The Conference Board Consumer Confidence Index decreased in February for the second consecutive month. The Index now stands at 102.9 (1985=100), down from 106.0 in January (a downward revision)...Consumer confidence declined again in February. The decrease reflected large drops in confidence for households aged 35 to 54 and for households earning $35,000 or more...And, while 12-month inflation expectations improved—falling to 6.3 percent from 6.7 percent last month—consumers may be showing early signs of pulling back spending in the face of high prices and rising interest rates.” Report at...

https://www.conference-board.org/topics/consumer-confidence/press/CCI-Feb-2023

“The report indicated that Chicago PMI declined from 44.3 in January to 43.6 in February, compared to analyst consensus of 45. Chicago PMI is declining for the second month in a row.” Story at...

https://www.fxempire.com/news/article/cb-consumer-confidence-misses-expectations-sp-500-remains-under-pressure-1296969

“According to Shapiro’s work [at the San Francisco Federal Reserve Bank], inflation for components categorized as supply-driven for the month of December amounted to 2.3% and for demand components 1.7%. Components that are not clearly affected by either supply or demand are categorized as ambiguous and given their own inflation number... “I think what the series is actually most beneficial at is it helps tell the story of how the supply and demand shocks have evolved over the pandemic and that it’s not just one or the other,” Shapiro said.” Story at...

Confused about what’s causing inflation? This metric shows what’s driving the price rise. (msn.com)

My cmt: The Fed can slow demand by raising rates and slowing the economy; but the above chart shows that a lot of the inflation is supply driven. I don’t see how the Fed can increase supply.

-Tuesday the S&P 500 dropped about 0.3% to 3970.

-VIX dipped about 1% to 20.69.

-The yield on the 10-year Treasury was little changed at 3.924%.

-Drop from Top: 17.2% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 289-days.

The S&P 500 is 0.8% ABOVE its 200-dMA & 0.2% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

QLD – 2xNasdaq 100 (added today)

XLK – Technology ETF.

XLE – Energy Sector ETF. It hasn’t been doing much recently, but Russia is cutting production and that should help the sector. We have a good dividend in the meantime.

BA – (Boeing) I am late on this one, but we’ll see.

XLY - Consumer Discretionary ETF.

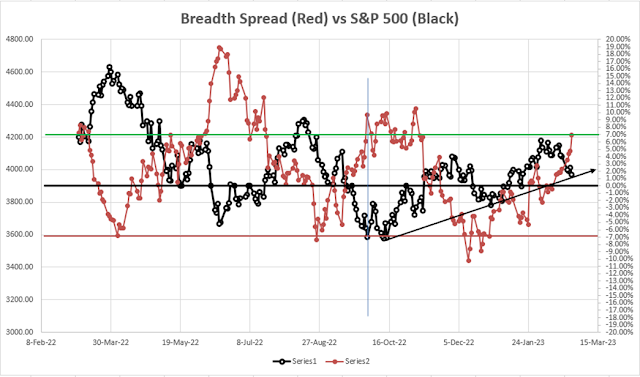

Is the rally running on empty? Internals were very good all day while the S&P 500 price fluctuated. In the end, internals were leaning negative and the Index went down.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals declined to SELL. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)