“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The Biden Administration’s regulations are coming so fast and furious that it’s hard even to keep track, but we’re trying. On Thursday the Environmental Protection Agency proposed its latest doozy—rules that will effectively force coal plants to shut down while banning new natural-gas plants.... EPA is also replacing the Obama Clean Power Plan that the Supreme Court struck down with a rule requiring that coal plants and new gas-fired plants adopt costly and unproven carbon-capture technology by 2032... carbon capture uses 20% to 25% of the electricity generated by a power plant, less will be available to the grid... All of this will hit while demand for power is surging... Meantime, China has added about 200 gigawatts of coal power over the last five years—about as much as the entire U.S. coal fleet. The Biden fossil-fuel onslaught will have no effect on global temperatures.” – WSJ Editorial Staff...

https://www.wsj.com/articles/environmental-protection-agency-rules-power-plants-fossil-fuels-coal-natural-gas-b6d2ea72

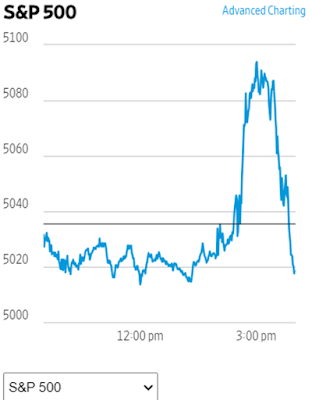

“Federal Reserve Chair Jerome Powell said it was unlikely that the central bank’s next move will be a rate hike. The comment spurred a rally for the three major averages, with the Dow surging more than 500 points in its session high. Central bank policymakers kept rates steady at the conclusion of their May meeting, holding at a range of 5.25% to 5.5%.” Story at...

https://www.cnbc.com/2024/05/01/fed-meeting-today-live-updates-on-may-fed-rate-decision.html

My cmt: The market didn’t like the Fed comment that there was a ‘lack of further progress’ on inflation. The Fed statement said, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,”

“Hiring was broad-based in April. Only the information sector — telecommunications, media, and information technology — showed weakness, posting job losses and the smallest pace of pay gains since August 2021.” Report at...

https://adpemploymentreport.com/

“The Manufacturing PMI® registered 49.2 percent in April, down 1.1 percentage points from the 50.3 percent recorded in March. The overall economy continued in expansion for the 48th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.)” Report at...

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/april/

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 7.3 million barrels from the previous week. At 460.9 million barrels, U.S. crude oil inventories are about 3% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

My cmt: Rising inventories led to falling prices and we see that reflected in the XLE today, down 1.6%.

-Wednesday the S&P 500 slipped about 0.3%% to 5018.

-VIX declined about 2% to 15.39.

-The yield on the 10-year Treasury declined to 4.641%.

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLK – Technology ETF (holding since the October 2022 lows). I don’t want to pay taxes on this gain, so I am holding this position.

CRM – Added 1/22/2024

“The Dow Jones U.S. Completion Total Stock Market Index, also known as the DWCPF, is a widely used financial index that provides a comprehensive measure of the US equity market. The DWCPF includes all US stocks that are not included in the Dow Jones US Total Stock Market Index, which comprises large-cap and mid-cap companies. As a result, the DWCPF provides a complete picture of the US stock market, including small-cap and micro-cap companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) slipped, but is close to Neutral with 12 Bear-signs and 9-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.) The chart below continues to look bullish. The 10-dMA of the 50 Indicator Spread (Bulls minus Bears) is clearly moving higher. That is associated with a rising S&P 500.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

This may sound familiar: The pullback is over, but the S&P 500 could always retest its low. That’s my story and I’m sticking with it.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)