“U.S. single-family homebuilding and permits surged to

more than 10-year highs in November, in a hopeful sign for a housing market

that has been hobbled by supply constraints.” Story at…

Chart from WSJ.com at…

Intel was again the big winner on the Dow today and

climbed to #3 in my momentum ranking system. It is up almost 8.5% in the last 3-days.

It was #1 at the end of November. Note that Intel had been stalled for more

than 2.5-years and has recently broken out to the upside. It looks like profit

taking may be over; now we’ll see if it can continue higher. With a low PE of

16.5 and a 2.3% dividend yield this one remains a Buy. The average Dow 30 PE is

27 with a yield of 1.9%.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 was down about 0.3% to 2681.

-VIX was up about 5% to 10.03.

-The yield on the 10-year Treasury rose to 2.448%.

My sum of 17 Indicators improved from +4 to +8 on the day.

There was also strong improvement on a 10-day basis as well. The 10-day number

just means that conditions are better now than they were 2-weeks ago.

We are due for a stall or pullback of some kind – we’ll

see. I’m not seeing too many negative indicators, but there are a number of

indicators that are close to turning negative. Perhaps profit taking in the

new-year will start some real selling. For now, I’ll go with the flow.

Smart Money (based on late day action) is neutral so the

Pros aren’t sure now either.

In the near term I am leaning neutral to slightly

bearish; longer term I am a bull, but I recommend caution with the Fed raising

rates and shrinking its balance sheet. This party could end sometime in 2018.

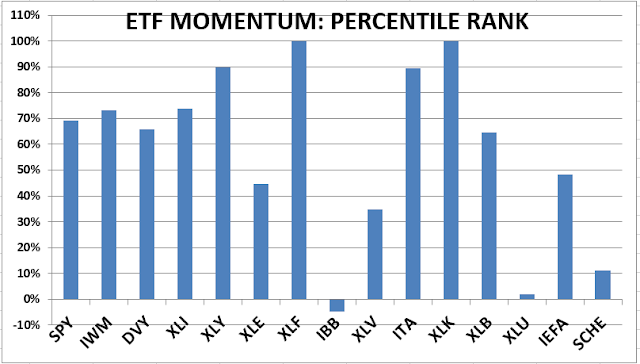

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%.

*For additional background on the ETF ranking system see

NTSM Page at…

Technology (XLK) hasn’t been the leader since the end of

November. Today it is tied with Financials (XLF) at #1. The markets look a bit

strained so perhaps I’ll get a better buying opportunity. I’ll wait before adding any positions. (I

hold XLK, DVY and SPY. DVY is a dividend play. SPY is a good core holding.)

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

Caterpillar (CAT) and Boeing (BA) have been trading first

place in the last few days. CAT is #1 today. (I hold Intel – I’m waiting for a

better entry point before adding other positions.)

Avoid GE, IBM and Merck. Their 120-day moving averages

are falling.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals improved

to Positive on the market. (Market Internals are based on a package of

internals and all must be positive to create a positive indication.

Market Internals are a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are usually right, but they are often late. They are most useful when they diverge from

the Index. In 2014, using these

internals alone would have made a 9% return vs. 13% for the S&P 500 (in on Positive,

out on Negative – no shorting).

LONG TERM INDICATOR

Tuesday, Price indicator was positive; Sentiment, Volume & VIX

indicators were neutral. Price was too positive; it is so high that it is now a

worrisome sign. With VIX recently below 10 for a couple of days in May,

June, July, August, September, October, November and now December, VIX may be

prone to incorrect signals. Usually, a rising VIX is a bad market sign; now it

may move up, but that might just signal normalization of VIX, i.e., VIX and the

Index may both rise. As an indicator, VIX is out of the picture for a while.

MY INVESTED STOCK POSITION:

TSP (RETIREMENT ACCOUNT – GOV EMPLOYEES) ALLOCATION

I increased

stock allocation to 50% stocks in the S&P 500 Index fund (C-Fund) 24 March

2017 in my long-term accounts, based on short-term indicators. The remainder

is 50% G-Fund (Government securities). This is a conservative retiree

allocation, but I consider it fully invested for my situation.