“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

“Bubbles tend to topple under their own weight. Everybody

is in. The last short has covered. The last buyer has bought (or bought massive

amounts of weekly calls). The decline starts and the psychology shifts from

greed to complacency to worry to panic. Our working hypothesis, which might be disproven, is that September

2, 2020 was the top and the bubble has already popped.” - David

Einhorn, Greenlight hedge fund.

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

at 5:00 pm Friday. US total case numbers are on the left axis; daily numbers

are on the right side of the graph with the 10-dMA of daily numbers in Green.

(I averaged cases over the Holiday.)

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose

about 0.2% to 3630.

-VIX dropped about 2% to 20.84.

-The yield on the 10-year

Treasury slipped to 0.846%.

Today was an extreme

low-volume day. It’s Black Friday, everyone went shopping and the NYSE closed

early. Not much new...

The daily sum of 20 Indicators

improved from +6 to +13 (a positive number is bullish; negatives are bearish).

The 10-day smoothed sum that smooths the daily fluctuations remained+90. (These

numbers sometimes change after I post the blog based on data that comes in

late.) Most of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble switched back up to BUY, 24 Nov. Now, Price, Volume & VIX are

bullish; Sentiment is neutral. The Indicator remains BUY. I suspect the Index is near a top, so it is probably not a good time to buy.

I’ll continue to keep a low %

of funds in the stock market. The market remains extremely overbought with the

S&P 500 15.4% above its 200-dMA.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

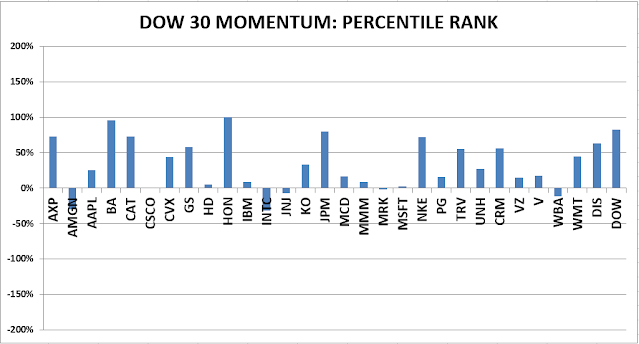

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

Market Internals improved to POSITIVE ON THE MARKET.

Market Internals are a decent trend-following

analysis of current market action, but should not be used alone for short term

trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator

in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold.

The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE

indication and stay out until the next POSITIVE indication. The back-test

included 13-buys and 13-sells, or a trade every 2-weeks on average.

My current stock allocation is

about 30% invested in stocks. You may wish to have a higher or lower % invested

in stocks depending on your risk tolerance. 30% is a very conservative position

that I re-evaluate daily, but it is appropriate for the correction.

As a retiree, 50% in the stock

market is about fully invested for me – it is a cautious and conservative

number. If I feel very confident, I might go to 60%; if this correction is deep

enough, 80% would not be out of the question.