“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

FED BEIGE BOOK (fxstreet)

“According to Federal Reserve’s Beige Book, “economic

activity was little changed overall in April and early May”. The expectations

for future growth deteriorated a little, “though contacts still largely

expected a further expansion in activity...Prices rose moderately over

the reporting period, though the rate of increase slowed in many Districts.”

Story at...

https://www.fxstreet.com/news/feds-beige-book-economic-activity-was-little-changed-overall-in-april-and-early-may-202305311807

CHICAGO PMI (Advisor Perspectives)

“The latest Chicago Purchasing Manager's Index (Chicago Business

Barometer) regressed to 40.4 in May from 48.6 in April. This is the ninth

straight month in contraction territory. This reading comes in below the

forecast of 47.0.”

Chart and commentary at...

https://www.advisorperspectives.com/dshort/updates/2023/05/31/chicago-pmi-regresses-to-six-month-low?topic=covid-19-coronavirus-coverage

JOLTS – JOB OPENINGS (YahooFinance)

The latest Job Opening and Labor Turnover Survey, or

JOLTs report, released Wednesday revealed 10.1 million job openings at

the end of April, an increase from the 9.8 million in job openings reported in

March... Oxford Economics wrote in a note on Wednesday. "While

there are some concerns over the veracity of the JOLTS survey due to

historically low response rates, the upshot remains that labor market strength

remains robust.” Story at...

https://finance.yahoo.com/news/job-openings-show-surprise-increase-in-april-142039924.html

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 dipped about 0.6% to 4180.

-VIX rose about 3% to 17.94.

-The yield on the 10-year Treasury slipped to 3.647%.

PULLBACK DATA:

-Drop from Top: 12.9%. 25.4% max (on a closing basis).

-Trading Days since Top: 353-days.

The S&P 500 is 5.1% ABOVE its 200-dMA and 1.7%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE tested its March low on 16

May on lower volume so I continue to hold it.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May.

SHY – Short term bonds. 30-day yield is 4%. (Trailing

1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

Utilities/S&P 500 spread over the longer term is

still bullish, however, today utilities outperformed the S&P 500 by a lot. It’s

a trend to watch, but it is not telling us much now.

The S&P 500 has been drifting down and is now only

1.7% above its 50-dMA. I’ll get worried

if it breaks below it.

Today, (Wednesday) unchanged volume was very high. As I’ve

often said, many believe that this indicator suggests investor confusion at

market turning points. The S&P 500 has been trending higher for about 2

months, but not very strongly. It hasn’t gone anywhere in the last month, so it’s

hard to determine the current trend. With the Debt Ceiling Debacle ongoing, it

may just be indicating investor confusion. The Long Term NTSM ensemble remains

hold and the most recent Friday summary of indicators was 13 Bull to 7 Bear,

suggesting that the appropriate action at this point is to wait and see.

The daily spread of 20 Indicators (Bulls minus Bears) improved

from -6 to -3 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -18 to -21.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a Bull.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked

Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

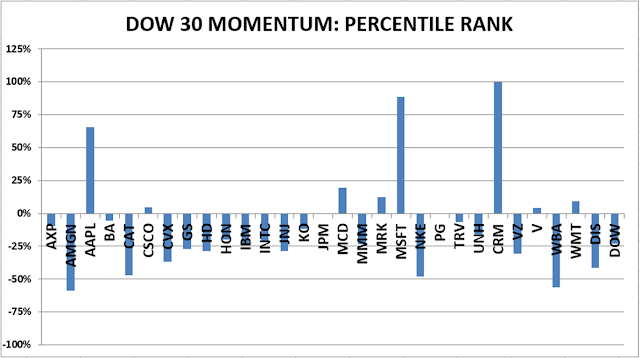

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained HOLD. (Market Internals are a

decent trend-following analysis of current market action, but should not be

used alone for short term trading. They are most useful when they diverge from

the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

THE PHONY DEBT CEILING CALAMITY (WSJ)

“With the U.S. Treasury predicted to run out of cash (the

“X date”) as early as June 1, Treasury Secretary Janet Yellen has

started warning of an “economic calamity” if Congress doesn’t raise the

statutory debt limit...These claims are dangerously misleading.

