“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

HOUSING STARTS / PERMITS (CNN.com)

“The number of housing starts fell for the second month

in a row in May, dropping 14.4% from April and 3.5% from the year before... Applications

to purchase new homes in May fell 4% from April, and 5% from a year ago,

according to the Mortgage Banker’s Association.” Story at...

https://www.cnn.com/2022/06/16/homes/us-housing-starts-new-home-building/index.html

JOBLESS CLAIMS (YahooFinance)

“Initial jobless claims ticked down last week, but were

higher than forecast, as investors monitor the labor market for potential signs

of a slowdown. First-time filings for unemployment insurance in the U.S.

totaled 229,000 for the week ended June 11...” Story at...

https://finance.yahoo.com/news/jobless-claims-june-16-2022-123826696.html

PHILADELPHIA FED INDEX (RTTnews)

“Manufacturing activity in the Philadelphia region saw a

modest contraction in the month of June, according to a report released by the

Federal Reserve Bank of Philadelphia on Thursday. The Philly Fed said its

current general activity index dropped to a negative 3.3 in June from a

positive 2.6 in May...” Story at...

https://www.rttnews.com/3291158/philly-fed-index-indicates-first-contraction-since-may-2020.aspx

IS $6 DOLLAR GASOLINE NEXT? (WSJ-Editorial Page)

“In a remarkable and threatening letter to oil and gas

CEOs this week, Mr. Biden seems stunned to learn that prices rise when supply

doesn’t meet demand...At least he’s finally noticed the dearth of refining

capacity to process crude, which some of us have warned about for years. The

U.S. has lost about one million barrels a day of refining capacity in the

pandemic...A major culprit is U.S. government policy. Some older refineries

have closed because companies couldn’t justify spending on upgrades as

government forces a shift from fossil fuels. They also have to account for the

Environmental Protection Agency’s tighter permitting requirements—the agency

recently challenged a permit for an Indiana refinery—and steeper biofuel

mandates...

...Chevron CEO

Mike Wirth said recently that refineries are shutting down or being repurposed

for renewable fuels because “the stated policy of the U.S. government is to

reduce demand for the products that refiners produce.” When companies are told

that demand for their product will become obsolete, it’s no surprise that they

don’t invest in supply.” WS

My cmt: How does an oil company finance a new billion-dollar

refinery? What bank would loan the money to build a facility that the Government

claims will be obsolete in 20 years?

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 fell about 3.3% to 3667.

-VIX rose about 11% to 29.62.

-The yield on the 10-year Treasury slipped to 3.289%

PULLBACK DATA:

-Drop from Top: 23.6% as of today. 23.6% max. (Avg.= 13%

for non-crash pullbacks)

-Days from Top to Bottom: 114-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

The S&P 500 is 17.1% BELOW its 200-dMA & 11.3%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes

a new-high; however, we hope to be able to call the bottom when we see it.

MY TRADING POSITIONS:

SH – I took a small position

in SH-ProShares Short S&P500. I’ll add to it if the markets go significantly

higher.

Carter Worth (CNBC contributor) predicted about a 10%

rally from today’s close based on the charts.

XLE - I took profits in XLE

today, but I admit that I held it too long and missed a bigger gain. Still,

better a gain than a loss.

TODAY’S COMMENT:

I wrote the following Wednesday night:

“So far, this week has produced the following data:

-The 30-year fixed rate mortgage was 6.3% yesterday. It was in the low 3’s earlier in the year. This

number will get worse and cause major problems for housing.

-Retail sales were down 3% in May.

-Auto sales plunged.

-NY Fed's Empire State Manufacturing Survey dropped to

-11.60 in May from 24.60 in April. A negative number signals worsening

conditions.

We can’t feel good about the future for the stock market.”

Looks like investors woke up today. Now, markets are pricing in a recession. Energy is falling because a recession will

cut demand (as will current high prices).

There was no follow-thru from yesterday’s buying. While

technical indicators are suggesting a bounce higher, it is not clear that we’ll

see much of a bounce. Markets can fall a

lot even though they are “oversold”. Still, my Bottom Indicator ensemble was +9

indicating there are 9 indicators calling for a bottom. The last time there was a number that high

was December 2018 at the bottom of a 20% correction. This isn’t a bottom, but

it may be signaling a bounce.

I added a small position in ProShares Short S&P500

(SH). It is a non-leveraged short position that I would feel comfortable

holding for a longer period. This is a trading position, but I am not net short

on the total portfolio. That just seems too risky now – the unknowns could

resolve to the bullish side – it may not seem likely now, but it will happen,

eventually. I’ll add more if we have a bounce.

As noted earlier, the charts are suggesting a final low

at least in the 3300-3500 range.

Just for kicks I looked up Apple’s PE from 3 years ago.

It was 15.6. Today, it’s PE is 21.2. Today’s PE is 36% higher than it was 3

years ago. Could Apple fall another 36%? It’s possible; that is not a

prediction – just an observation.

Today, the daily sum of 20 Indicators IMPROVED from -6 to

-1 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations dropped from +53 to +38. (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in

late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long

Term NTSM indicator improved to HOLD: SENTIMENT is bullish; PRICE is neutral;

VOLUME and VIX are bearish.

I’m a Bear, but I expect a bounce of some kind soon.

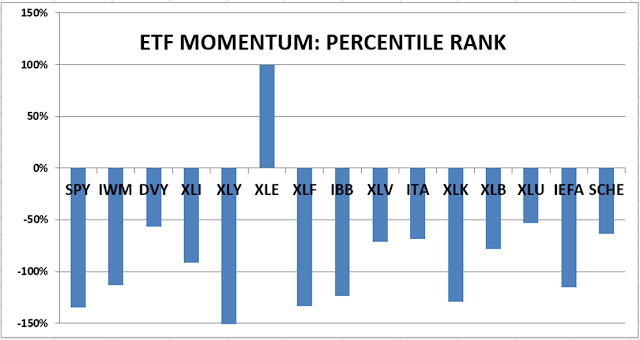

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained SELL.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now roughly 30% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.