Jobless Claims ... Philly Fed ... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more

money has been lost by investors in preparing for corrections, or anticipating

corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

CONSTITUTION SETS LIFETIME JUSTICE APPOINTMENTS

“The Supreme Court is the Nation's highest court. Eight

Associate Justices and one Chief Justice comprise the membership of the Court.

Like all Federal judges, Supreme Court Justices serve lifetime appointments on

the Court, in accordance with Article III of the United States Constitution.”

From...

https://www.judiciary.senate.gov/nominations/supreme-court

BIDEN TO ENDORSE SUPREME COURT TERM LIMITS (Forbes)

“Biden is preparing to endorse major Supreme Court

reforms including term limits and a binding code of ethics for justices, the

Washington Post first reported,

telling progressive lawmakers Saturday he’s “about to come out with a major

initiative on limiting the court.” – Story at...

https://www.forbes.com/sites/alisondurkee/2024/07/17/biden-reportedly-wants-supreme-court-term-limits-how-it-would-work-and-why-its-still-unlikely/

My cmt: Jeez. Where do they get this stuff? "Fat,

drunk and stupid is no way to go through life, son."

“For decades we disagreed with [Supreme] Court rulings

when progressives held sway, but we never called the Court illegitimate. But

now that the left has lost the Court as a backup legislature for its policy

goals, the institution is supposedly broken. Tell us again who is the threat to

democratic institutions?” – WSJ Editorial Board.

“The problem that Biden has is he has gone out for the

last three weeks to try and turn the narrative around...To say that the debate

was just a one-off, that he is in fact strong and vigorous and was just having

a bad night, he just had a cold and he was tired. The problem is his

appearances so far since then have been hit or miss.” - Nia-Malika Henderson,

CNN Senior Political Analyst.

“Peter Navarro, an aide in former President Donald

Trump’s White House, received thunderous cheers at the Republican National

Convention on Wednesday as he spoke hours after having left a federal prison in

Miami. ... Navarro reported to prison in March after he was convicted of

contempt of Congress. He was involved in Trump’s effort to overturn the 2020

presidential election and defied a subpoena from the House committee tasked

with investigating the Jan. 6, 2021, attack on the Capitol and the run-up to it.”

- NBC News.

My cmt: Today’s Republicans love their criminals. Ronald

Reagan would be appalled.

JOBLESS CLAIMS (Yahoo Finance)

“New data from the Department of Labor showed

243,000 initial jobless claims were filed in the week ending July 13, up from

222,000 the week prior and above the 229,000 economists had expected. This tied

with a weekly jobless claims reading from June for the highest level of weekly

filings since August 2023.” Story at...

https://finance.yahoo.com/news/jobless-claims-hit-highest-level-since-august-141051604.html

PHILADELPHIA FED (Advisor Perspectives)

“The latest Philadelphia Fed manufacturing index remained

in positive territory for a sixth straight month as manufacturing activity

expanded overall. In July, the index rose to 13.9 from 1.3 in June, coming in

above the forecast of 2.7.” Commentary at...

https://www.advisorperspectives.com/dshort/updates/2024/07/18/philadelphia-fed-manufacturing-index-activity-expands-july-2024

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 declined about 0.8% to 5545.

-VIX rose about 10% to 15.93.

-The yield on the 10-year Treasury rose to 4.215%

(compared to this time, prior trading day).

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows.

UWM – added 7/15.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread (Bull Indicators minus Bear

Indicators) remained a Bullish 7 Bear-signs and 17-Bull. (The rest are neutral.

It is normal to have a lot of neutral indicators since many of those are top or

bottom indicators that will signal only at extremes.) The 10-dMA of spread

(purple line in the chart below) is rising – a bullish sign, though this stat

has flopped back and forth.

The Bull/Bear, 50-Indicator spread rose from +9 to +10 (10

more Bull indicators than Bear).

TODAY’S COMMENT:

Thursday was another statistically significant down-day.

That just means that the price-volume move exceeded my statistical parameters.

Statistics show that a statistically-significant, down-day is followed by an up-day

about 60% of the time. The Overbought / oversold Index is no longer overbought,

so Friday may follow the odds and finish up. S&P 500 futures are up 0.16%

as I write this (11pm Thursday), but they were up yesterday and Thursday the

Index closed down. We’ll see.

Indicators are still bullish, but as previously noted, one

can see in the chart of the Summary of Indicator Spread (above) that indicators

do tend to be very bullish at tops.

The indicators were within a whisker of calling a top on

Tuesday, but didn’t quite get there. Based on the market action since then, it

looks to me like it was close enough, and I suspect the markets are in pullback

mode now.

Still, I don’t expect much more than a 5-7% pullback to

around the 50-dMA. Based on Thursday’s close, the S&P 500 is only 2.6% above

its 50-dMA.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: VIX is bearish; VOLUME, PRICE & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator.

It can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Summary of 50” indicator.

BOTTOM LINE

I am still Neutral to Bearish on the market; the pullback

we have been expecting appears to be here now. If we do see a correction, it

would probably be in the 5-7% range so I will not try to time it. I am more likely to be a buyer on the dip, if

I can see a bottom. Small pullbacks give small signals so it may not be

possible to “call-the-bottom.”

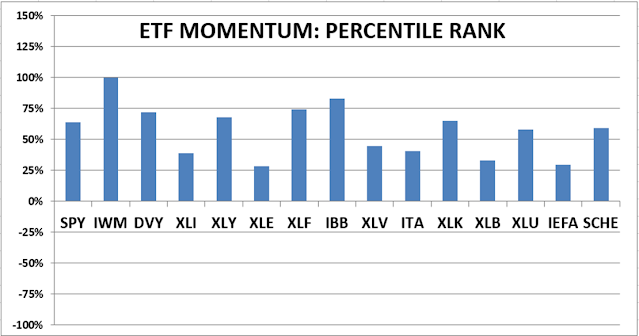

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to BUY. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 55% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched; my current

stock position is slightly above the norm. (75% is my max stock allocation when

I am strongly bullish.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 2022 and 2023.