“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

“In my decades of investing experience, I have not seen

such mindless and uninformed speculation as I have witnessed

recently. Indeed, in nominal dollar terms...it is far in excess of the

dot.com boom.” – Doug Cass.

“I never imagined that I would see the day that the

Chairman of the House Judiciary Committee would step forward to call for raw

court packing. It is a sign of our current political environment where rage

overwhelms reason.” - Professor Jonathan Turley, honorary Doctorate of Law from

John Marshall Law School for his contributions to civil liberties and the

public interest.

VA DEPT OF EDUCATION CONTESTS NEWS REPORTS ABOUT MATH

EQUITY PROPOSALS (Richmond Times Dispatch)

“Virginia Department of Education officials on Monday

defended the agency’s process in revising the mathematics Standards of Learning

and criticized news reports stating the agency planned to limit advanced math

class offerings in an effort to boost equity...Lane said agency officials are

weighing many shifts among routine draft revisions to state accountability

tests. ‘Absolutely acceleration is not going away in mathematics courses in

Virginia,’ he said. ‘If a student needs an accelerated pathway, they will

absolutely be able to do that.’ Story

at...

FOMC RATE DECISION (YahooFinance)

“The Federal Reserve on Wednesday said the vaccine

rollout has improved the U.S. economy, but still held interest rates at

near-zero as part of its commitment to aggressive economic stimulus...The Fed

said inflation has “risen” but attributed the higher readings to ‘transitory

factors...’ The Fed had described the economy as facing “considerable risks” in

its March meeting, but struck the word “considerable” in its updated statement.” Story

at...

https://finance.yahoo.com/news/fed-fomc-monetary-policy-decision-april-2021-135535532.html

GUNDLACH SAYS FED IS GUESSING THAT INFLATION WILL BE

TRANSITORY (Bloomberg)

“It is not clear that U.S. inflation will be ‘transitory’

as the Federal Reserve economists are trying to convey, according to Jeffrey

Gundlach. ‘I’m not sure why they think they know that it’s transitory,’

Gundlach of DoubleLine Capital LP said in an interview with BNN

Bloomberg Tuesday. ‘How do they know that when there’s plenty of money printing

that’s been going on and we’ve seen commodity prices going up really massively.’”

Story at...

EIA CRUDE INVENTORIES (Energy Information Administration)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) increased by 0.1 million barrels from the previous

week. At 493.1 million barrels, U.S. crude oil inventories are at the five-year

average for this time of year.” Press release at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 5:30pm Wednesday. US total case numbers are on the left axis; daily

numbers are on the right side of the graph with the 10-dMA of daily numbers in

Green.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500

slipped about 0.1% to 4183.

-VIX slipped about 1.6% to 17.28.

-The yield on the 10-year

Treasury slipped to 1.614%.

In the last 9 trading-days, the S&P 500 has improved by

0.25% in choppy trading, i.e., it has nearly stalled. That’s a bad sign for the Bulls. A pullback

is overdue, but not guaranteed. Indicators have been neutral to bullish over

the last week or so, and internals were negative last week

The daily sum of 20 Indicators

declined from +8 to +5 (a positive number is bullish; negatives are bearish);

the 10-day smoothed sum that smooths the daily fluctuations improved from +14

to +17 (These numbers sometimes change after I post the blog based on data that

comes in late.) Most of these indicators are short-term and many are trend

following.

The Long Term NTSM indicator

ensemble remained BUY. Price & VIX are bullish; Volume & Sentiment are

neutral. This indicator can be slow to turn.

I have been saying, “We are getting close to a pullback

of some kind.” I suspect that it is here, but it didn’t surprise me that the

Index made a new-high Monday. I just

don’t expect it to get too much higher.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

40 DAY GAINS OF THE ETFs

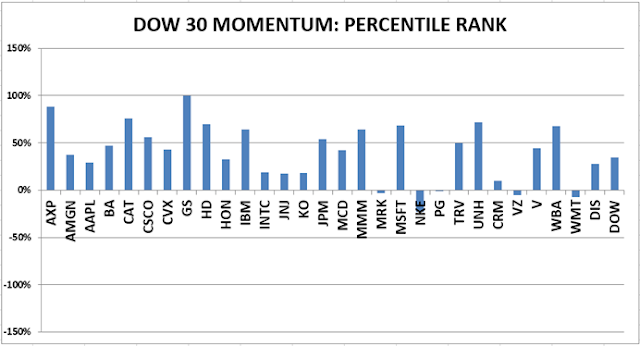

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

40 DAY GAINS OF THE DOW 30

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

Market Internals remained BULLISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator

in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold.

The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE

indication and stay out until the next POSITIVE indication. The back-test

included 13-buys and 13-sells, or a trade every 2-weeks on average.

As of 19 April, my

stock-allocation is about 40% invested in stocks. I hadn’t intended to drop

this low, but I took profits in both Boeing and Intel due to their dropping out

of the top 3 in momentum.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees. As a

retiree, 50% in the stock market is about fully invested for me – it is a

cautious and conservative number. If I feel very confident, I might go to 60%;

if a correction is deep enough, and I can call a bottom, 80% would not be out

of the question.

The markets have not

retested the lows on recent corrections and that left me under-invested on the

bounces. I will need to put less reliance on retests in the future.