Political commentary from...

https://www.reviewjournal.com/opinion/michael-ramirez/cartoon-heating-up-3088505/

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“Mr. Biden’s interview with George

Stephanopoulos was not unlike the conversations I have had, as a

practicing medical neuropsychologist, with countless dementia patients

regarding their inability to continue driving. “I have been driving for 50 years.

Just watch me,” they say.” - Paul M.

Dammers, Ph.D., WSJ letters.

“...Washington could be trusted with power because he was

ready to relinquish it. His aura of greatness was enhanced because he was ready

to surrender power when he felt the encroachment of age. If Mr. Biden were to

relinquish power, he would leave office with honor.” - Eileen Pollock, WSJ Letters

Now the Dems want to impeach Justices Alito and Thomas...

“For decades we disagreed with [Supreme] Court rulings when progressives held sway, but we never called the Court illegitimate. But now that the left has lost the Court as a backup legislature for its policy goals, the institution is supposedly broken. Tell us again who is the threat to democratic institutions?” – WSJ Editorial Board.

STRANGE DAY IN THE STOCK MARKET (CNBC)

“Bespoke Investment Group shared two statistics on the social media site X to demonstrate how rare it is to have that type of split. Thursday was just the second day since 1979 when the Russell 2000 rose more than 3% while the S&P 500 declined. The Nasdaq Composite underperformed the Russell 2000 by more than 5 percentage points in what appears to be biggest daily gap on record...

... every stock in the so-called Magnificent Seven fell, including a more than 5% decline for Nvidia and a 2.3% drop for Apple, which dragged down both the S&P 500 and Nasdaq Composite.” Story at...

https://www.cnbc.com/2024/07/11/thursday-was-a-strange-day-in-the-stock-market-that-may-be-good-news.html

CPI / CORE CPI (CNN)

“The Consumer Price Index, a measurement of the average change in prices for a commonly purchased basket of goods and services, dropped 0.1% from May, which helped to slow the annual rate of inflation to 3% from 3.3% in May, according to the Bureau of Labor Statistics’ latest report... Excluding energy and food prices, a closely watched “core” index of underlying inflation also slowed more than expected. The core CPI rose 0.1% from May — its slowest pace since August 2021 — nudging the annual rate of core inflation lower, to 3.3% from 3.4%...” Story at...

https://www.cnn.com/2024/07/11/economy/us-cpi-consumer-inflation-june/index.html

JOBLESS CLAIMS (ABCNews)

“The Labor Department reported Thursday that jobless claims for the week ending July 6 fell by 17,000 to 222,000 from 239,000 the previous week.” Story at...

https://abcnews.go.com/Business/wireStory/fewer-americans-apply-jobless-claims-week-labor-market-111841993

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 declined about 0.9% to 5584.54.

-VIX rose about 0.5% to 12.92. (Not much higher for a nearly 1% drop on the S&P 500.)

-The yield on the 10-year Treasury declined to 4.211% (compared to this time yesterday).

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) was a Bullish 7 Bear-signs and 18-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.) The 10-dMA of spread (purple line in the chart below also reversed up, a bull-sign.

The Bull/Bear, 50-Indicator spread improved from +7 to +11

(11 more Bull indicators than Bear).

TODAY’S COMMENT:

The Index broke above the upper trend line in the wedge pattern yesterday (red, dashed-lines in the above chart), but declined back into the wedge zone today. In my opinion, we still need to worry about the bearish rising wedge in the charts.

Thursday there was another Bearish outside

reversal day. Today’s is the fifth one in 4-weeks.

According to Investopedia: “This demonstrates that the bulls had control over the market before the bears took the reins in a meaningful way, signaling a shift in the overall trend... For instance, a stock may have a small move higher on the first day, climb even higher the second day, but then sharply decline by the second day’s end... This formation is considered a strong indicator that the prior upward momentum is waning and a reversal is on the horizon.”

https://www.investopedia.com/terms/o/outsidereversal.asp#:~:text=A%20bearish%20outside%20reversal%2C%20also,by%20the%20second%20day's%20end

“On the horizon” seems to be the key. How long does one wait? Yesterday there was

nearly a top-warning, so we are left to wonder whether yesterday was a top. Internals and most indicators would say, no.

Thursday was a statistically significant down-day. That

just means that the price-volume move exceeded my statistical parameters.

Statistics show that a statistically-significant, down-day is followed by a up-day

about 60% of the time.

Today, 80% of volume was up-volume; advancers outpaced

decliners by 6 to 1; and there were 279 new, 52-week new highs on the NYSE. Those

are solid numbers and it’s hard to believe the S&P 500 was down. Usually, the Index follows the majority so I

would expect the S&P 500 to follow higher Friday, but we still see issues

in the market.

The S&P 500 is 13.7% above the 200-dMA and that

remains stretched. The bear sign is greater than 12%.

