“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“The big money is not in the buying and selling. But in

the waiting.” - Charlie Munger, Vice Chairman, Berkshire Hathaway

“In my decades of investing experience, I have not seen

such mindless and uninformed speculation as I have witnessed recently. Indeed,

in nominal dollar terms...it is far in excess of the dot.com boom.” – Doug

Cass.

“I never imagined that I would see the day that the

Chairman of the House Judiciary Committee would step forward to call for raw

court packing. It is a sign of our current political environment where rage

overwhelms reason.” - Professor Jonathan Turley, honorary Doctorate of Law from

John Marshall Law School for his contributions to civil liberties and the

public interest.

DURABLE ORDERS (Reuters)

“New orders for key U.S.-made capital goods rose solidly

in March and shipments surged, cementing expectations that economic growth

accelerated in the first quarter as massive government aid and improving public

health boosted demand... Orders for non-defense capital goods excluding

aircraft, a closely watched proxy for business spending plans, increased 0.9%

last month.” Story at...

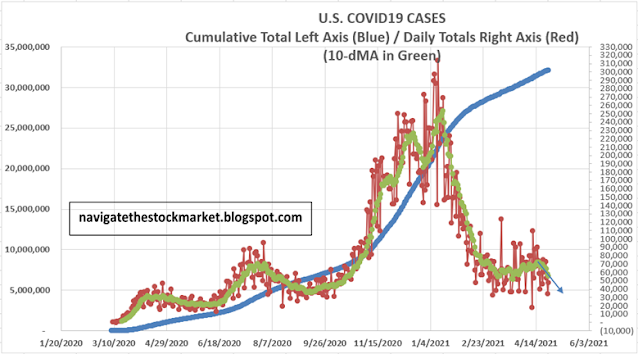

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 8:30pm Monday. US total case numbers are on the left axis; daily

numbers are on the right side of the graph with the 10-dMA of daily numbers in

Green.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 rose

about 0.2% to 4188.

-VIX rose about 2% to 17.64.

-The yield on the 10-year

Treasury was little changed at 1.574%.

The up-volume was 72% today,

so we didn’t see another 80% up-volume day on the NYSE. That just means I didn’t

see the back-to-back 80% up-volume days that would have been a bullish sign.

While the day was up, today,

the S&P 500 faded after about 3:20. The DJI faded all day and ended in

negative territory. Overall, my late-day-action indicator is headed down, so

the Pros are getting pessimistic.

Top Indicators that are

currently warning: (1) The Index is 15.3% above its 200-dMA; (2) the Index is

too far ahead of breadth. That’s not a large number of top indicators, but the

2 negatives are fairly reliable.

The S&P 500 made a new high today. 12% of all

issues traded on the NYSE made new, 52-week highs when the S&P 500 made a

new all-time-high 26 Apr. Currently, the value is above average and suggests

that if we do have a correction from here it would likely be less than 10%.

Friday was a statistically-significant,

up-day. Data shows that a statistically-significant, up-day is followed by a

down-day about 60% of the time. We haven’t seen that down-day yet – perhaps tomorrow.

The daily sum of 20 Indicators

declined from +9 to +6 (a positive number is bullish; negatives are bearish);

the 10-day smoothed sum that smooths the daily fluctuations declined from +11

to +10 (These numbers sometimes change after I post the blog based on data that

comes in late.) Most of these indicators are short-term and many are trend

following.

The Long Term NTSM indicator

ensemble remained BUY. Price & VIX are bullish; Volume & Sentiment are

neutral. This indicator can be slow to turn.

I have been saying, “We are getting close to a pullback

of some kind. I suspect that it is here, but it wouldn’t surprise me if the

Index made a new-high.” We made the new high today. I just don’t expect it to get too much higher.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

Market Internals remained BULLISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

Using the Short-term indicator

in 2018 in SPY would have made a 5% gain instead of a 6% loss for buy-and-hold.

The methodology was Buy on a POSITIVE indication and Sell on a NEGATIVE

indication and stay out until the next POSITIVE indication. The back-test

included 13-buys and 13-sells, or a trade every 2-weeks on average.

As

of 19 April, my stock-allocation is about 40% invested in stocks. You may wish

to have a higher or lower % invested in stocks depending on your risk

tolerance. 50% is a conservative position that I consider fully invested for

most retirees.

As a retiree, 50% in the stock

market is about fully invested for me – it is a cautious and conservative

number. If I feel very confident, I might go to 60%; if a correction is deep

enough, and I can call a bottom, 80% would not be out of the question.

The markets have not

retested the lows on recent corrections and that left me under-invested on the

bounces. I will need to put less reliance on retests in the future.