PCE PRICES (Reuters)

"Consumer prices as measured by the personal consumption

expenditures (PCE) price index edged up 0.1% in January.” Story at…

PERSONAL SPENDING (CNBC)

“U.S. consumer spending rose moderately in February and

momentum is set to fade rapidly in the coming months.” Story at…

MICHIGAN SENTIMENT (Rueters)

“U.S. consumer sentiment dropped to near a 3-1/2-year low

in March as the coronavirus epidemic upended life for Americans, and consumer

spending was sluggish in February, strengthening economists’ expectations of a

deep recession…The University of Michigan’s Consumer Sentiment Index fell to a reading

of 89.1 this month, the lowest level since October 2016…” Story at…

My cmt: This is the first time I’ve seen a reference to a

“deep recession.”

MARKET REPORT / ANALYSIS

-Friday the S&P 500 dropped about 3.4% to 2541.

-VIX rose about 7% to 65.54.

-The yield on the 10-year

Treasury dropped to 0.683.

I don’t think we’ve had a positive Friday since

mid-February, so today’s market action was not a surprise. In addition, we were

due for some profit-taking. The S&P 500 climbed for most of the day and

then dropped nearly 3% in the final half-hour of trading. Apparently, traders didn’t

want to hold over the weekend. There was no panic though; volume was about 20%

below the monthly average today and I think the rally will resume Monday or

Tuesday of next week.

The Index is currently down 24.9% from its all-time high.

Time for Friday’s rundown of some important indicators.

BULL SIGNS

-FED action.

-Congressional action.

-We saw a bullish, Breadth-Thrust signal 26 March.

-We saw a 90% up-volume reversal followed by consecutive

80%+ up-volume days 24-26 March.

-MACD of S&P 500 price made a bullish crossover 26 Mar.

-MACD of stocks advancing on the NYSE (breadth) made a bullish

crossover 26 Mar.

-The S&P 500 is too far below its 200-dMA giving an

oversold, bull-signal when sentiment is considered.

-Breadth on the NYSE vs the S&P 500 index remains in

bull territory.

-The Smart Money (late-day-action) is oversold.

-The Smart Money (late-day action) is buying and is

definitely bullish. (This is a variant of Don Hayes’, Smart Money indicator.)

-The Fosback High-Low Logic Index is Bullish. It called

the top of the 20% correction in Sep-Dec 2018 to the day.

-Cyclical Industrials are turning up and gaining on the

S&P 500, a bullish sign.

-Money Trend is headed up.

-New-high/new-low data is bullish.

NEUTRAL

-Overbought/Oversold Index, a measure of advance-decline

data, is neutral. (This indicator isn’t followed much anymore, but it was overbought

yesterday and we did see a large selloff today. Hmmmmm?)

-Statistically, the S&P 500 has been bearish due to

several panic-signals, but it is now in the Neutral category.

-Bollinger Bands and RSI are in neutral territory.

-Over the last 20-days, the number of up-days is neutral.

-The size of up-moves has been about equal to the size of

down-moves over the last month.

BEAR SIGNS

-The 5-10-20 Timer is SELL, because the 5-dEMA and the

10-dEMA are below the 20-dEMA.

-VIX jumped sharply higher when the correction started

and is still giving a bearish signal.

-CORONAVIRUS: Today, the number of new coronavirus cases

doubled world-wide and US cases were up by 60% at 5PM. We don’t know whether

the variability is caused by more testing or inconsistent reporting from

Hospitals. Keeping up with statistics is probably not the number one priority

at hospitals. Either way, it’s a bearish sign. Today’s projection would put the

total cases at 350,000 in one week. 3 times the amount estimated just 3 days

ago. My analysis is not medical; it’s just math.

-Utilities ETF (XLU) is now under-performing the S&P

500 index.

Just for kicks, I looked back to Friday, 21 February, 2

days after the top of this pullback. There were 10 bear-signs and 1 bull-sign. Now

there are 14 bull-signs and 4 bear-signs.

It just shows we’ve had a lot of improvement in indicators.