Hitting the X date won’t cause a default on the national

debt. Debt-service payments have a feature that most other government payments

lack: When the government pays off maturing debt, the amount of debt subject to

the statutory limit declines. This means that the government can “roll over”

such obligations—that is, issue new debt to pay off old debt—without violating

the debt limit.

...It is a matter of public record that the Treasury made

such a plan during a 2011 showdown over the debt limit, when one official

explained that “the principal on Treasury securities that are maturing would be

funded by having auctions that would roll over those maturing securities into

new issues, so the new issues would be able to fund the redemption of the

maturing securities.”

For a similar reason, hitting the X date need not stop

Social Security and other payments that come from federal trust funds....

...The X date still presents uncertainty, and we don’t

want to appear pollyannaish. But...it may well be that hitting the X date—and a

short lapse in the government’s ability to raise revenue—looks like a temporary

government shutdown that follows an appropriations lapse.” - Conor J. Clarke and Kristin A. Shapiro. Mr. Clarke is an incoming

associate professor at the Washington University in St. Louis School of Law.

Ms. Shapiro practices appellate and constitutional law in Washington and is a

senior fellow at the Independent Women’s Forum.

FULL Commentary at...

https://www.wsj.com/articles/the-phony-debt-ceiling-calamity-x-date-default-social-security-roll-over-treasury-ac939d83

My cmt: When I began working in Government, the permits

program was included in the same appropriation as Operation & Maintenance

of civil works facilities such as dams, locks, or bridges. When there was a

threat of appropriation shortfall, my boss would direct that we cut the Permits

Program so the public would be impacted and would harass Congress to increase

funding. But there were plenty of cuts that could have been made with no impact

to the public. For example, we could

have deferred some maintenance on various projects. The same BS is going on now. If the debt

ceiling isn’t raised, spending on discretionary projects could be delayed, such

as the Infrastructure Bill (among others), so that Social Security and other

non-discretionary expenditures would continue until a debt ceiling agreement

could be reached. But cutting Social Security scares people, so that’s all we

hear about.

CONSUMER CONFIDENCE (Conference Board)

“Consumer confidence declined in May as consumers’ view

of current conditions became somewhat less upbeat while their expectations

remained gloomy... While consumer confidence has fallen across all age and

income categories over the past three months, May’s decline reflects a

particularly notable worsening in the outlook among consumers over 55 years of

age.” Report at...

https://www.conference-board.org/topics/consumer-confidence/press/CCI-May-2023

PE RATIOS FOR THE S&P 500 (multpl.com)

“Current S&P 500 PE

Ratio: 24.34 +0.31 (1.30%)

4:00

PM EDT, Fri May 26

|

Mean:

|

16.01

|

|

|

Median:

|

14.93

|

|

|

Min:

|

5.31

|

(Dec 1917)

|

|

Max:

|

123.73

|

(May 2009)

|

Price to earnings ratio, based on trailing twelve month

“as reported” earnings.”

Chart from...

https://www.multpl.com/s-p-500-pe-ratio

My cmt: We keep hearing Pundits suggest that high PEs

will derail the current rally, but PEs were much higher before the 2000 dot.com

crash - around 34. (The extreme highs in the above chart were during recessions

when earnings fell faster than prices.) It seems to me that PEs can go much

higher than they are now. There are more

investors chasing fewer stocks. I don’t remember much from Econ I, but when

demand is strong and supply is low, prices go up.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 was little changed at 4206.

-VIX slipped about 3% to 17.48.

-The yield on the 10-year Treasury slipped to 3.703%.

PULLBACK DATA:

-Drop from Top: 12.3%. 25.4% max (on a closing basis).

-Trading Days since Top: 352-days.

The S&P 500 is 5.8% ABOVE its 200-dMA and 2.4%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE tested its March low on 16

May on lower volume so I continue to hold it.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May.

