“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

“People always ask me what is going on in the markets. It

is simple. Greatest Speculative Bubble of All Time in All Things. By two orders

of magnitude.” – Michael “Big Short” Burry.

“I never imagined that I would see the day that the

Chairman of the House Judiciary Committee would step forward to call for raw [Supreme]

court packing. It is a sign of our current political environment where rage

overwhelms reason.” - Professor Jonathan Turley, honorary Doctorate of Law from

John Marshall Law School for his contributions to civil liberties and the

public interest.

LEADING ECONOMIC INDICATORS – LEI (Conference Board)

The Conference Board Leading Economic

Index® (LEI) for the U.S. increased by 1.3 percent in May to

114.5 (2016 = 100), following a 1.3 percent increase in April and a 1.4 percent

increase in March. "After another large improvement in May, the U.S. LEI

now stands above its previous peak reached in January 2020 (112.0),

suggesting that strong economic growth will continue in the near term,"

said Ataman Ozyildirim, Senior Director of Economic Research at The Conference

Board.” Press release at...

JOBLESS CLAIMS (CNBC)

“Initial jobless claims unexpectedly rose last week

despite an ongoing recovery in the U.S. employment market, the Labor Department

reported Thursday. First-time filings for unemployment insurance for the week ended

June 12 totaled 412,000...” Story at...

https://www.cnbc.com/2021/06/17/us-weekly-jobless-claims.html

PHILADELPHIA FED INDEX (Reuters)

“Factory activity in the U.S. mid-Atlantic region

declined for the second consecutive month in June after hitting its highest

pace in nearly half a century earlier this spring, a survey showed on Thursday.

The Philadelphia Federal Reserve Bank said its business

activity index fell to 30.7...” Story at...

https://www.reuters.com/world/us/philly-fed-factory-activity-edges-lower-june-2021-06-17/

RATE HIKES GOOD FOR BANKS (CNBC)

“Higher rates sooner can allow banks to finally earn more

money on all those deposits that they gathered...and give a tailwind to banks...

[news of rate hikes expected sooner] was good for banks...” – Mike Mayo, Sr.

Analyst at Wells Fargo. Video interview at...

He also said that the down side is inflation. Inflation is “hell” for banks, but Wells

Fargo doesn’t expect inflation to continue.

SLOWLY AT FIRST – THEN ALL AT ONCE (RIA)

“...the reason investors “get trapped” in bear markets is

that when they realize what is happening, it is far too late to do anything

about it...Pay attention to the market. The action this year is very reminiscent of

previous market topping processes. Tops are hard to

identify during the process as “change happens slowly.” The mainstream

media, economists, and Wall Street will dismiss pickup in volatility as simply

a corrective process. But when the topping process completes, it will seem as if

the change occurred “all at once.” Commentary at...

https://realinvestmentadvice.com/technically-speaking-slowly-at-first-then-all-at-once/

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 9:45 PM Thursday. US total case numbers are on the left axis; daily numbers

are on the right side of the graph with the 10-dMA of daily numbers in Green.

MARKET REPORT / ANALYSIS

-Thursday the S&P 500

dipped about 0.04% to 4222.

-VIX dipped about 2% to 17.75.

-The yield on the 10-year

Treasury was 1.514%.

I never saw very many top

indicators at Monday’s top. Both RSI and

Bollinger Bands were close to overbought warnings, but never got to extremes we

usually see at tops. That suggests (but

doesn’t guarantee) that a pullback would be smaller (if we do have a pullback). My guess is that the 50-dMA would be the

bottom or near the bottom for this pullback. As of today’s close, the Index is 1%

above its 50-dMA.

The daily sum of 20 Indicators dropped from zero to -6 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations dropped from +54 to +45. (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble remained HOLD. Price is Bullish; Volume, VIX, & Sentiment are

neutral.

I am bullish until we see more

bearish signs.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

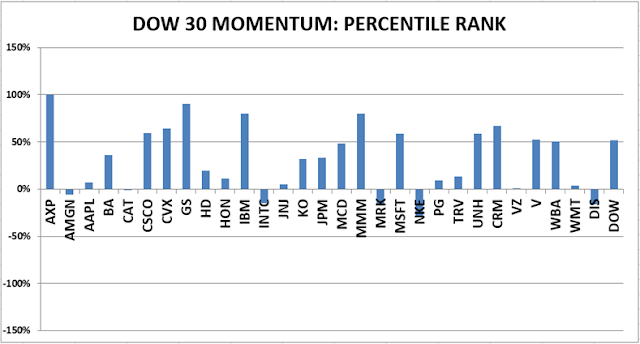

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

Market Internals remained NEUTRAL on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator

in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold.

The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE

indication and stay out until the next POSITIVE indication. The back-test

included 13-buys and 13-sells, or a trade every 2-weeks on average.

As of 25 May, my

stock-allocation is about 50% invested in stocks. I am not super bullish, but I

am not bearish either so 50% is a reasonable allocation for me.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees. As a

retiree, 50% in the stock market is about fully invested for me – it is a

cautious and conservative number. If I feel very confident, I might go to 60%;

if a correction is deep enough, and I can call a bottom, 80% would not be out

of the question.

The markets have not

retested the lows on recent corrections and that left me under-invested on the

bounces. I will need to put less reliance on retests in the future.