Sign.

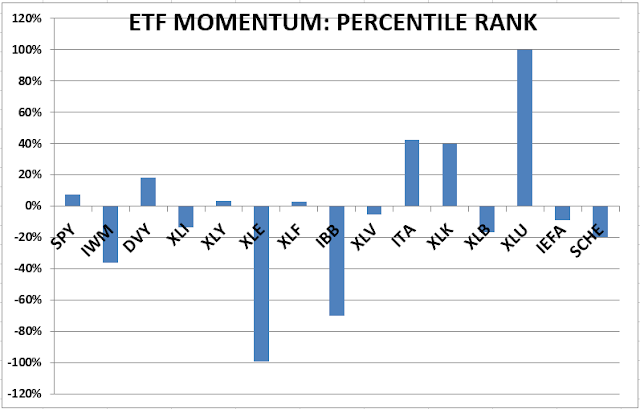

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

MONDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained NEGATIVE on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 60% invested in

stocks as of 7 Oct 2019 (up from 50%). This is a conservative balanced position

appropriate for a retiree.

INTERMEDIATE / LONG-TERM INDICATOR

Monday, the VOLUME, VIX, PRICE and

SENTIMENT Indicators were neutral. Overall, the Long-Term Indicator remained

HOLD.