Happy Hanukah!

Merry Christmas! Have a great holiday. Markets will be closed Monday.

“The trend is clear: Inflation is cooling off in America. The Federal Reserve’s preferred measurement of inflation showed price increases continued to moderate in November...The Personal Consumption Expenditures price index, or PCE, rose 5.5% in November from a year earlier, the Commerce Department reported Friday. That’s lower than in October, when prices rose 6.1% annually.

https://www.cnn.com/2022/12/23/economy/pce-inflation-november/index.html

“Reflecting a sharp pullback in orders for transportation equipment, the Commerce Department released a report on Friday showing U.S. durable goods orders tumbled by much more than expected in the month of November. The report said durable goods orders plunged by 2.1 percent in November after climbing by a downwardly revised 0.7 percent in October.” Story at...

https://www.nasdaq.com/articles/u.s.-durable-goods-orders-tumble-much-more-than-expected-in-november

“Personal spending increased 0.1% in November from the prior month, the Commerce Department said Friday, marking a pullback from a robust 0.9% increase in October.” Story at...

https://www.wsj.com/articles/consumer-spending-personal-income-inflation-november-2021-11671750930

“The U.S. Census Bureau and Department of Housing and Urban Development said that sales during the month were at a seasonally adjusted annual rate of 640,000 units. This was a monthly increase of 5.8 percent, but October’s sales, originally reported at a 632,000-unit rate, were downgraded to 605,000 units. Sales are now down 15.4 percent compared to last year.” Story at...

https://www.mortgagenewsdaily.com/news/12232022-new-home-sales

-Friday the S&P 500 rose about 0.6% to 3845.

-VIX fell about 5% to 20.87

-The yield on the 10-year Treasury rose to 3.749%.

-Drop from Top: 19.8% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 246-days.

The S&P 500 is 4.3% BELOW its 200-dMA & 1.1% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

I am doing less trading now. You may do better watching the momentum charts rather than my moves.

In spite of the positive close today on the S&P 500, the index is still below its 50-dMA, a continuing bearish sign, although it is not one that I track as an indicator.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) is above 50%.

-There have only been 7 up-days over the last 20 sessions – bullish.

-On average, the size of up-moves has been larger than the size of down-moves over the last month.

-VIX indicator. (VIX is falling fast enough to be bullish.)

-XLI-ETF (Cyclical Industrials) is outperforming the S&P 500.

-My Money Trend indicator is improving.

-The smoothed advancing volume on the NYSE is rising.

NEUTRAL

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) has been above 50%, for 3 days in a row ending the “correction-now” signal.

-Overbought/Oversold Index (Advance/Decline Ratio).

-Bollinger Bands.

-The short-term, 10-day, Fosback Hi-Low Logic Index.

-The longer-term, 50-dEMA, Fosback Hi-Low Logic Index is neutral.

-Long-term new-high/new-low data.

-There have been 5 up-days over the last 10 sessions – neutral.

-RSI

-There have been 4 Distribution Days since the last follow-thru day, but 4 is not enough to send a signal.

-There have been 2 Statistically-Significant days (big moves in price-volume) in the last 15-days.

-Sentiment.

- 90% up-volume days – the last one was down - neutral.

-The Calm-before-the-Storm/Panic Indicator flashed a panic-buying signal 10 November - expired.

-The S&P 500 is 4.3% below its 200-dMA. (Bull indicator is 12% below the 200-day, although this is based on “normal” pullbacks.)

-There was an Inverse Zweig Breadth Collapse (negative Breadth Thrust) 21 June. That’s a rare, very-bearish sign, but it was a long time ago - expired.

-There was a Hindenburg Omen signal 8 April – expired.

-2.8% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is no bullish signal for this indicator.) This indicated that the advance was too narrow and a correction was likely to be >10%. It proved correct, but is now Expired

-The 52-week, New-high/new-low ratio improved by 3.5 standard deviations. More simply, the spread between new-highs and new-lows improved by 716 on 14 October. That’s a solid bottom sign at a retest. – Expired.

-13 & 21 Oct were Bullish Outside Reversal Days with no Bearish Outside Reversal days since then - expired.

-The Smart Money (late-day action) is flat.

-49% of the 15-ETFs that I track have been up over the last 10-days.

BEAR SIGNS

-The 10-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%.

-The 100-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%

-MACD of the percentage of issues advancing on the NYSE (breadth) made a bearish crossover 15 Dec.

-Issues advancing on the NYSE (Breadth) compared to the S&P 500 remains bearish.

-Smoothed Buying Pressure minus Selling Pressure is falling.

-MACD of S&P 500 price made a bearish crossover 6 Dec.

-Short-term new-high/new-low data.

-The graph of the 100-day Count (the 100-day sum of up-days) is falling.

-Slope of the 40-dMA of New-highs is falling.

