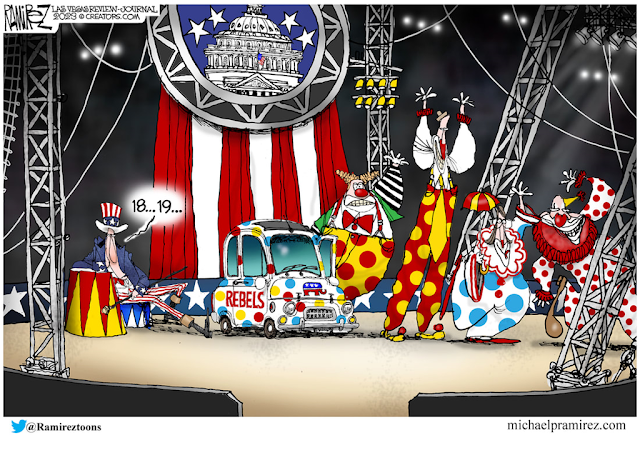

"The Clown Show continues in Congress." – Michael Ramirez.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

ADP EMPLOYMENT ADP (ADP)

“Private employers added 235,000 jobs in December.

Job resurgence was seen in the last two months of 2022 led by consumer-facing service industries. Hiring was strong across small and medium establishments while large establishments saw a drop in employment of 151,000 jobs.” Story at...

https://adpemploymentreport.com/

JOBLESS CLAIMS (CNN)

“Around 204,000 people applied for first-time unemployment benefits last week, according to the latest data from the Bureau of Labor Statistics. That’s down from the previous week’s total jobless claims and only slightly below the pre-pandemic weekly average of 218,000.” Story at...

https://www.cnn.com/2023/01/05/economy/weekly-jobless-claims-december-31/index.html

EIA CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.7 million barrels from the previous week. At 420.6 million barrels, U.S. crude oil inventories are about 4% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 fell about 1.2% to 3808.

-VIX rose about 2% to 22.46

-The yield on the 10-year Treasury rose to 3.719%.

PULLBACK DATA:

-Drop from Top: 20.6% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 253-days.

The S&P 500 is 4.8% BELOW its 200-dMA & 2.4% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

MY TRADING POSITIONS:

I am doing less trading now. You may do better watching the momentum charts rather than my moves.

XLK – Technology ETF. (The S&P 500 is not far from

its prior lows so I am holding this position, even though it is now a losing

one.)

TODAY’S COMMENT:

The Junk Bond spread is showing bullish divergence; My Money Trend indictor turned up; New-Hi/New-lo data is improving. Perhaps this downtrend will take a break? Let’s wait until tomorrow and see what the Friday summary of many of the NTSM indicators tells us.

The S&P 500 is about 5% above its October closing low

and the S&P 500 remains below its 50-dMA. I still think that the most

likely scenario will see the S&P 500 test its prior correction low.

The 50-dMA is the key for me; if the S&P 500 can

climb above its 50-dMA and remain for consecutive days, I’ll be adding to stock

holdings.

Today, the daily sum of 20 Indicators declined from +12

to +9 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations increased from +54 to 57. (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: VIX, VOLUME, PRICE & SENTIMENT are all neutral.

Bottom line: I’m a Bear at this point. I am defensively

positioned in the markets, but not drastically so. There was a successful test

and buy signal 27 September, so I need to be careful not to get too bearish.

Perhaps cautious is a better word than bearish.

I’m now have about 40% of the portfolio invested in

stocks. (As a retiree, 50% invested in stocks is my “normal” portfolio.) I was

75% invested in stocks in early December.

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 40% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. Last week’s Friday-run-down indicator

ensemble was bad enough to convince me to take a more conservative view of the

markets.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Private employers added 235,000 jobs in December.

Job resurgence was seen in the last two months of 2022 led by consumer-facing service industries. Hiring was strong across small and medium establishments while large establishments saw a drop in employment of 151,000 jobs.” Story at...

https://adpemploymentreport.com/

“Around 204,000 people applied for first-time unemployment benefits last week, according to the latest data from the Bureau of Labor Statistics. That’s down from the previous week’s total jobless claims and only slightly below the pre-pandemic weekly average of 218,000.” Story at...

https://www.cnn.com/2023/01/05/economy/weekly-jobless-claims-december-31/index.html

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.7 million barrels from the previous week. At 420.6 million barrels, U.S. crude oil inventories are about 4% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

-Thursday the S&P 500 fell about 1.2% to 3808.

-VIX rose about 2% to 22.46

-The yield on the 10-year Treasury rose to 3.719%.

-Drop from Top: 20.6% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 253-days.

The S&P 500 is 4.8% BELOW its 200-dMA & 2.4% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

I am doing less trading now. You may do better watching the momentum charts rather than my moves.

The Junk Bond spread is showing bullish divergence; My Money Trend indictor turned up; New-Hi/New-lo data is improving. Perhaps this downtrend will take a break? Let’s wait until tomorrow and see what the Friday summary of many of the NTSM indicators tells us.

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)