CONSUMER CONFIDENCE (Reuters)

“U.S. consumer confidence edged up in February,

suggesting a steady pace of consumer spending that could support the economy

despite growing fears over the impact of the fast spreading coronavirus, which

have roiled financial markets. The Conference Board said its consumer

confidence index ticked up to a reading of 130.7 this month…” Story at…

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 dropped about 3 % to 3128.

-VIX jumped up about 11% to 27.85.

-The yield on the 10-year Treasury fell to 1.354.

Bullish signs? Bollinger Bands and RSI are both giving oversold

buy-signals. We may see a bounce tomorrow, but the pullback is not likely to be

over.

Overall, the daily sum of 20 Indicators improved slightly

from -14 to -12 (a positive number is bullish; negatives are bearish). The

10-day smoothed sum that negates the daily fluctuations declined from -16

to -31. (These numbers sometimes change after I post the blog based on data

that comes in late.) Most of these indicators are short-term.

As of today, the Index is 7.6% off of its recent high and

we’ve seen back-to-back, down-days of 3% and 3.4%. In Oct 2018, the market

bounced up after 2 similar back-to-back drops.

That bounce lasted about 4 days before selling picked up again. We can guess

that we might see something similar this time.

The “average” correction has been 12% since 2009 per my

records. Carter Worth, technician for Cornerstone Macro, reported on CNBC yesterday

that the average pullback has been 12% since 1927 so my smaller sample is ok.

Actually, I prefer more recent stats since they show what is happening…duh…more

recently.

My data shows that corrections greater than 10% have lasted, on average,

68 days top to bottom; those less than 10% have lasted 35 days. We’re at day 4.

My revised correction guess (made Monday) was that a drop

of 8-15% may be a reasonable guess for S&P 500 declines.

Some support levels follow:

4 December low:3093

Current S&P 500 200-day Moving Average: 3045

8 October low: 2893

A buying opportunity is pretty far off, based on prior

lengths of pullbacks, but the S&P 500 may be closer to a bottom than the

top.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10 (Zero is a

neutral reading.)

Today’s Reading: +2

Most Recent Day with a value other than Zero: +2 on 25

February. (Bollinger Bands and RSI were bullish.)

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or higher is a Buy

Sign.

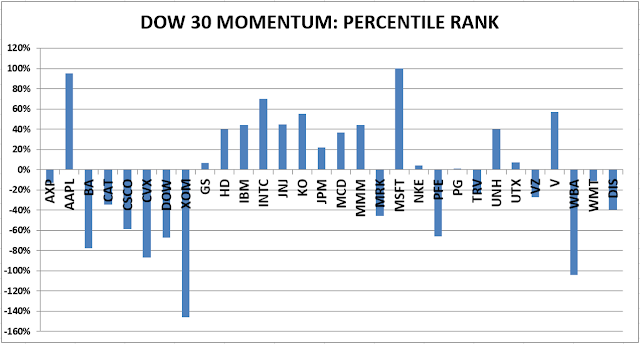

MOMENTUM ANALYSIS:

CAUTION: Momentum is not a good tool during market

declines. For example, while Apple is still number 2 in momentum, it has gained

zero over the last 2 months.

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

*For additional background on the ETF ranking system see

NTSM Page at…

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

TUESDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained

NEGATIVE on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

Using the Short-term indicator in 2018 in SPY would have

made a 5% gain instead of a 6% loss for buy-and-hold. The methodology was Buy

on a POSITIVE indication and Sell on a NEGATIVE indication and stay out until

the next POSITIVE indication. The back-test included 13-buys and 13-sells, or a

trade every 2-weeks on average.

My current stock allocation is about 45% invested in

stocks as of 27 January (down from 60%). This is a conservative position

appropriate for a retiree based on an overstretched S&P 500. You may wish

to have a higher or lower % invested in stocks depending on your risk

tolerance.

INTERMEDIATE / LONG-TERM INDICATOR

Tuesday, the VOLUME, VIX, PRICE and PANIC Indicators gave

bear signals; The SENTIMENT Indicator was neutral. The Long-Term Indicator remined SELL. If you wish

to reduce equity exposure, sell on a bounce upward. Perhaps a bounce will start

tomorrow. There is a risk is that stocks

continue to fall in a waterfall slide downward.

If that happens it may be best to ride it out. We are probably closer to the bottom than the top, if the averages are to be

believed.