SHY – Short term bonds. 30-day yield is 4%. (Trailing

1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

Breadth continues to be stubbornly weak. The 10-dMA of the % of issues advancing on

the NYSE remains below 50% and today it dropped to 47.2%. The good news is

that, so far, both the 50-day and 100-day moving averages remain above

50%. 50% is an important benchmark because,

if the moving average drops below 50%, it means that less than half of all

issues have gone up over the time frame of the moving average. Stated more

simply, over the last 2 weeks most issues have gone down.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -3 to -6 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -14 to -18.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a Bull.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

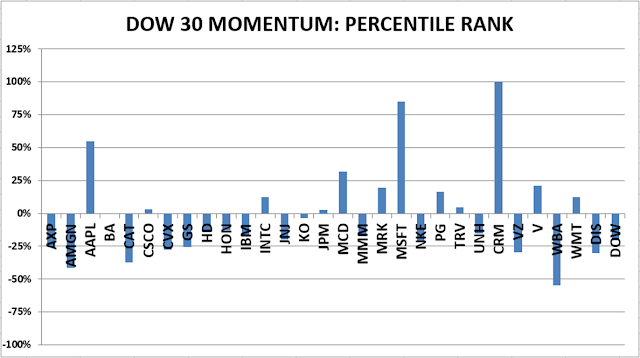

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals

remained HOLD. (Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

CONSUMER SPENDING (Seeking Alpha)

“Consumers increased their spending in April, by 0.8% from

March, double the +0.4% expected and strengthening from the 0.1% increase in

March... Real consumer spending, which is adjusted for inflation, increased

0.5% in April, up from 0.0% in March. That "resilient rebound" is

"another sign that the economy

refuses to go gently into that good night," Joseph Brusuelas, RSM US chief

economist, said via tweet.”

Story at...

https://seekingalpha.com/news/3975401-personal-spending-jumps-in-april-pce-inflation-ticks-up-from-march

PCE PRICES (Morningstar)

“The increase in the personal consumption expenditures

index was a tick higher than the Wall Street forecast. The PCE index is the

Federal Reserve's preferred inflation barometer. The yearly increase in prices

rose to 4.4% from 4.2% in the prior month...the core PCE index, which omits

food and energy, suggests the progress in reducing inflation may have stalled.

It also rose 0.4% last month.” Story at...

https://www.morningstar.com/news/marketwatch/20230526358/us-prices-rise-sharply-pce-shows-in-sign-fight-vs-inflation-has-stalled

DURABLE ORDERS (Morningstar)

“Orders for U.S. manufactured goods jumped 1.1% in April

largely because of the military, but business investment also rose sharply in a

positive sign for the economy.” Story at...

https://www.morningstar.com/news/marketwatch/20230526423/durable-goods-orders-get-a-boost-from-military-spending

UNIV OF MICHIGAN SENTIMENT – FINAL (Univ of Michigan)

“Consumer sentiment slid 7% amid worries about the path

of the economy, erasing nearly half of the gains achieved after the all-time

historic low from last June. This decline mirrors the 2011 debt ceiling crisis,

during which sentiment also plunged. This month, sentiment fell severely for

consumers in the West and those with middle incomes. The year-ahead economic

outlook plummeted 17% from last month. Long-run expectations plunged by 13% as

well, indicating that consumers are concerned that any recession to come may

cause lasting pain.” Story at...

http://www.sca.isr.umich.edu/

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 1.3% to 4205.

-VIX slipped about 6% to 17.95.

-The yield on the 10-year Treasury slipped to 3.806%.

PULLBACK DATA:

-Drop from Top: 12.3%. 25.4% max (on a closing basis).

-Trading Days since Top: 351-days.

The S&P 500 is 5.8% ABOVE its 200-dMA and 2.6%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft. Current PE 36.1 Historic PE:

Chart from...

https://www.macrotrends.net/stocks/charts/MSFT/microsoft/pe-ratio

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE tested its March low on 16

May on lower volume so I continue to hold it.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May.

SHY – Short term bonds. 30-day yield is 4%. (Trailing

1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

Here’s my weekly review of indicators:

The weekly rundown of indicators slipped more to the bear

side, but remained bullish overall (now 7-bear and 13-bull). (These indicators

tend to be both long-term and short-term, so they are different than the 20

that I report on daily.)

BULL SIGNS

-The smoothed advancing volume on the NYSE is rising.

-The 50-dMA percentage of issues advancing on the NYSE

(Breadth) is above 50%.

-The 100-dMA percentage of issues advancing on

the NYSE (Breadth) is above 50%.

-MACD of the percentage of issues advancing on the NYSE

(breadth) made a bullish crossover 19 May.

-Smoothed Buying Pressure minus Selling Pressure is rising.

-MACD of S&P 500 price made a bullish crossover 26

May.

-Short-term new-high/new-low data.

-The graph of the 100-day Count (the 100-day sum of

up-days) is moving higher.

