“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The NFIB Small Business Optimism Index dipped 2.3 points in January following surges in November and December. Despite the setback, the index remains far above its prevailing level over the past three years.” Story at...

https://www.fxstreet.com/analysis/small-business-optimism-falls-back-slightly-in-january-202502111516

-Tuesday the S&P 500 rose about 2pts to 6069.

-VIX rose about 1% to 16.02.

-The yield on the 10-year Treasury rose (compared to about this time, prior trading day) to 4.537%.

XLK – Holding since the October 2022 lows. Added more 9/20/2024.

QLD – added 12/20/2024. (IRA acct.)

NVDA – added 1/6/2025.

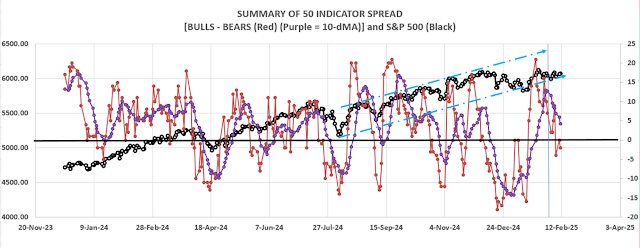

Today, of the 50-Indicators I track, 11 gave Bear-signs and 9 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators declined to a Neutral -2 ( 2 more Bear indicators than Bull indicators). The 10-dMA of the spread is still falling, a bearish sign.

I am Neutral – 60% in stocks.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.