“Robert F Kennedy Jr. and Tulsi Gabbard have cleared the

hurdle towards Senate confirmation. Is this the best America can do?” - Michael

Ramirez. Political commentary at...

https://michaelpramirez.com/index.html

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or anticipating

corrections, than has been lost in the corrections themselves.” - Peter

Lynch, former manager of Fidelity’s Magellan® fund.

MUSK’s DOGE (NTSM)

“I can’t say that I disagree with the goals of DOGE. There is plenty of waste in Government. During my 35-year career in Government I managed a relatively small program (by Government standards) that might be in the 50-million dollar range (inflation adjusted) these days. At one point, the program managers in my agency met with the head of OMB (Office of Management and Budget). He explained how the President could delay expenditures of federal money using apportionment of appropriated funds as political retribution against politicians who wouldn’t support the President’s programs. Delays in Federal expenditures have occurred regularly. The outright cancelation of spending seems to be another matter. To spend money in the Federal Government, it takes 2 bills: (1) an authorization bill and (2) an appropriations bill. These bills are approved by both the House and Senate and signed into law by the President. A President does not have the authority to unilaterally cancel expenditures. A President is not King, whether his name is Biden or Trump.” – M Stith

LOOK AT THE S&P 500 (Heritage Capital)

“Let’s look, yet again, at the S&P 500... Not much going on this week. It remains one good day from new highs. I would really like to see the bulls have enough energy to get that fresh high which I think would be a decent opportunity to reduce exposure or cut risk.” – Paul Schatz, President Heritage Capital. Commentary at...

https://investfortomorrow.com/blog/inflation-hotter-as-expected/

RISING NEW LOWS IN THE NASDAQ (McClellan Financial

Publications)

“This week's chart shows us that the numbers of Nasdaq stocks making 52-week New Lows has been ramping up higher recently. That is not the normal thing to see while prices are continuing to push to higher highs. The normal relationship is that when prices are higher, New Lows go down...

...We saw a similar ramp higher in Nasdaq New Lows back in late 2021, just before the bear market of 2022. This does not mean that we have to get the exact same outcome this time. But it does serve as a warning that things are not acting normally...” Analysis and charts at...

https://www.mcoscillator.com/learning_center/weekly_chart/rising_new_lows_in_the_nasdaq/

My cmt: We’ve noticed a similar issue on the NYSE and that is why there was a Hindenburg Omen Wednesday. I might also note that both of my New-high/New-low indicators have been bearish for both long-term and short-term durations.

PPI

The producer price index, which measures what producers get for their goods and services, increased by a seasonally adjusted 0.4% on the month, compared with the Dow Jones estimate for 0.3%... Excluding food and energy, the core PPI was up 0.3%, in line with the forecast... Over the past year, the all-items PPI increased 3.5%, well ahead of the central bank’s objective.

https://www.cnbc.com/2025/02/13/ppi-january-2025-.html

JOBLESS CLAIMS (YahooFinance)

“Initial claims for state unemployment benefits fell 7,000 to a seasonally adjusted 213,000 for the week ended February 8, the Labor Department said on Thursday. Economists polled by Reuters had forecast 215,000 claims for the latest week.” Story at...

https://ca.finance.yahoo.com/news/us-weekly-jobless-claims-decline-134014252.html

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Thursday the S&P 500 rose about 1% to 6115.

-VIX declined about 5% to 15.10.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.533%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20/2024.

QLD – added 12/20/2024. (IRA acct.)

NVDA – added 1/6/2025.

The decline in Nvidia appears to be overblown. Regarding

competition to Nvidia, Dan Ives (Managing Director and Senior Equity Research

Analyst covering the Technology sector at Wedbush Securities) says, “The

threat is minimal.” He recommended buying Nvidia. I will hold NVDA and see what

develops...

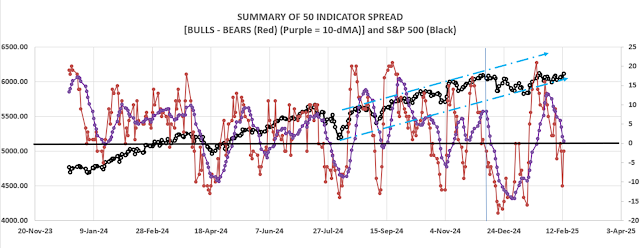

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 12 gave Bear-signs and 10 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

I must admit that if you had told me beforehand that PPI would come in below expectations and the S&P 500 would be up around 1%, I wouldn’t have believed it - but that’s what happened today. Further, advancing stocks outpaced decliners by over 3 to 1; advancing volume outpaced declining volume by more than 2 to 1 and new-highs were about double new-lows. The Index closed only 0.1% below its all-time high. Wow. Indicators improved too.

