“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“Personal income increased $50.4 billion (0.2 percent at a monthly rate) in June...” From...

https://www.calculatedriskblog.com/2024/07/personal-income-increased-02-in-june.html

“The personal consumption expenditures price index increased 0.1% on the month and was up 2.5% from a year ago, in line with Dow Jones estimates, the Commerce Department reported Friday.” Story at...

https://www.cnbc.com/2024/07/26/pce-inflation-june-2024-.html

-Friday the S&P 500 rose about 1.1% to 5459.

-VIX fell about 11% to 18.46.

-The yield on the 10-year Treasury declined to 4.195% (compared to this time, prior trading day).

XLK – Holding since the October 2022 lows.

XLK – added more 7/26. This reestablishes the position I had before this recent weakness.

UWM – added 7/15.

QLD – added 7/24.

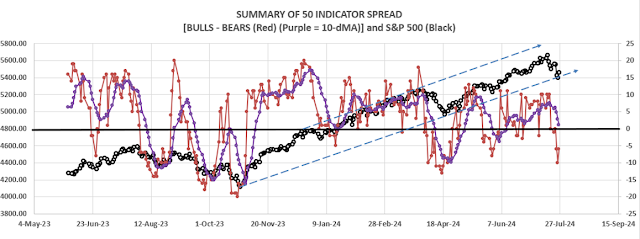

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) improved to 13 Bear-signs and 7-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.)

The Bull/Bear, 50-Indicator spread improved from -10 to -6 (6 more Bear indicators than Bull indicators).

The S&P 500 bounced back above its 50-dMA and that was a good sign. As of yesterday, the S&P 500 declined 4.7% from its all-time high of 5667. If yesterday was the low, and it appears that it may have been, that’s about what we expected. The Index dropped exactly to its 50-dMA. I’ll feel better when the 10-dMA of the 50-indicator spread (purple line in the chart above) starts moving up. When that happens, I’ll add to stocks.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

I am leaning Bullish on the market, but I’ll feel better when the 10-dMA of indicators moves higher.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)