Statistical analysis of daily moves is indicating that

the daily moves have gotten too predictably small, a sign of complacency. This

suggests a top within the next 20-days. The last time we saw this indicator was

at the 31 July top last year. That was followed by a 10% correction.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE, VOLUME, VIX & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

(The important major BUY in this indicator was on 21 October

2022, 7-days after the bear-market bottom. For my NTSM overall signal, I

suggested that a short-term buying opportunity occurred on 27 September (based

on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of this recent bear market, based on the bearish “Friday Rundown”

of indicators.)

BOTTOM LINE

I am still Neutral on the market. It’s hard to be bullish when there are issues to be resolved. A pullback is coming, but we don’t yet have a smoking gun to say it’s here. My guess now is that we’ll see a 5-7% correction in late July or early August, but I’ll wait for the indicators. It may change based on what we see. If we expect a small correction I won’t make any portfolio changes; I don’t like to try to time corrections unless I expect a 10% or greater pullback.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

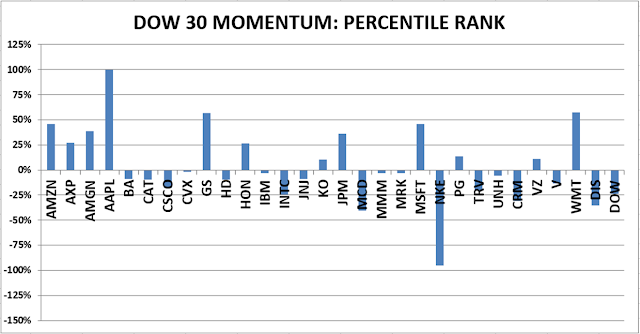

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

.My current invested

position is about 50% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks, so this is normal invested position. (75%

is my max stock allocation so I have some cash now.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 2022 and 2023.

https://www.reviewjournal.com/opinion/michael-ramirez/cartoon-heating-up-3088505/

“For decades we disagreed with [Supreme] Court rulings when progressives held sway, but we never called the Court illegitimate. But now that the left has lost the Court as a backup legislature for its policy goals, the institution is supposedly broken. Tell us again who is the threat to democratic institutions?” – WSJ Editorial Board.

“Bespoke Investment Group shared two statistics on the social media site X to demonstrate how rare it is to have that type of split. Thursday was just the second day since 1979 when the Russell 2000 rose more than 3% while the S&P 500 declined. The Nasdaq Composite underperformed the Russell 2000 by more than 5 percentage points in what appears to be biggest daily gap on record...

... every stock in the so-called Magnificent Seven fell, including a more than 5% decline for Nvidia and a 2.3% drop for Apple, which dragged down both the S&P 500 and Nasdaq Composite.” Story at...

https://www.cnbc.com/2024/07/11/thursday-was-a-strange-day-in-the-stock-market-that-may-be-good-news.html

“The Consumer Price Index, a measurement of the average change in prices for a commonly purchased basket of goods and services, dropped 0.1% from May, which helped to slow the annual rate of inflation to 3% from 3.3% in May, according to the Bureau of Labor Statistics’ latest report... Excluding energy and food prices, a closely watched “core” index of underlying inflation also slowed more than expected. The core CPI rose 0.1% from May — its slowest pace since August 2021 — nudging the annual rate of core inflation lower, to 3.3% from 3.4%...” Story at...

https://www.cnn.com/2024/07/11/economy/us-cpi-consumer-inflation-june/index.html

“The Labor Department reported Thursday that jobless claims for the week ending July 6 fell by 17,000 to 222,000 from 239,000 the previous week.” Story at...

https://abcnews.go.com/Business/wireStory/fewer-americans-apply-jobless-claims-week-labor-market-111841993

-Thursday the S&P 500 declined about 0.9% to 5584.54.

-VIX rose about 0.5% to 12.92. (Not much higher for a nearly 1% drop on the S&P 500.)

-The yield on the 10-year Treasury declined to 4.211% (compared to this time yesterday).

XLK – Holding since the October 2022 lows.

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) was a Bullish 7 Bear-signs and 18-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.) The 10-dMA of spread (purple line in the chart below also reversed up, a bull-sign.

The Index broke above the upper trend line in the wedge pattern yesterday (red, dashed-lines in the above chart), but declined back into the wedge zone today. In my opinion, we still need to worry about the bearish rising wedge in the charts.

According to Investopedia: “This demonstrates that the bulls had control over the market before the bears took the reins in a meaningful way, signaling a shift in the overall trend... For instance, a stock may have a small move higher on the first day, climb even higher the second day, but then sharply decline by the second day’s end... This formation is considered a strong indicator that the prior upward momentum is waning and a reversal is on the horizon.”

https://www.investopedia.com/terms/o/outsidereversal.asp#:~:text=A%20bearish%20outside%20reversal%2C%20also,by%20the%20second%20day's%20end

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

I am still Neutral on the market. It’s hard to be bullish when there are issues to be resolved. A pullback is coming, but we don’t yet have a smoking gun to say it’s here. My guess now is that we’ll see a 5-7% correction in late July or early August, but I’ll wait for the indicators. It may change based on what we see. If we expect a small correction I won’t make any portfolio changes; I don’t like to try to time corrections unless I expect a 10% or greater pullback.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)