“President Biden’s defiant, accusatory defense on Tuesday

of his Afghanistan withdrawal and its execution was so dishonest, and so

lacking in self-reflection or accountability, that it was unworthy of the

sacrifices Americans have made in that conflict.” – WSJ Editorial.

ADP EMPLOYMENT CHANGE (Yaho Finance)

“Private sector employment increased by 374,000 jobs from

July to August according to the August ADP® National Employment Report™..."Our data, which

represents all workers on a company's payroll, has highlighted a downshift in

the labor market recovery. We have seen a decline in new hires, following

significant job growth from the first half of the year," said Nela Richardson, chief economist, ADP. "Despite the

slowdown, job gains are approaching 4 million this year, yet still 7 million

jobs short of pre-COVID-19 levels.”

Story at...

https://finance.yahoo.com/news/adp-national-employment-report-private-121500166.html

IHS MARKIT MANUFACTURING PMI (Morningstar News)

“Activity in the U.S. manufacturing sector slowed in

August as strong demand for goods met with persistent capacity constraints and

material shortages that constrained output growth. The final reading for the

U.S. Manufacturing Business Activity PMI for August came in at 61.1..” Story

at...

CONSTRUCTION SPENDING (Business Times)

“US construction spending picked up in July, lifted by

gains in both private and public sector projects...Construction spending rose

9.0 per cent on a year-on-year basis in July.” Story at...

https://www.businesstimes.com.sg/real-estate/construction-spending-rises-in-july-amid-abroad-gains

EIA CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 7.2 million barrels from the

previous week. At 425.4 million barrels, U.S. crude oil inventories are about

6% below the five year average for this time of year.” Press release at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

USING A LIVESTOCK DEWORMING DRUG TO TREAT COVID (WFLA)

“Using Ivermectin for COVID is not recommended by the FDA

and isn’t proven to be effective...Leah Ward Winchester, who has studied the

drug’s connection to COVID...cites ongoing studies conducted to determine how

effective the drug is against COVID. But these studies are being done with the

proper doses and ingredients meant for humans, not things found in farm stores.”

Story at...

My cmt: My niece is a veterinary PA. She can’t get this drug for her practice due

to panic buying by people using it for Covid. Don’t use the veterinary version

of this medicine! The jury is still out, but see the following piece.

IVERMECTIN FOR PREVENTION AND TREATMENT OF COVID-19

INFECTION (American Journal of Therapeutics)

“The antiparasitic ivermectin, with antiviral and

anti-inflammatory properties, has now been tested in numerous clinical

trials...Moderate-certainty evidence finds that large reductions in COVID-19

deaths are possible using ivermectin. Using ivermectin early in the clinical

course may reduce numbers progressing to severe disease. The apparent safety

and low cost suggest that ivermectin is likely to have a significant impact on the SARS-CoV-2 pandemic globally...Ivermectin is

likely to be an equitable, acceptable, and feasible global intervention against

COVID-19. Health professionals should strongly consider its use, in both

treatment and prophylaxis.” Journal paper at...

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 6:00 PM Wednesday. U.S. total case numbers are on the left axis; daily

numbers are on the right side of the graph in Red with the 10-dMA of daily

numbers in Green.

The smoothed 10-dMA of new cases rose to a new-high of

over 150,000 cases today. I don’t see

the improvement reported by the media. They were saying the new-case load is

falling in hot-spot locations. Maybe, but

cases must be picking up elsewhere, because overall US numbers continue to

climb.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 was up about 1pt to 4524.

-VIX slipped about 0.4% to 16.11.

-The yield on the 10-year Treasury slipped to 1.300%.

One of the simplest indicators is to count how many

up-days occur on a given index over varying timeframes. I keep track of this

over 10 and 20-day periods for the S&P 500.

Currently, both have reached their upper limits. We’ve seen 15 up-days

over the last 20-days and 8 up-days over the last 10-days. If either of those

numbers get higher, it would send a bearish signal. It would take 3 more consecutive

up-days to flip the 20-day and even more to flip the 10-day value. That’s because

in a moving average, the last value (in this case 10 or 20 days ago) is dropped

and the latest value is added. If the last value is an up-day and the latest

value is an up-day, there is no change on the overall number. As it is, these

indicators are mildly bearish and suggest a down-day for tomorrow.

Investors were buying utilities today. In the longer

term, utilities (XLU-ETF) are outperforming the S&P 500. The cyclical industrials (XLI-ETF) are

underperforming the S&P 500. Both are bearish signs.

Otherwise, Indicators continue to improve slowly.

The daily sum of 20 Indicators improved from +2 to +4 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations improved from -58 to -42. (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble remained HOLD. Volume is bullish; Price, VIX & Sentiment

indicators are neutral.

I am cautiously bullish. A top is coming, but not THE TOP.

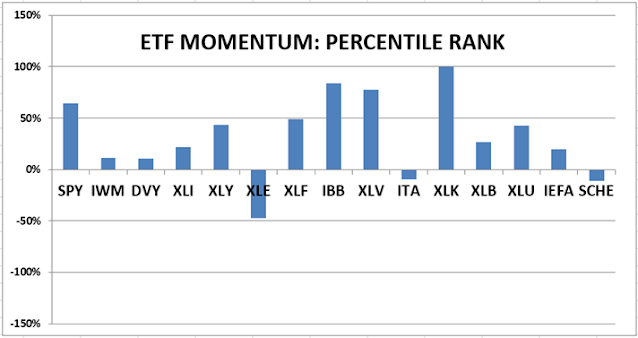

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

Market Internals remained BULLISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation is now about

50% invested in stocks; this is my “normal” 50% allocation.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So a 30 year

old person would have 70% of the portfolio in stocks, stock mutual funds and/or

stock ETFs. That’s ok, but I usually don’t

recommend keeping less than 50% invested in stocks (as a fully invested

position) since most people need some growth in the portfolio to keep up with

inflation.