“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

My cmt: Someone tell her that she is a federal employee.

Jeremy Grantham on the meltdown coming for U.S. stocks and where he’s putting his money now

“The latest reading of the Federal Reserve's preferred inflation gauge showed prices rose on a monthly basis but dropped year over year, which should keep interest rates on hold when the central bank meets next in March.”

From...

https://finance.yahoo.com/news/pce-inflation-gauge-matches-expectations-offering-relief-to-fed-134539849.html

“The Chicago Purchasing Managers’ Index (Chicago Business Barometer) rose for a second straight month in February but remains historically low. The index increased to 45.5 from 39.5 in January, surpassing the 40.5 forecast. The index remained in contraction territory for a 15th consecutive month.” Commentary and charts at...

https://www.advisorperspectives.com/dshort/updates/2025/02/28/chicago-pmi-contracts-for-15th-consecutive-month

-Friday the S&P 500 rose about 1.6% to 5955.

-VIX fell about 7% to 19.63.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.203%.

None

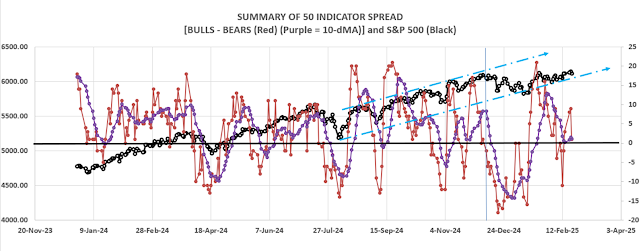

Today, of the 50-Indicators I track, 12 gave Bear-signs and 8 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators improved to a Neutral -4 (4 more Bear indicators than Bull indicators). The 10-dMA of the spread continued falling, a bearish sign.

I am bearish with a very conservative allocation of only about 30% invested in stock holdings.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.