“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

JOBLESS CLAIMS (Baton Rouge Business Report)

“The number of Americans applying for jobless aid ticked

up slightly last week but the total number of Americans collecting benefits

remains at its lowest level in more than five decades.

Applications for unemployment benefits rose by 1,000 to

203,000 for the week ending May 7...” Story at...

https://www.businessreport.com/economy/us-initial-jobless-claims-rise-slightly

PRODUCER PRICE INDEX CORE PPI (CNBC)

“Prices at the wholesale level accelerated further in

April, part of a broader inflation problem persisting through the U.S. economy,

the Bureau of Labor Statistics reported Thursday. The producer

price index, which tracks how much manufacturers get for products at

their initial sale, rose 0.5% on the month and 11% from a year ago... Excluding

food, energy and trade services, core PPI rose 0.6% in April and 6.9% from a

year ago...” Story at...

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 fell about 0.1% to 3930.

-VIX dropped about 2% to 31.77.

-The yield on the 10-year Treasury slipped to 2.865%.

PULLBACK DATA:

-Drop from Top: 18.1% as of today. 18.1% max. (Avg.= 13%

for non-crash pullbacks)

-Days from Top to Bottom: 90-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

The S&P 500 is 12.3% BELOW its 200-dMA & 9.4%

BELOW its 50-dMA.

*We can’t be sure that the correction is over until the

S&P 500 makes a new-high; however, we hope to be able to call the bottom

when we see it.

TODAY’S COMMENT:

Volume on the NYSE was higher today than it has been in

the last 2 months. That suggests 3 things: (1) increasing fear (2) no bottom

yet (3) and finally, perhaps we won’t have to wait too much longer for the big wash

out that would signal a short-term bottom.

Importantly, I don’t think that any “bottom” we see in

the near term will prove to be the final bottom. This downturn is looking more like

a major crash is underway.

I don’t see that this bear

market is going to end until inflation begins to act better; the FED is accommodative;

and recession questions are answered.

Today, the daily sum of 20 Indicators improved from -3 to

zero (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations improved from -11 to -8. (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in

late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDCATOR: The Long

Term NTSM indicator was SELL: VOLUME & VIX are bearish; PRICE &

SENTIMENT are hold. 45 days out of the

last 100 have been up-days; that leans bullish.

The SELL signal now doesn’t

mean much. The important sell-signal was 14 January. For now, it looks like we will

have a significant bounce soon, but as I noted above, I don’t see that this

bear market is going to end even if we do have a significant bounce from current

levels.

I’m Bearish. I’ve seen no confirmation of a low by the

markets and no actionable bottom signs in my analysis.

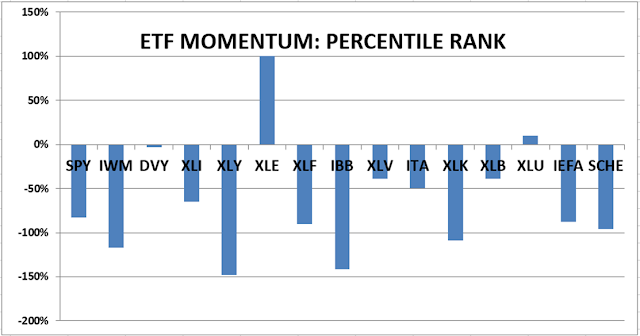

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

My only current trading

position is in the Energy XLE-ETF.

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to HOLD.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now about 35% invested in stocks. This is below my “normal” fully

invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.