I was traveling Monday so the post is late. I hope you got to see the Northern lights over the weekend. Amazing!

-Monday the S&P 500 was little changed at 5221.

-VIX rose about 8% to 13.60.

-The yield on the 10-year Treasury declined to 4.490%.

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

CRM – Added 1/22/2024.

“The Dow Jones U.S. Completion Total Stock Market Index, also known as the DWCPF, is a widely used financial index that provides a comprehensive measure of the US equity market. The DWCPF includes all US stocks that are not included in the Dow Jones US Total Stock Market Index, which comprises large-cap and mid-cap companies. As a result, the DWCPF provides a complete picture of the US stock market, including small-cap and micro-cap companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

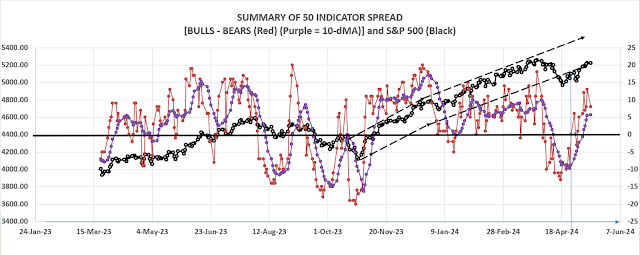

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) remained bullish at 7 Bear-signs and 15-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.) The 10-dMA of spread (purple line in the chart below) continues to improve, a bullish sign.

TODAY’S COMMENT:

Not much new. Markets started well, but faded to negative for the day before finishing around unchanged. A so-so day. Internals were bullish, but not overly so. PPI is due Tuesday at 08:30 and that may have troubled markets Monday.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

I am bullish. The S&P 500 is headed back to all-time, new highs.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

I forgot to update this chart yesterday, but below is Friday’s chart. DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)