“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“Policymakers ‘reaffirmed their strong commitment’ to returning inflation to the Fed's 2% goal, with many officials stressing the need to stay the course even as labor market slows...Consensus was to “purposefully’ move to restrictive stance in the near term, though several officials saw it as ‘important to calibrate” the pace of tightening to minimize harm to the economy.” Story at...

https://finance.yahoo.com/news/key-takeaways-minutes-feds-september-180001745.html

“The producer price index, a measure of prices that U.S. businesses get for the goods and services they produce, increased 0.4% for the month, compared with the Dow Jones estimate for a 0.2% gain. On a 12-month basis, PPI rose 8.5%, which was a slight deceleration from the 8.7% in August...“Inflationary momentum has built up in the U.S. economy and will persist near-term, keeping the Fed hiking aggressively,” said Bill Adams, chief economist for Comerica Bank.” Story at...

https://www.cnbc.com/2022/10/12/producer-price-index-september-2022.html

My cmt: Markets dipped on the news, but didn’t fall into negative territory. That’s somewhat bullish, but now investors are waiting for the CPI news to be released tomorrow at 8:30 am.

“...nothing has changed in my thesis that the markets are going to find a meaningful, if not major, low in Q4 with an eye towards October. Recall that incredible bottoms were seen in midterm election years of 2018, 2010, 2002, 1998, 1994, 1990, 1982 and 1974 with most being in Q4 and the majority in October. The news is dreadful. It’s a constant barrage of bad news. But remember, real bottoms are only made in the face of a very negative backdrop. You don’t see unicorns and rainbows at lows. And the 2-Year Note absolutely must roll over to the downside. It has remained stubbornly high. This is as key as anything else to watch right now.” - Paul Schatz. Commentary at...

https://investfortomorrow.com/blog/barrage-of-bad-news-looking-for-volatility-to-spike/

-Wednesday the S&P 500 fell about 0.3% to 3577 (a new correction low).

-VIX bucked trend and dipped about 0.2% to 33.57.

-The yield on the 10-year Treasury slipped to 3.907%.

-Drop from Top: 25.4% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 195-days.

The S&P 500 is 14.3% Below its 200-dMA & 9.5% Below its 50-dMA.

Support is around 3585, the low of 5 October 2020.

CVX – (I may hold this as a long-term position. I already owned a small position in CVX.)

SPY – S&P 500 (I may hold this as a long-term position.)

IWM - Russell 2000. (I may hold this as a long-term position.)

Volume was down today again vs. the 30 Sept low suggesting selling continues to slow. As noted for other recent tests, internals weren’t as good as we might have liked, but they were still much improved relative to the June lows. This continues to support the position that the best move now is to “buy-the-dip.”

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

#1. XLE #2. IBB #3. ITA

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

#1. AMGN #2. CVX #3. UNH

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

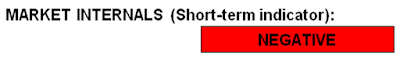

My basket of Market Internals declined to SELL.

(Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)