-McClellan Oscillator.

-The 5-10-20 Timer System is SELL; the 5-dEMA and 10-dEMA are both below the 20-dEMA.

-The 5-day EMA is below the 10-day EMA so short-term momentum is bearish.

-S&P 500 is underperforming the Utilities (XLU).

On Friday, 21 February, 2 days after the top before the

Coronavirus pullback, there were 10 bear-signs and 1 bull-sign. Now there

are 13 bear-sign and 7-Bull. Last week, there were 16 bear-sign and 6

bull-signs.

Today, the daily sum of 20 Indicators improved from +3 to

+5 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations declined from +69 to 65. (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in late.

Most of these 20 indicators are short-term so they tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: SENTIMENT is neutral; VIX & PRICE are bullish; VOLUME is

negative.

Bottom line: I’m a Bear at this point. I am defensively

positioned in the markets, but not drastically so. I may cut stock holdings to 30% (the lowest I

will go), but I’ll wait rather than selling into this downturn now. Maybe we’ll

get some more bullish action before the new year. Since the Index has broken below its 50-dMA,

a retest of the October lows (about 6% below today’s close) seems likely.

I’m now have about 40% of the portfolio invested in

stocks. (As a retiree, 50% invested in stocks is my “normal” portfolio.)

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

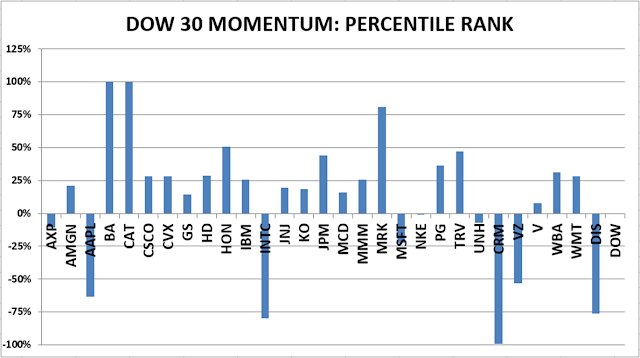

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained NEUTRAL. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 40% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. Last week’s Friday-run-down indicator

ensemble was bad enough to convince me to take a more conservative view of the

markets.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) has been above 50%, for 3 days in a row ending the “correction-now” signal.

-Overbought/Oversold Index (Advance/Decline Ratio).

-Bollinger Bands.

-The short-term, 10-day, Fosback Hi-Low Logic Index.

-The longer-term, 50-dEMA, Fosback Hi-Low Logic Index is neutral.

-Long-term new-high/new-low data.

-There have been 5 up-days over the last 10 sessions – neutral.

-RSI

-There have been 4 Distribution Days since the last follow-thru day, but 4 is not enough to send a signal.

-There have been 2 Statistically-Significant days (big moves in price-volume) in the last 15-days.

-Sentiment.

- 90% up-volume days – the last one was down - neutral.

-The Calm-before-the-Storm/Panic Indicator flashed a panic-buying signal 10 November - expired.

-The S&P 500 is 4.3% below its 200-dMA. (Bull indicator is 12% below the 200-day, although this is based on “normal” pullbacks.)

-There was an Inverse Zweig Breadth Collapse (negative Breadth Thrust) 21 June. That’s a rare, very-bearish sign, but it was a long time ago - expired.

-There was a Hindenburg Omen signal 8 April – expired.

-2.8% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is no bullish signal for this indicator.) This indicated that the advance was too narrow and a correction was likely to be >10%. It proved correct, but is now Expired

-The 52-week, New-high/new-low ratio improved by 3.5 standard deviations. More simply, the spread between new-highs and new-lows improved by 716 on 14 October. That’s a solid bottom sign at a retest. – Expired.

-13 & 21 Oct were Bullish Outside Reversal Days with no Bearish Outside Reversal days since then - expired.

-The Smart Money (late-day action) is flat.

-49% of the 15-ETFs that I track have been up over the last 10-days.

-The 10-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%.

-The 100-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%

-MACD of the percentage of issues advancing on the NYSE (breadth) made a bearish crossover 15 Dec.

-Issues advancing on the NYSE (Breadth) compared to the S&P 500 remains bearish.

-Smoothed Buying Pressure minus Selling Pressure is falling.

-MACD of S&P 500 price made a bearish crossover 6 Dec.

-Short-term new-high/new-low data.

-The graph of the 100-day Count (the 100-day sum of up-days) is falling.

-Slope of the 40-dMA of New-highs is falling.

-McClellan Oscillator.

-The 5-10-20 Timer System is SELL; the 5-dEMA and 10-dEMA are both below the 20-dEMA.

-The 5-day EMA is below the 10-day EMA so short-term momentum is bearish.

-S&P 500 is underperforming the Utilities (XLU).

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained NEUTRAL. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)