"Here’s the situation. And when it comes to the

gas prices, we’re going through an incredible transition that is taking place

that, God willing, when it’s over, we’ll be stronger and the world will be

stronger and less reliant on fossil fuels when this is over." - President Joe Biden.

When it’s over? “Clueless Joe” seems to think high gas

prices will solve the transition to fossil fuels in short order. It’s not that simple: “...replacing over 3,000

fossil-fuel power plants and millions of internal-combustion vehicles would

require thousands of new factories, and cost trillions of dollars. It also will

take at least a few generations.” - Emeritus Prof. Peter Z. Grossman, Butler

University, Indianapolis.

FOMC MINUTES (CNBC)

“Federal Reserve officials earlier this month stressed

the need to raise interest rates quickly and possibly more than markets

anticipate to tackle a burgeoning inflation problem, minutes from their meeting

released Wednesday showed. Not only did policymakers see the need to increase

benchmark borrowing rates by 50 points, but they also said similar hikes likely

would be necessary at the next several meetings.” Story at...

https://www.cnbc.com/2022/05/25/fed-minutes-may-2022.html

DURABLE ORDERS

“Orders at U.S. factories for long-lasting goods inched

slightly higher in April but came in below expectations as manufacturers

confronted a worsening supply-chain crisis that continued to weigh on business

investment. Bookings for all durable goods – products that are intended to last

at least three years – rose 0.4% last month...” Story at...

https://www.foxbusiness.com/economy/us-durable-goods-orders-rise-less-than-expected-april

EIA CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 1.0 million barrels from the

previous week. At 419.8 million barrels, U.S. crude oil inventories are about

14% below the five year average for this time of year.” Press release at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

EVIDENCE INCREASING THAT THE MARKETS ARE BOTTOMING

(Heritage Capital)

“...the stock market continues the bottoming process much

like it did in the 13 days leading up to the COVID crash bottom on March 23,

2020...Plainly and directly put, stocks are supposed to rally and not make new

lows for the foreseeable future. The stars are aligning properly and the odds

have increased. If you want confirmation, watch for the major stock market

indices to close above last week’s highest point. If I am correct, the stock

market should bounce 7-12% into the summer before the next opportunity for a

fresh leg lower comes.” – Paul Schatz, President, heritage Capital. Commentary

at...

https://investfortomorrow.com/blog/lots-of-increasing-evidence-that-stocks-are-bottoming-for-now/

Nice to see that someone agrees with me. I should have

read this before I posted yesterday – I wouldn’t have needed to work so hard

reviewing data!

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 rose about 1% to 3979.

-VIX fell about 4% to 28.37.

-The yield on the 10-year Treasury slipped to 2.751%.

PULLBACK DATA:

-Drop from Top: 17.1% as of today. 18.7% max. (Avg.= 13%

for non-crash pullbacks)

-Days from Top to Bottom: 99-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

The S&P 500 is 10.8% BELOW its 200-dMA & 7.2%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, we hope to be able to call the bottom when we see

it...and... we did call the market a trading “Buy” one day after the recent

trading-bottom on 12 May...

MY TRADING POSITIONS:

QQQ*

UWM*

XLE

DOW

*Sell when the markets make it to the 50-dMA.

TODAY’S COMMENT:

I wrote yesterday that “I am not going to panic over my

trades, yet...still waiting for that rally.” I think the rally is here, though

it probably won’t be straight up. Let’s

hope the FOMO Crowd (Fear-of-Missing-Out) buys into the “bottom-is-in” talk

that is bound to show up.

Indicators are improving so much that I am modifying my

sell point. Earlier I had said that I would sell the rally when I saw signs of markets

being overbought. That’s here already.

The overbought/oversold (A/D) ratio is now overbought. The 10-day percentage

of advancing issues was 56% today, up from 40% just 6 sessions ago. As a

result, I will use the 50-dMA as a likely sell point. It’s now 4288.

Today, the daily sum of 20 Indicators improved from +10

to +11 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations improved from +39 to +53. (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long

Term NTSM indicator was HOLD: VIX is bearish; SENTIMENT, VOLUME and PRICE are

hold. 45 days out of the last 100 have

been up-days; that leans bullish.

I am cautiously Bullish in the short-term and Bearish

longer-term. I expect a rally in the 7-9% range. Around 4300 is as good a

target as any: it would be a 50% retracement and it is also currently close to

the 50-dMA.

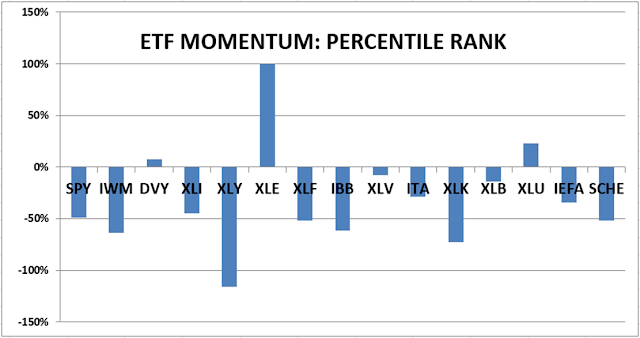

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now roughly 45% invested in stocks, but some percentage includes

trading-positions that I will exit if a rally fails to materialize. This is

slightly below my “normal” fully invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.