“The latest Chicago Purchasing Manager's Index, or the Chicago Business Barometer, rose to 44.9 in December from 37.2 in November, which is still in contraction territory. It has spent 1/3 of 2022 in contraction territory. Values above 50.0 indicate expanding manufacturing activity.” Story at...

https://www.advisorperspectives.com/dshort/updates/2022/12/30/chicago-pmi-rises-in-december

Breadth (% of stocks advancing on the NYSE) has been holding its own recently, so currently, it is not looking too bad. We still need to see it above 50% to feel bullish.

-Friday the S&P 500 slipped about 0.3% to 3840.

-VIX rose about 1% to 21.67

-The yield on the 10-year Treasury rose to 3.880%.

-Drop from Top: 20% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 250-days.

The S&P 500 is 4.2% BELOW its 200-dMA & 1.5% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

I am doing less trading now. You may do better watching the momentum charts rather than my moves.

It still appears that the most likely scenario will see the S&P 500 test its October lows.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) is above 50%.

-My Money Trend indicator is improving.

-Short-term new-high/new-low data.

-Long-term new-high/new-low data.

-There have only been 7 up-days over the last 20 sessions – bullish.

-The graph of the 100-day Count (the 100-day sum of up-days) has turned up sharply.

-The Smart Money (late-day action).

-VIX indicator. (VIX is falling fast enough to be bullish.)

-XLI-ETF (Cyclical Industrials) is outperforming the S&P 500.

-Bollinger Bands.

-Issues advancing on the NYSE (Breadth) compared to the S&P 500.

-On average, the size of up-moves has been larger than the size of down-moves over the last month, but not enough to send a signal.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) has been above 50%, for 3 days in a row ending the “correction-now” signal.

-Overbought/Oversold Index (Advance/Decline Ratio).

-The short-term, 10-day, Fosback Hi-Low Logic Index.

-The longer-term, 50-dEMA, Fosback Hi-Low Logic Index is neutral.

-There have been 4 up-days over the last 10 sessions – neutral.

-RSI

-There have only been 2 Statistically-Significant days (big moves in price-volume) in the last 15-days.

-Sentiment.

- 90% up-volume days - the last one was down - neutral.

-The Calm-before-the-Storm/Panic Indicator flashed a panic-buying signal 10 November - expired.

-The S&P 500 is 4.2% below its 200-dMA. (Bull indicator is 12% below the 200-day, although this is based on “normal” pullbacks.)

-There was an Inverse Zweig Breadth Collapse (negative Breadth Thrust) 21 June. That’s a rare, very-bearish sign, but it was a long time ago - expired.

-There was a Hindenburg Omen signal 8 April – expired.

-2.8% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is no bullish signal for this indicator.) This indicated that the advance was too narrow and a correction was likely to be >10%. It proved correct, but is now Expired

-The 52-week, New-high/new-low ratio improved by 3.5 standard deviations. More simply, the spread between new-highs and new-lows improved by 716 on 14 October. That’s a solid bottom sign at a retest. – Expired.

-13 & 21 Oct were Bullish Outside Reversal Days with no Bearish Outside Reversal days since then - expired.

-The smoothed advancing volume on the NYSE is falling.

-The 10-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%.

-The 100-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%

-MACD of the percentage of issues advancing on the NYSE (breadth) made a bearish crossover 15 Dec.

-Smoothed Buying Pressure minus Selling Pressure is falling, but not by much.

-MACD of S&P 500 price made a bearish crossover 6 Dec.

-McClellan Oscillator.

-Slope of the 40-dMA of New-highs is down.

-There have been 7 Distribution Days since the last follow-thru day.

-The 5-10-20 Timer System is SELL; the 5-dEMA and 10-dEMA are both below the 20-dEMA.

-The 5-day EMA is below the 10-day EMA so short-term momentum is bearish.

-S&P 500 is underperforming the Utilities (XLU), but the spread is getting more bullish. I’ll call it bear for now.

-45% of the 15-ETFs that I track have been up over the last 10-days.

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

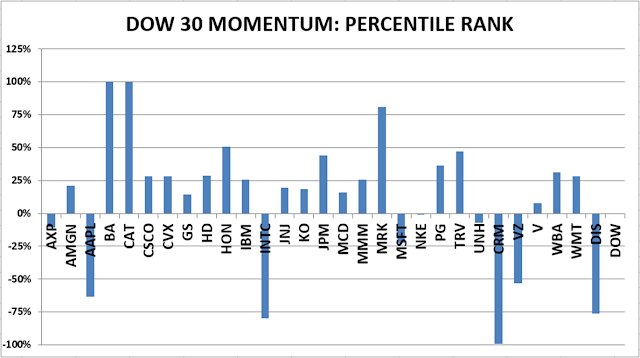

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)