PENDING HOME SALES (YahooFinance)

“Pending home sales, a leading indicator of the health of

the housing market, rose in August, reversing two straight months of declines.

The National Association of Realtors’ (NAR) Pending Home Sales Index,

which tracks the number of homes that are under contract to be sold, rose 8.1%

in August to a seven-month high from the previous month.” Story at...

https://finance.yahoo.com/news/pending-home-sales-august-2021-140006767.html

EIA CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) increased by 4.6 million barrels from the

previous week. At 418.5 million barrels, U.S. crude oil inventories are about

7% below the five year average for this time of year.” Press release at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

BOOK REVIEW: “UNSETTLED: WHAT CLIMATE SCIENCE TELLS US

ABOUT GLOBAL WARMING AND WHAT IT DOESN’T, BY STEVEN E. KOONIN” (RealClearEnergy)

“Koonin’s indictment of The Science starts with its

reliance on unreliable computer models...One particularly jarring feature is

that the simulated average global surface temperature,” Koonin notes, “varies

among models by about 3°C, three times greater than the observed value of the

twentieth century warming they’re purporting to describe and explain.” Another

embarrassing feature of climate models concerns the earlier of the two

twentieth-century warmings from 1910 to 1940, when human influences were much

smaller. On average, models give a warming rate of about half of what was

actually observed...“That the models can’t reproduce the past is a big red flag

– it erodes confidence in their projections of future climates.” Neither is it

reassuring that for the years after 1960, the latest generation of climate

models show a larger spread and greater uncertainty than earlier ones –

implying that, far from advancing, The Science has been going backwards. That

is not how science is meant to work.” Book Review at...

My cmt: I am reading “Unsettled?” now. It is a very good book. Dr. Koonin is not a climate denier. He goes into great detail explaining the

earth’s temperature rise of 1.1 degree C over the last 120 years. He discusses

CO2 as the primary greenhouse gas and its increase over the 20th

Century. However, the book is disturbing, because he presents a convincing case

that a great deal of the science related to the impacts of Global Warming is

truly unsettled and subject to media propaganda.

LET’S WORK FOR SCIENCE WITH INTEGRITY (Forbes)

...Why is the [climate] science so poorly communicated to

the public and policy makers? For Koonin, it is clear that distorted science

serves the interests of diverse players, ranging from environmental NGOs

[Non-Governmental Orgaizations], media, politicians, scientists and scientific

organizations. The ideological corruption of the hard sciences has been

remarked upon by others but

Koonin covers it with telling examples arising from his own experiences over

the years. Climate science, he asserts, has been an effort “to persuade rather

than inform”, leaving out what does not fit the overarching narrative.... “It

is up to scientists to put forward facts without an agenda or a pre-existing

narrative, but it is not easy. Koonin says, “I should know, that used to be my

job” Story at...

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

as of 9:00 PM Wednesday. U.S. total case numbers are on the left axis; daily

numbers are on the right side of the graph in Red with the 10-dMA of daily

numbers in Green.

I added the smoothed 10-dMA of new cases (in purple) to the chart.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 rose about 0.2% to 4359.

-VIX slipped about 3% to 22.56.

-The yield on the 10-year Treasury rose to 1.512%.

The Democrats have the votes to raise the Debt Limit

without any action from the Republicans and the Republicans won’t vote to raise

the Debt Ceiling. That’s what the Republicans have been saying all along. So,

we have a crisis, because the democrats won’t pass the Debt Ceiling and they

(the Democrats) are trying to blame the Republicans. Insane. Both parties are

just posturing and neither deserves our respect, or votes for that matter.

The current market weakness could always just be a result

of the clowns in DC. Sorry, I didn't mean to insult clowns.

The S&P 500 tested the prior low yesterday, but

volume was higher and internals were worse – that’s a “failed test” that suggests

that selling pressure increased. Is more

selling to come? It would seem so, but there is no guarantee and these signals

can sometimes be just a fake-out. In this case, my long-term ensemble indicator

also switched to sell. Together, or separately,

they are decent enough signals that I cut stock holdings to 45%. Is it the

right decision? I don’t really know, but I am following the indicators rather

than over thinking the decision. Trade what you see not what you think.

The daily sum of 20 Indicators declined from -3 to -10 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations declined from -53 to -55 (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble dropped to SELL. VIX and Volume were bearish; Price & Sentiment

indicators are neutral.

I’m leaning bearish, but who

knows – perhaps buy-and-hold would have worked better. We’ll have to wait and

see.

Utilities (the XLU-ETF) way

outperformed the S&P 500 today, so there are others who agree that a more

defensive stance might be a good idea.

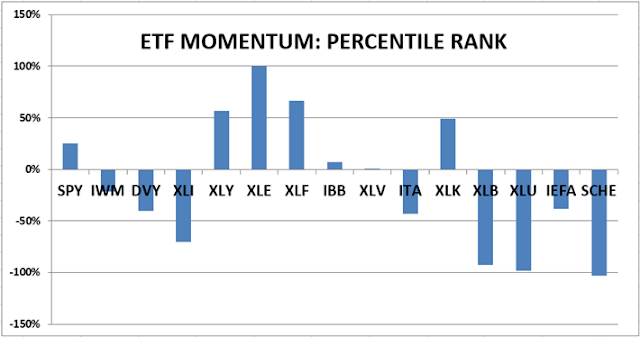

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

Market Internals declined to BEARISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now about 45% invested in stocks; this is below my “normal” fully

invested allocation of 50%.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.