“U.S. consumer spending increased more than expected in

April. The data were a further sign that economic growth was regaining momentum

early in the second quarter, while inflation continued to rise steadily.” Story

at…

PCE PRICES (Reuters)

“U.S. consumer prices accelerated in the year to May,

with a measure of underlying inflation hitting the Federal Reserve’s 2 percent

target for the first time in six years.” Story at…

CHICAGO PMI (fxStreet)

“The MNI Chicago Business Barometer rose 1.4 points to

64.1 in June, up from 62.7 in May, hitting the highest level since January…”

Story at…

CONSUMER SENTIMENT (Bloomberg)

“Consumer sentiment weakened in the latter part of June

on concerns about the economic impact of a trade war, according to a University

of Michigan survey on Friday that also showed a pickup in inflation

expectations.” Story at…

MARKET REPORT / ANALYSIS

-Friday the S&P 500 was up about 0.6% to 2716.

-VIX dipped about 5% to 16.09.

-The yield on the 10-year Treasury rose to 2.860%.

What an ugly close today. The S&P 500 index dropped

nearly 1% in the last hour or so and the closing Tick (sum of last trades of

the day) was high at -420.

There was a silver lining in the data though. The 10-day

closing Tick was minus 23. Minus numbers

are where bottoms are made since it really is indicative of too many bad days.

As is often the case in stock market analysis, too much of a bad thing can be

good. In this case, 10-day, closing-tick

in minus territory is somewhat bullish, especially given some of the other

indicators.

My daily sum of 17 Indicators improved from -7 to -3,

while the 10-day smoothed version dropped from -57 to -58. The 10-day version continues

to slow its decline. The indicators are neutral at this point.

The Bollinger Band indicator was very close to oversold

and RSI (14-d,SMA) was 30 and that is oversold. Combine those oversold signals

with the Advance/Decline ratio that was oversold a few days ago and we have a

decent bullish set-up.

The % of stocks advancing is improving faster than the

S&P 500 and that’s a bullish sign too.

The charts need to confirm these bullish signs, but so

far they haven’t, at least not convincingly. The S&P 500 remains at the 50-dMA today so we’ll have to

wait longer to see where the market is headed. Indicators are beginning to

suggest up, but the signal is not very strong – we’d like to have more

confirmation.

My longer-term indicator system remained neutral. I

remain cautiously bullish.

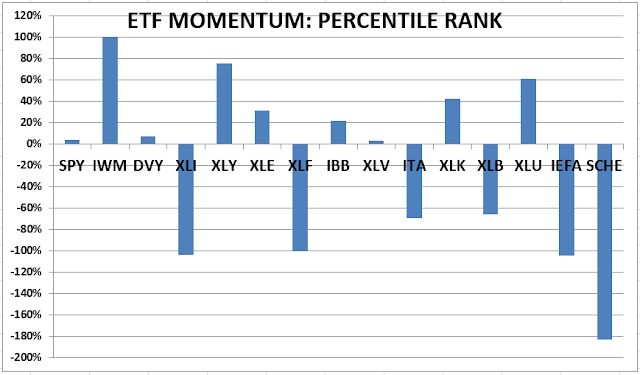

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the 4-months

from Oct thru mid-February 2016, the number 1 ranked Financials (XLF) outperformed

the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked in the top 3

Momentum Plays for 52% of all trading days in 2017 (if I counted correctly.) XLK

was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock. (On 5 Apr 2018 I

corrected a coding/graphing error that had consistently shown Nike

incorrectly.)

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

I still have GE in my DOW 30 chart. I’ll have to update my calculations to delete

GE and add Walgreens Boots Alliance (WBA) since it has replaced GE in the DOW

30. WBA is best known for operating Walgreens drug stores.

FRIDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained

Neutral on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

On 10 May 2018 I

added stock positions to increase Stock investments to 58% based on more

evidence that the correction is over. This is high for me given that we are

late in this cycle (and as a retiree), but it indicates my bullishness after

the correction. I’ll sell these new positions quickly if the market turns down.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Friday, the VIX, Price, Sentiment & Volume indicators were

neutral. Overall this is a NEUTRAL indication.