“There are multiple signs of equity strength going on

below the surface of the major indexes, which could be a signal that the recent

uptrend in stocks is justified and could continue. One positive signal looks at

the ratio of rising stocks on the New York Stock Exchange to the number of

falling ones over time…Paul Schatz, the president of Heritage Capital, referred

to this as “the one indicator that’s 90% accurate” for forecasting moves. Currently,

the NYSE’s advance/decline line is at an all-time high…” Story at…

MARKET RESISTANCE LEVELS (RIA)

“Last week, the SP500 experienced a breakout above its

downtrend line that started in late-January, which is a bullish sign as long as

this breakout remains intact. The 2,800 resistance is the next hurdle that the

SP500 needs to clear. If the SP500 can successfully clear 2,800, the

2,872-2,900 resistance zone (the January 2018 highs) is the final level that

needs to be broken in order for the next phase of the bull market to begin.” –

Jesse Columbo. Commentary at…

HOW THE RUSSIANS ARE ATTACKING US (MSN.com)

“Young Mie Kim, a University of Wisconsin-Madison

researcher who published some of the first scientific analysis of social media

influence campaigns during the election, said the ads show that the Russians

are attempting to destabilize Western Democracy by targeting extreme identity

groups.” Story at…

My cmt: During the Ferguson crisis it was claimed by many

that a black man had his hands up when he was shot and he had done nothing to justify

a shooting. The Officer claimed he was attacked and there was a struggle for

the gun and that was corroborated by some witnesses according to reliable news

sources.

I heard a young man call in to a local talk show. He was

irate and claimed that the fact there were no fingerprints found on the officer’s

gun proved there had not been a struggle. I wondered where he got his news.

Both the WSJ and the Washington Post had reported that the Police didn’t look

for fingerprints; they tested for DNA on the officer’s gun and found the

assailants DNA. (Police test for DNA or fingerprints – it is not feasible to

look for both.) Everything the caller claimed was wrong. I wondered where he

got his news…now we know – the Russians.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 was up about 0.1% to 2730.

-VIX rose about 2% to 12.93.

-The yield on the 10-year Treasury was up a bit to 2.994%.

The S&P 500 is up 7 days out of the last 10 days and 4

days in a row. That is the kind of price action we expect to see after investors

decide a correction has ended. This tends to bolster what I have been saying

for some time – the correction is over. Sentiment is giving a clue about the

market too.

I measure Sentiment as %-Bulls (Bulls/{bulls+bears})

based on the amounts invested in Rydex/Guggenheim mutual funds. Short money

doubled last week in 3-days and the %-bulls dropped from 85% to 79% on a 5-day

basis. This is telling us that traders in the Rydex funds don’t believe this

rally will continue. History says to bet against the Rydex herd. The falling

Sentiment value (%-bulls) suggests that the rally can continue.

I think we’ll make new highs, but how much further the

index may go after that is anyone’s guess and of course, there are no guarantees. When we make new highs, we can check

the data and see where we are.

Indicators are fairly similar to Friday’s. Not much has

changed so I won’t go through them in detail today. RSI is nearly overbought,

but overbought conditions can remain for some time after a correction end.

My daily sum of 17 Indicators remained +6, while the

10-day smoothed version improved from -7 to +5.

I am currently bullish in the near term. If I am wrong, my plan ahead remains: If the

S&P 500 drops to its prior low of 2581 and there is an unsuccessful retest,

I will probably cut stock holdings. If we see a successful test I’ll be adding

to stocks. At this point though, I think the correction is over. We’ll see…

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.)

XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

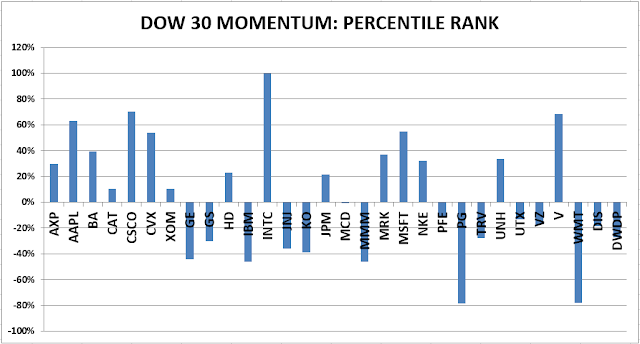

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock. (On 5 Apr 2018 I

corrected a coding/graphing error that has consistently shown Nike

incorrectly.)

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

MONDAY MARKET INTERNALS (NYSE DATA)

Market Internals

remained Positive on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

18 Apr 2018 I

increased stock investments from 35% to 50% based on the Intermediate/Long-Term

Indicator that turned positive on the 17th. (It has since turned Neutral.) For

me, fully invested is a balanced 50% stock portfolio. 50% is my minimum unless

I am in full defense mode.

On 10 May 2018 I

added stock positions to increase Stock investments to 55% based on more

evidence that the correction is over. I’ll sell these new positions quickly if

the market turns down.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Monday, the Volume Indicator was positive; VIX, Price and

Sentiment indicators were neutral. Overall this is a NEUTRAL indication.