“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

“Bubbles tend to topple under their own weight. Everybody

is in. The last short has covered. The last buyer has bought (or bought massive

amounts of weekly calls). The decline starts and the psychology shifts from

greed to complacency to worry to panic. Our working hypothesis, which might be

disproven, is that September 2, 2020 was the top and the bubble has already

popped.” - David Einhorn, Greenlight hedge fund.

My cmt: The 2 Sept high was 3581, so it looks like

David Einhorn was too early.

My cmt: Based on the above number, the debt is about $85,000 per person. Thank-you,

“GW” Bush, Obama, Trump. Clinton managed to balance the budget, for the most

part. The others made no attempt.

ISM MANUFACTURING (Institute for Supply Management)

“The December Manufacturing PMI® registered 60.7

percent, up 3.2 percentage points from the November reading of 57.5 percent.

This figure indicates expansion in the overall economy for the eighth month in

a row after contracting in March, April, and May, which ended a period of 131

consecutive months of growth... “The manufacturing economy continued its

recovery in December. Survey Committee members reported that their companies

and suppliers continue to operate in reconfigured factories, but absenteeism,

short-term shutdowns to sanitize facilities and difficulties in returning and

hiring workers are causing strains that are limiting manufacturing growth

potential. However, panel sentiment remains optimistic (three positive comments

for every cautious comment), an improvement compared to November.” Press

release at...

S&P 500 TRADING AT HISTORICAL EXTREMES - EXCERPT

(Real Investment Advice)

“Welcome to 2021. As we kick off a new year, we begin

with the S&P 500 trading at historical extremes. It is essential to have

some perspective to set reasonable expectations for future returns and quantify

the “risk” of

something going wrong...“Currently, Wall Street analysts are wildly exuberant on

expectations of explosive economic growth, rising interest rates, and

inflation. The problem with those expectations is that in an economy that is

$85 Trillion in debt, higher rates and inflation are a ‘death knell’ to

economic growth. Yes, while the Fed may come to the rescue with more QE, with

markets already trading at 36x times earnings it is becoming increasingly

difficult to justify overpaying for earnings. Eventually, corporate earnings

are going to have to markedly improve, or prices will revert.” Commentary at

https://realinvestmentadvice.com/technically-speaking-sp-500-trading-at-historical-extremes/

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 5:30pm Tuesday. US total case numbers are on the left axis; daily numbers

are on the right side of the graph with the 10-dMA of daily numbers in Green.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose

about 0.7% to 3727.

-VIX slipped about 6% to 25.34.

-The yield on the 10-year

Treasury rose to 0.955%.

More of the same. Indicators deteriorated some more. Perhaps we’ve seen a short-term top, but I

don’t see a smoking gun.

The daily sum of 20 Indicators declined from -3 to -7 (a

positive number is bullish; negatives are bearish). The 10-day smoothed sum

that smooths the daily fluctuations declined from +5 to -2. (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble remained HOLD. Now, Price VIX, Sentiment & Volume are neutral.

The market remains overbought

with the S&P 500 14.7% above its 200-dMA. If past history follows, that

tends to cap the gains going forward and suggest that the downside risk is

greater than the upside risk.

I’ll continue to keep a low %

of funds in the stock market until I see a better buying point.

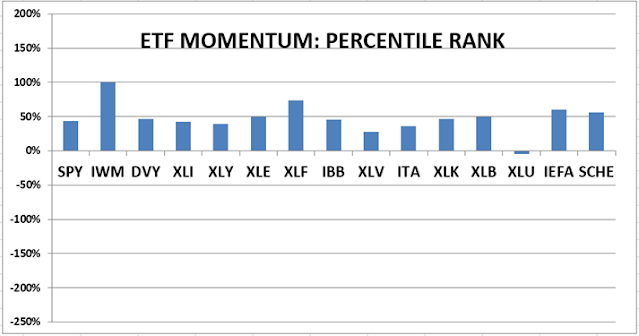

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

Market Internals improved to NEUTRAL on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a trade every 2-weeks on average.

My current stock allocation is

about 30% invested in stocks. You may wish to have a higher or lower % invested

in stocks depending on your risk tolerance. 30% is a very conservative position

that I re-evaluate daily.

The markets have not

retested the lows on recent corrections and that has left me under-invested on

the bounces. I will need to put less reliance on retests in the future.

As a retiree, 50% in the stock market is about fully invested for me – it is a cautious and conservative number. If I feel very confident, I might go to 60%; if a correction is deep enough, 80% would not be out of the question.