-On average, the size of up-moves has been larger than

the size of down-moves over the last month.

-The 5-10-20 Timer System is BUY.

-The 5-day EMA is above the 10-day EMA so short-term

momentum is bullish.

-S&P 500 spread vs. Utilities (XLU-ETF).

-Slope of the 40-dMA of New-highs is rising but not by

much.

NEUTRAL

-There was a Distribution Day 23 May. – Neutral.

-There have been 3 Statistically-Significant days (big

moves in price-volume) in the last 15-days.

-Sentiment.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth)

has not been below 50%, for more than 3 days in a row.

-Overbought/Oversold Index (Advance/Decline Ratio).

-Bollinger Band Squeeze 28 April - expired.

-The long-term, 50-dEMA, Fosback Hi-Low Logic Index is

neutral.

-The short-term, 10-day EMA, Fosback Hi-Low Logic Index

is neutral.

-There have been 6 up-days over the last 10 sessions – neutral.

-There have been 9 up-days over the last 20 sessions -

neutral.

-RSI

-VIX indicator.

-There was a 90% down-volume day 9 March.

-There was a Hindenburg Omen signal 3 May 2023. The

McClellan Oscillator turned positive 18 May. – Expired.

-The S&P 500 is 5.8% above its 200-dMA. (Bear

indicator is 12% above the 200-day.)

-There was a Zweig Breadth Thrust 31 March. That’s a

rare, very-bullish sign, but the McClellan Oscillator turned negative, so this

indicator has expired.

-The Calm-before-the-Storm/Panic Indicator flashed a

panic-buying signal 10 November - expired.

-2.8% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is

no bullish signal for this indicator.) This indicated that the advance was too

narrow and a correction was likely to be >10%. It proved correct, but is now

Expired.

-10 May there was a Bullish Outside Reversal Day –

Expired.

-47% of the 15-ETFs that I track have been up over the

last 10-days.

BEAR SIGNS

-The 10-dMA percentage of issues advancing on

the NYSE (Breadth) is below 50%.

-Issues advancing on the NYSE (Breadth) compared to the

S&P 500. The Index is too far ahead of Breadth.

-My Money Trend indicator is falling.

-Long-term new-high/new-low data.

-McClellan Oscillator.

-The Smart Money (late-day action) is pointing down.

-XLI-ETF (Cyclical Industrials) is underperforming the

S&P 500.

On Friday, 21 February, 2 days after the top before the

Coronavirus pullback, there were 10 bear-signs and 1 bull-sign. Now there

are 7 bear-signs and 13-Bull. Last week, there were 6 bear-sign and 18

bull-signs.

The daily spread of 20 Indicators (Bulls minus Bears) improved

from -10 to -3 (a positive number is bullish; negatives are bearish); the

10-day smoothed sum that smooths the daily fluctuations declined from -11

to -14. (The trend direction is more important than the actual number for the

10-day value.) These numbers sometimes change after I post the blog based on

data that comes in late. Most of these 20 indicators are short-term so they

tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved market

internals on the retest), although without market follow-thru, I was unwilling

to call a buy; however, I did close shorts and increased stock holdings. I

issued a Buy-Signal on 4 October, 6-days before the final bottom, based on

stronger market action that confirmed the market internals signal. The NTSM

sell-signal was issued 20 December, 8 sessions before the high of this recent

bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a Bull.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to HOLD. (Market Internals are a

decent trend-following analysis of current market action, but should not be

used alone for short term trading. They are most useful when they diverge from

the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Under the current approach to journalism, it is the New

York Times that receives a Pulitzer for a now debunked Russian collusion story

rather than the New York Post for a now proven Hunter Biden laptop story.” –

Jonathan Turley, Shapiro Chair for Public Interest Law at The George

Washington University Law School, where he teaches torts, criminal procedure, and constitutional law. Commentary

at...

https://jonathanturley.org/

JOBLESS CLAIMS (YahooFinance)

“The number of Americans filing new claims for

unemployment benefits rose moderately last week and the prior week's data was

revised sharply lower, suggesting persistent labor market strength. Initial

claims for state unemployment benefits increased 4,000 to a seasonally adjusted

229,000 for the week ended May 20...” Story at...

https://finance.yahoo.com/news/u-weekly-jobless-claims-rise-124306917.html

GDP – 2ND EST (The Hill)

“First-quarter gross domestic product (GDP) was revised

up on Thursday as the long-predicted recession following the blistering

economic recovery from the pandemic once again failed to hit the U.S. economy. GDP

was corrected up 0.2 percentage points to a gain of 1.3 percent in the first

quarter...” Story at...

https://thehill.com/homenews/4020869-first-quarter-gdp-revised-up-as-corporate-profits-give-way-to-labor-share/

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.9% to 4151.

