FED MINUTES (MarketWatch)

“The Federal Reserve’s decision in March to cease raising

interest rates this year was driven by unease over the U.S. and global

economies and surprisingly subdued inflation, according to minutes of the

pivotal central bank meeting.” Story at…

CPI (Bloomberg)

“A key measure of U.S. inflation rose less than forecast

in March…The core consumer price index, which excludes food and energy, rose

0.1 percent from the prior month, and 2 percent from a year earlier…while the

broader CPI climbed 0.4 percent...” Story at…

CRUDE INVENTORIES (oilprice.com)

“Crude oil prices brushed off the Energy Information

Administration inventory report today,

which saw a 7-million-barrel build in crude oil inventories for the week to

April 5.” Story at…

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 rose about 0.4% to 2888.

-VIX dropped about 7% to 13.3.

-The yield on the 10-year Treasury slipped to 2.468%.

We still have the problem of too many positive days. Markets don’t go up forever. As of today, 9 of the last 10 day have been

up-days. Over the last month 13-days have been up days; the monthly number is not bad, so this isn't a disaster for the bulls. Overall though, this indicator is

mildly bearish and we might expect a few down days in response.

Volume continues to be low…still. Wednesday, it was again about 15% below the

monthly average. We still have to wonder if buyers went on strike, but it may

just represent caution by investors. We

are nearing the old S&P 500 all-time high and Earnings Season is about to

get underway.

My daily sum of 20 Indicators improved from -3 to +3 (a

positive number is bullish; negatives are bearish) while the 10-day smoothed

version that negates the daily fluctuations climbed from +39 to +43. Most of

these indicators are short-term.

I’ll just watch a bit longer and see what the markets are

doing. I still am looking for a couple of down days. Earnings season may send

tell me what to do investment wise. I am

bullish now, but still looking for a better entry point.

TOP / BOTTOM INDICATOR SCALE OF 1 TO 10

Today’s Reading: Zero (Solidly Neutral.)

Most Recent Day with a value other than Zero: 21 March

2019 value = -1

(1) +10 Max Bullish / -10 Max Bearish)

(2) -4 or below is a Sell sign. +4 or better is a Buy

Sign.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF

15 ETFs (Ranked Daily)

The top ranked ETF receives 100%. The rest are then ranked

based on their momentum relative to the leading ETF. While momentum isn’t stock performance per

se, momentum is closely related to stock performance. For example, over the

4-months from Oct thru mid-February 2016, the number 1 ranked Financials (XLF)

outperformed the S&P 500 by nearly 20%. In 2017 Technology (XLK) was ranked

in the top 3 Momentum Plays for 52% of all trading days in 2017 (if I counted

correctly.) XLK was up 35% on the year while the S&P 500 was up 18%.

*For additional background on the ETF ranking system see

NTSM Page at…

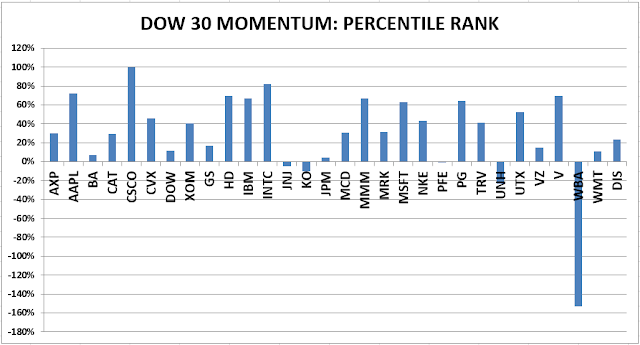

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

*I rank the Dow 30 similarly to the ETF ranking system.

For more details, see NTSM Page at…

WEDNESDAY MARKET INTERNALS (NYSE DATA)

Market Internals remained

to NEUTRAL on the market.

Market Internals are a decent trend-following analysis of

current market action but should not be used alone for short term trading. They

are usually right, but they are often late.

They are most useful when they diverge from the Index. In 2014, using these internals alone would

have made a 9% return vs. 13% for the S&P 500 (in on Positive, out on

Negative – no shorting).

My current stock allocation is about 30% invested in

stocks as of 9 January 2019.

INTERMEDIATE / LONG-TERM INDICATOR

Wednesday, the VOLUME

indicator was positive. The VIX, PRICE and SENTIMENT indicators were neutral.

Overall this is a NEUTRAL indication.