“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

“Bubbles tend to topple under their own weight. Everybody

is in. The last short has covered. The last buyer has bought (or bought massive

amounts of weekly calls). The decline starts and the psychology shifts from

greed to complacency to worry to panic. Our working hypothesis, which might be

disproven, is that September 2, 2020 was the top and the bubble has already

popped.” - David Einhorn, Greenlight hedge fund.

RETAIL SALES (npr)

“Retail sales barely budged, inching up just 0.3% from

September, the Commerce Department said Tuesday.”

Story at...

https://www.npr.org/2020/11/17/934328257/retail-sales-barely-budge-ahead-of-critical-holiday-season

INDUSTRIAL PRODUCTION (chron)

“U.S. industrial production rose 1.1% in October, recovering

much of the spring decline caused by the virus pandemic. It was a rebound after

a downturn in September, but production still remains below pre-pandemic levels...”

Story at...

https://www.chron.com/business/article/US-industrial-production-jumps-1-1-in-October-15733164.php

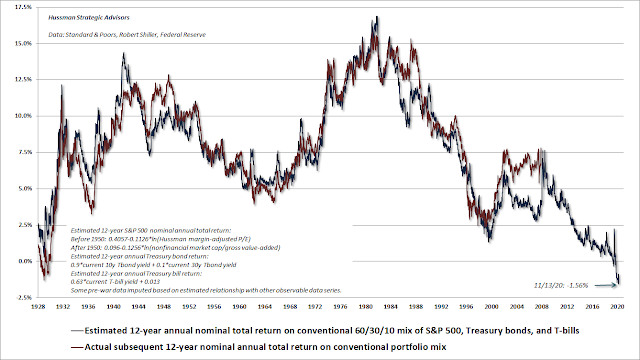

PUSHING EXTREMES – JOHN HUSSMAN COMMENTARY EXCERPT

(Hussman Funds)

“...it’s worth understanding what the present combination

of depressed interest rates and extreme market valuations implies for long-term

and full-cycle investment returns. The chart below shows our estimate of

12-year nominal average annual total returns for a passive investment mix

invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury

bills. In nearly a century of data, including the market extremes of 1929 and

2000, this estimate has never been lower than it is today. The red line (which

of course ends 12 years ago) shows the actual subsequent 12-year total return

on that same portfolio mix across history.” – John Hussman, PhD.

Commentary and Charts at...

https://www.hussmanfunds.com/comment/mc201116/

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

at 5:20 pm Tuesday. US total case numbers are on the left axis; daily numbers

are on the right side of the graph with the 10-dMA of daily numbers in Green.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500

dipped about 0.5% to 3627.

-VIX rose about 1% to 22.71.

-The yield on the 10-year

Treasury dropped to 0.870%.

The daily sum of 20 Indicators

improved from +14 to +15 (a positive number is bullish; negatives are bearish).

The 10-day smoothed sum that smooths the daily fluctuations improved from +104

to +117. (These numbers sometimes change after I post the blog based on data

that comes in late.) Most of these indicators are short-term and many are trend

following. These are very high numbers.

The Long Term NTSM indicator

ensemble switched to BUY, 9 Nov. Now, Price, VIX and Volume are bullish;

Sentiment indicator is all neutral. The ensemble remains BUY.

I’m beginning to see some more warnings

from top-indicators: RSI; % above the 200-dMA; Breadth-S&P 500 spread are

all bearish. I think we’ll see a correction down to near the 200-dMA. Oddly,

one top-indicator, the Fosback Hi-Low Indicator, turned bullish today. That’s

because we haven’t seen too many new-lows for a while.

I still see only one indicator

that counts:

The extreme overbought market

pretty much guarantees that we’ll have a pullback. I think it will begin sooner

rather than later.

We are very near a top; I’ll

continue to sit out.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

Market Internals remained POSITIVE.

Market Internals are a decent trend-following

analysis of current market action, but should not be used alone for short term

trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My current stock allocation is

about 30% invested in stocks. You may wish to have a higher or lower % invested

in stocks depending on your risk tolerance. 30% is a very conservative position

that I re-evaluate daily, but it is appropriate for the correction.

As a retiree, 50% in the stock

market is about fully invested for me – it is a cautious and conservative

number. If I feel very confident, I might go to 60%; if this correction is deep

enough, 80% would not be out of the question.