“For the year to date, starts are running 6.2% higher

than the same period in 2017…Construction on new houses increased by less than

1% in July, reflecting a recent slowdown in building that’s likely tied to

higher mortgage rates and growing shortages of skilled craftsmen.” Story at…

JOBLESS CLAIMS (Reuters)

“The number of Americans filing for unemployment benefits

fell for a second straight week last week, suggesting no impact yet on the

labor market from ongoing trade tensions between the United States and its

trading partners. Initial claims for state unemployment benefits slipped 2,000

to a seasonally adjusted 212,000 for the week ended Aug. 11…” Story at…

PHILADELPHIA FED (MarketWatch)

“The Philadelphia Fed manufacturing index sank to 11.9 in

August from 25.7 in July, the lowest reading in 21 months, the regional district of the central bank said Thursday.”

Story at…

My cmt: A number above zero indicates expansion; it’s

just at a much slower rate than last month.

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 was up about 0.8% to 2840.

-VIX dropped about 8% to 13.45.

-The yield on the 10-year Treasury rose to 2.868% as of

this post.

Bollinger Bands are exhibiting a “Squeeze” today (top and

bottom bands are close together) suggesting a breakout (up or down) is coming.

RSI is neutral and indicators seem generally mixed. We had a squeeze on 3

August and also early June that led nowhere. Before that we had a squeeze in

late June of 2017. That too, was inconsequential.

The S&P 500 has been trying to break above the January

2017 high and has failed so far. In addition, a series of big up and down moves

(like we have seen recently) can indicate a top so I have been mildly concerned

this week.

Thursday was a statistically-significant, up-day. That

just means that the price-volume move up exceeded statistical parameters that I

track. The stats show that about 60% of the time a statistically significant

move up will be followed by a down-day the next day. As noted, this sort of

back and forth action can indicate a top, so today’s big day up is not

necessarily good news.

Indicators are mixed, so unless we see signs of market

deterioration there is no move to make now.

Currently, my daily sum of 17 Indicators improved from -7

to -3 (a minus number is bearish) while the 10-day smoothed version that

negates the daily fluctuations improved from -32 to -30. That’s not much change,

but at least the indicators have turned around and are now headed up. We’ll have to see if the trend continues.

I remain fully invested.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then

ranked based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the

4-months from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

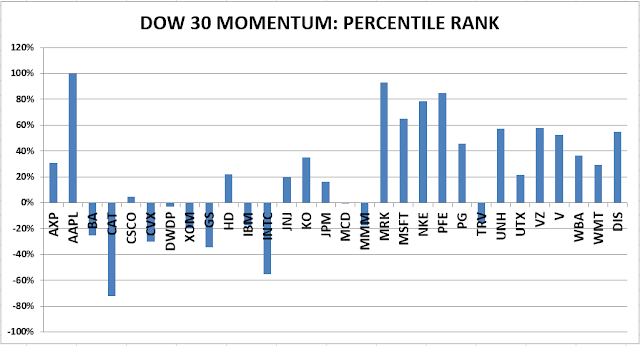

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

THURSDAY MARKET INTERNALS (NYSE DATA)

Market Internals improved

to NEUTRAL on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

I am now 50% invested in stocks. For me, fully invested

is a balanced 50% stock portfolio. As a retiree, this is a position with which

I am comfortable unless I am in full defense mode or feeling especially

optimistic.

INTERMEDIATE / LONG-TERM INDICATOR

Intermediate/Long-Term

Indicator: Thursday, the Price indicator was positive; Volume, VIX &

Sentiment indicators were neutral. Overall this is a NEUTRAL indication.