-VIX slipped about .9% to 19.14.

-The yield on the 10-year Treasury rose to 3.822%.

PULLBACK DATA:

-Drop from Top: 13.5%. 25.4% max (on a closing basis).

-Trading Days since Top: 350-days.

The S&P 500 is 4.4% ABOVE its 200-dMA and 1.4%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE tested its March low on 16

May on lower volume so I continue to hold it.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May.

SHY – Short term bonds. 30-day yield is 4%. (Trailing

1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

The 200-day moving average of the S&P 50 turned down yesterday

and reversed upward today. I don’t think this is a particularly telling indicator.

I’d be more concerned if the S&P 500 fell below its 200-dMA.

The S&P 500 is still too far ahead of issues trading

on the NYSE, suggesting that the Index may experience some continued weakness.

I would not be surprised to see the index dip to around the 4000 level, but I

doubt that we’ll see much of a drop,

barring unforeseen bad news.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -9 to -11 (a positive number is bullish; negatives are bearish); the

10-day smoothed sum that smooths the daily fluctuations declined from -2

to -11. (The trend direction is more important than the actual number for the

10-day value.) These numbers sometimes change after I post the blog based on

data that comes in late. Most of these 20 indicators are short-term so they

tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a Bull.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained SELL. (Market Internals are a

decent trend-following analysis of current market action, but should not be

used alone for short term trading. They are most useful when they diverge from

the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Despite impressive

efforts at spinning the findings by the media, the Durham

Report highlighted two scandals. First, there was a comprehensive effort of the

political and media establishments to perpetrate one of the great hoaxes in

history — a political hit job that ultimately derailed an American presidency.

Second, there was no real accountability for that effort for the main players

from Clinton to Comey to Congress. It was much like The Murder on the Orient

Express. The question is not “whodunit” but who didn’t do it.

Spoiler alert: they all did it so no one was punished.” – Jonathan Turley, Shapiro

Chair for Public Interest Law at The George

Washington University Law School, where he teaches torts, criminal procedure, and constitutional law. Commentary at...

https://jonathanturley.org/

FOMC (FED) MINUTES (Benzinga)

"The minutes of the May 2-3 FOMC meeting revealed

uncertainty about how much more policy tightening may be appropriate,

with some FOMC participants warning that a

failure to raise the federal debt limit in a timely manner will

threaten significant financial system disruptions and lead to tighter financial conditions... The economic forecast prepared

by the staff for the May FOMC meeting forecasted a mild recession starting

later this year, followed by a modestly paced recovery.” Story at...

https://www.benzinga.com/economics/macro-economic-events/23/05/32555812/fed-may-not-be-done-hiking-interest-rates-missing-the-debt-ceiling-deadline-will-

CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 12.5 million barrels from the

previous week. At 455.2 million barrels, U.S. crude oil inventories are 3%

below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 fell about 0.7% to 4115.

-VIX rose about 9% to 20.12.

-The yield on the 10-year Treasury rose to 3.750%.

PULLBACK DATA:

-Drop from Top: 14.2%. 25.4% max (on a closing basis).

-Trading Days since Top: 348-days.

The S&P 500 is 3.5% ABOVE its 200-dMA and 0.6%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE tested its March low on 16

May on lower volume so I continue to hold it.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May.

SHY – Short term bonds. 30-day yield is 4%. (Trailing

1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

The S&P 500 is now only 0.6% above its 50-dMA. It

looks like the 50-dMA may not hold, just based on my guess.

The next line of support may be the lower trend line. There’s

always some guess work in drawing trend lines – it all depends on the scales

used in the charts. The current Lower, trend line looks like it is around 4000.

That’s about 2.5% below where the S&P 500 closed Wednesday. That’s where this dip may settle if the Index

doesn’t hold the 50-dMA. That is roughly half way between the 100-dMA and the

200-dMA.

