“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“In 2020, the top 20% of taxpayers paid 78% of federal income taxes,

according to the Tax Policy Center, which was up from 68% in 2019. The top 1% of taxpayers paid 28% of taxes in

2020, up from 25% in 2019.” - ZeroHedge.

NEW HOME SALES (Reuters)

“Sales of new U.S. single-family homes increased in July

after three straight monthly declines, but housing market momentum is slowing

as surging housing prices amid tight supply sideline potential buyers from the

market... New home sales rose 1.0% to a seasonally adjusted annual rate of

708,000 units last month. ” Story at...

https://www.reuters.com/world/us/us-new-home-sales-increase-july-2021-08-24/

NO KEY SECTORS SUPPORTING THE BULLS (Heritage Capital, 23

Aug)

“In what would be the most unlikely of scenarios, it would be super interesting and surprising if the S&P 400 and Russell 2000 gathered themselves for a run to new highs while the other indices went sideways or pulled back. My four key sectors are not offering any support to the bulls as none are at or close to new highs...The bulls absolutely need to see a minimum of two sectors move to new highs on the next rally. If not, a more significant overall stock market decline may get closer.” Paul Schatz, President Heritage Capital. Full commentary at...

https://investfortomorrow.com/blog/no-key-sectors-supporting-bulls/

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 6:00 PM Tuesday. U.S. total case numbers are on the left axis; daily numbers

are on the right side of the graph in Red with the 10-dMA of daily numbers in

Green.

The 10-dMA of new cases has been bouncing up and down so

it is not clear to me that this wave has peaked. When we smooth out the 10-dMA to get a better

handle on trend, it is still rising. Keep an eye on this. Dr. Gottlieb thinks

this wave of the pandemic is waning – we’ll see.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.2% to 4486.

-VIX rose about 0.3% to 17.20.

-The yield on the 10-year Treasury rose to 1.295%.

The S&P 500 made a new high today, slightly higher than the last new-high. On the bullish side, we’ve seen 3 days in a row with advancing volume above 75%. It was 81% today. A nice bullish sign. On the other hand, there was a significant dip late in the day as the index gave up more than half of its gain. That’s somewhat bearish and raises the concern that tomorrow will continue the trend down.

Further, only 3.4% of issues on the NYSE made new,

52-week, all-time-highs at today’s new S&P 500 high. That’s very close to

my Bear-signal for this indicator. Even

if it didn’t quite send the bear signal, it still is a warning that the market

is not as healthy as it would seem. We still have both the 10-dMA and the

50-dMA of Breadth (percentage of issues advancing on the NYSE) below 50%. The

50-dMA of breadth has been below 50% for 6 days in a row. 3 days in a row is practically a definition

of a pullback; that stat needs to improve soon or markets will be headed down.

However, there were bullish signs.

Tuesday, the McClellan Oscillator turned positive so all recent

Hindenburg Omens have been cancelled.

This occurred because the ratio of new-highs to new-lows has improved

and the number of new-lows declined. That’s all bullish.

We’ve also had 3 consecutive days with up-vol greater than

75% - that’s a strong Bullish sign, too.

The daily sum of 20 Indicators improved from -8 to -6 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations slipped from -63 to -68. (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble remained HOLD. Price, Volume, VIX & Sentiment indicators are

neutral.

I am less convinced that we’re

going to have a pullback. Still, it’s odd to see such a consistently strong

bounce coming after a slight dip of less than 2% when combined with extremely

poor market-internals and bearish internal divergences in utilities and

cyclicals only a few days ago. Perhaps

we should thank the FED again!

If signs continue to improve,

I’ll get back to a fully invested position in the next day or 2.

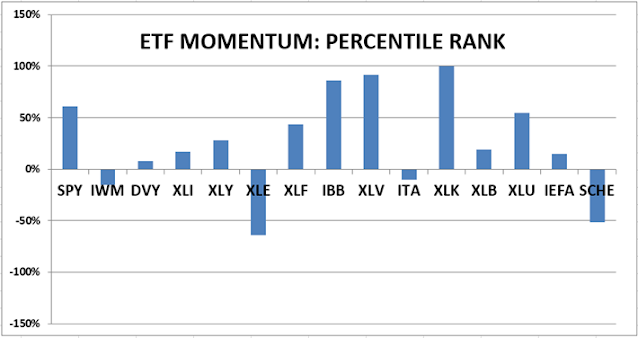

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

Market Internals remained NEUTRAL on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator

in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold.

The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE

indication and stay out until the next POSITIVE indication. The back-test

included 13-buys and 13-sells, or a trade every 2-weeks on average.

My stock-allocation is about 45%

invested in stocks. I am bearish and watching the markets and indicators

closely. This is only slightly below my fully invested position of 50%.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees. As a

retiree, 50% in the stock market is about fully invested for me – it is a

cautious and conservative number. If I feel very confident, I might go to 60%;

if a correction is deep enough, and I can call a bottom, 80% would not be out

of the question.