Overall, the daily sum of 20 Indicators (somewhat different

than the above list) declined from +9 to +5 (a positive number is

bullish; negatives are bearish). The 10-day smoothed sum that negates the daily

fluctuations improved from -46 to -35. (These numbers sometimes change

after I post the blog based on data that comes in late.) Most of these

indicators are short-term.

I suspect we have seen the low or close to it. That

doesn’t mean we won’t have a retest of that low. I will wait for a retest

before adding further to stock holdings.

RECENT STOCK PURCHASES

-SSO. (2x S&P 500 ETF) I will sell my SSO position

when I think the rally is over. This is a true trading position. Other recent

purchases may or may not be long-term holds – just depends on market action and

indicators.

-Biotech ETF (IBB). #1 in momentum. We’re in a health crisis

so perhaps this will be a good longer-term hold too.

-Apple. China is returning. #1 in momentum before the

crisis.

-Intel. Low PE; good story (laptops are in demand for

working at home); good momentum before the crisis.

-XLK. Technology ETF spreads some risk and gives exposure

to Microsoft, Cisco, etc.; was #1 in momentum before the crisis.

-Starbucks. China is returning and they should do better

than most in earnings here in the US.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10 (Zero is a neutral

reading.)

Today’s Reading: +6**

Most Recent Day with a value other than Zero: +6 on 27

March. (The S&P 500 is too far below its 200-dMA when sentiment is

considered; Non-Crash Sentiment is bullish; Breadth has made a bullish

divergence from the S&P 500; Money Trend has turned bullish; the Fosback

New-hi/new-low Logic Indicator is bullish; and Smart Money {late-day-action} is

oversold.)

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or higher is a Buy

Sign.

**The Top/Bottom indicator continues to give

extreme oversold readings, but as I have been saying, we won’t know when we

have a bottom until we have a successful retest, or a reversal buy-signal from

Breadth or Volume…Well, we had the bullish Breadth AND Volume reversal signals,

but nothing is ever certain, is it?

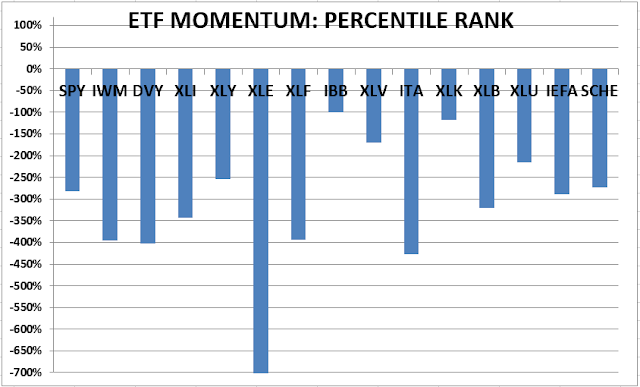

MOMENTUM ANALYSIS:

CAUTION: Momentum is not a good tool during market

declines.

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%; in this case, -100%

because the market has been so bad. The rest are then ranked based on their

momentum relative to the leading ETF. The

highest ranked are those closest to zero. While momentum isn’t stock

performance per se, momentum is closely related to stock performance. For

example, over the 4-months from Oct thru mid-February 2016, the number 1 ranked

Financials (XLF) outperformed the S&P 500 by nearly 20%. In 2017 Technology

(XLK) was ranked in the top 3 Momentum Plays for 52% of all trading days in

2017 (if I counted correctly.) XLK was up 35% on the year while the S&P 500

was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%, rather minus 100%

since the market has been bad. The rest are then ranked based on their momentum

relative to the leading stock. The highest ranked are those closest to zero.

For more details, see NTSM Page at…

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals slipped

to NEUTRAL on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 50% invested in

stocks. (I previously dropped stock allocations to 45% on 27 January and lower

a few days after the decline started.) You may wish to have a higher or lower %

invested in stocks depending on your risk tolerance.

INTERMEDIATE / LONG-TERM INDICATOR

Friday, the New-High/New-Low and NON-CRASH SENTIMENT indicators

are bullish; the VIX and VOLUME indicators gave a bear signal. The and PRICE

indicator is Neutral.

The

Long-Term Indicator DECLINED to HOLD. I am already at 50% invested in stocks. If we

do retrace down, I’ll try to find a good buy-point. At that time, I’ll increase stock holdings significantly.