200-day moving average of the S&P 50 turned down

today. It had been rising since 30 March 2023.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -4 to -9 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from +13 to -2.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a Bull.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals declined to SELL. (Market Internals are a

decent trend-following analysis of current market action, but should not be

used alone for short term trading. They are most useful when they diverge from

the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

IHS MARKIT COMPOSITE PMI (S&P Global US Composite

PMI)

“Companies in the US registered a solid upturn in

business activity during May, according to the latest ‘flash’ PMI™ data from

S&P Global. Overall growth in output was the fastest for just over a year.

The expansion was led by service providers, however, as manufacturers recorded

only a slight rise in production. The headline S&P Global Flash US PMI

Composite Output Index registered 54.5 in May, up from 53.4 in April, to signal

a solid and faster expansion in private sector business activity. The rise in

output was the sharpest since April 2022, but led by service providers, who

reported stronger demand conditions. Although manufacturers registered growth

in production, it was only marginal and slowed from the previous survey

period.” Report at...

https://www.pmi.spglobal.com/Public/Home/PressRelease/fb16b048c1ca4d659e136ae0c52faaa2

My cmt: What recession? It’s not in this report.

TALKING DEBT CEILING (Heritage Capital)

“While everyone knows the debt ceiling will be raised

this time as it has all previous times, it is one of the few times where the

opposition party has some power. Although these types of negotiations belong in

the budget process, the party in power never seems to want the minority to

engage at that point because a simple majority wins that vote. It is painful to

watch, but it’s still the best system around. Democrats point to three

straight, clean debt ceiling increases under Donald Trump. Republicans counter

that Joe Biden and Chuck Schumer are both on record as demanding negotiations

and compromise when they were Senators from the minority party...worst case, I

can see a BREXIT type decline, 4-6% in short, sharp fashion. If that occurs,

buy it with both hands.” Commentary at...

https://investfortomorrow.com/blog/still-talking-debt-ceiling-but-pga-was-the-story/

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 fell about 1.1% to 4146.

-VIX rose about 8% to 18.53.

-The yield on the 10-year Treasury dipped slightly to 3.701%.

PULLBACK DATA:

-Drop from Top: 13.6%. 25.4% max (on a closing basis).

-Trading Days since Top: 348-days.

The S&P 500 is 4.3% ABOVE its 200-dMA and 1.5%

ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to

use the momentum charts and/or the Monday 40-day gain charts for trading the

Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE

tested its March low on 16 May on lower volume so I continue to hold it. XLE is

up about 4% since then.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May. It’s up about 10% since then.

SHY – Short term bonds. 30-day yield is 4%. (Trailing

1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

Listen to the Pundits on CNBC and you would be sure that

high PEs will derail the current rally.

PEs are nowhere near extremes we saw in 2000 before the dot.com

crash. Now, there are more investors

chasing fewer stocks so PEs can go much higher than seems reasonable. I don’t

think we are in a bubble yet.

Divergences mentioned during the CNBC Halftime Report are

more troubling. Only certain sectors

have been pulling this market along and breadth has been weak, according to the

pundits. I’ve mentioned one sign of divergence over the last couple of days; issues

advancing on the NYSE (Breadth) vs. the S&P 500 is still leaning bearish.

Currently, the S&P 500 is advancing too far ahead of other issues on the

NYSE. That’s a concern, but Breadth has been improving.

The 50-dMA of issues advancing on the NYSE improved and

has now risen above 50%. The 10-dMA of issues advancing on the NYSE was 53% 3

days ago although it has dipped to 49.6% today.

The point here is that overall breadth has been improving. Small caps

(Russel 2000) have outperformed other issues over the last few days.

I don’t see any reason why markets can’t go higher, other

than Debt Ceiling angst; we just have to wait and see where that mess is

going.

Today was a statistically significant down-day. That just

means that the price-volume move exceeded my statistical parameters. Statistics

show that a statistically-significant, down-day is followed by an up-day about

60% of the time.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -1 to -4 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from +21 to +13.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator declined

to HOLD: PRICE is positive; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a Bull. I would add to stock

holdings, except that I am concerned about the Debt Ceiling negotiations. They

haven’t bothered the markets yet. That

may change as the deadline approaches.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (Market Internals are a

decent trend-following analysis of current market action, but should not be

used alone for short term trading. They are most useful when they diverge from

the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.