The daily, bull-bear spread of 50-indicators improved to

a Neutral -2 (2 more Bear indicators than Bull indicators). The

10-dMA of the spread is still falling, a bearish sign.

Wednesday’s Hindenburg Omen was cancelled today because

the McClellan Oscillator also improved above zero.

Thursday was a statistically significant up-day. That

just means that the price-volume move exceeded my statistical parameters.

Statistics show that a statistically-significant, up-day is followed by a

down-day about 60% of the time. Tops

almost always occur on Statistically-significant, up-days, but not all

statistically-significant, up-days occur at tops. Today could be a short-term

top, but there was only 1 top indicator that was bearish, not enough to send a

top-signal.

If the S&P 500 makes a new high we’ll get some added

information about the health of markets. For now, markets appear unsettled.

BOTTOM LINE

I am still Neutral – 60% in stocks.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 60% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.

https://michaelpramirez.com/index.html

“I can’t say that I disagree with the goals of DOGE. There is plenty of waste in Government. During my 35-year career in Government I managed a relatively small program (by Government standards) that might be in the 50-million dollar range (inflation adjusted) these days. At one point, the program managers in my agency met with the head of OMB (Office of Management and Budget). He explained how the President could delay expenditures of federal money using apportionment of appropriated funds as political retribution against politicians who wouldn’t support the President’s programs. Delays in Federal expenditures have occurred regularly. The outright cancelation of spending seems to be another matter. To spend money in the Federal Government, it takes 2 bills: (1) an authorization bill and (2) an appropriations bill. These bills are approved by both the House and Senate and signed into law by the President. A President does not have the authority to unilaterally cancel expenditures. A President is not King, whether his name is Biden or Trump.” – M Stith

“Let’s look, yet again, at the S&P 500... Not much going on this week. It remains one good day from new highs. I would really like to see the bulls have enough energy to get that fresh high which I think would be a decent opportunity to reduce exposure or cut risk.” – Paul Schatz, President Heritage Capital. Commentary at...

https://investfortomorrow.com/blog/inflation-hotter-as-expected/

“This week's chart shows us that the numbers of Nasdaq stocks making 52-week New Lows has been ramping up higher recently. That is not the normal thing to see while prices are continuing to push to higher highs. The normal relationship is that when prices are higher, New Lows go down...

...We saw a similar ramp higher in Nasdaq New Lows back in late 2021, just before the bear market of 2022. This does not mean that we have to get the exact same outcome this time. But it does serve as a warning that things are not acting normally...” Analysis and charts at...

https://www.mcoscillator.com/learning_center/weekly_chart/rising_new_lows_in_the_nasdaq/

My cmt: We’ve noticed a similar issue on the NYSE and that is why there was a Hindenburg Omen Wednesday. I might also note that both of my New-high/New-low indicators have been bearish for both long-term and short-term durations.

The producer price index, which measures what producers get for their goods and services, increased by a seasonally adjusted 0.4% on the month, compared with the Dow Jones estimate for 0.3%... Excluding food and energy, the core PPI was up 0.3%, in line with the forecast... Over the past year, the all-items PPI increased 3.5%, well ahead of the central bank’s objective.

https://www.cnbc.com/2025/02/13/ppi-january-2025-.html

“Initial claims for state unemployment benefits fell 7,000 to a seasonally adjusted 213,000 for the week ended February 8, the Labor Department said on Thursday. Economists polled by Reuters had forecast 215,000 claims for the latest week.” Story at...

https://ca.finance.yahoo.com/news/us-weekly-jobless-claims-decline-134014252.html

-Thursday the S&P 500 rose about 1% to 6115.

-VIX declined about 5% to 15.10.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.533%.

XLK – Holding since the October 2022 lows. Added more 9/20/2024.

QLD – added 12/20/2024. (IRA acct.)

NVDA – added 1/6/2025.

Today, of the 50-Indicators I track, 12 gave Bear-signs and 10 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

I must admit that if you had told me beforehand that PPI would come in below expectations and the S&P 500 would be up around 1%, I wouldn’t have believed it - but that’s what happened today. Further, advancing stocks outpaced decliners by over 3 to 1; advancing volume outpaced declining volume by more than 2 to 1 and new-highs were about double new-lows. The Index closed only 0.1% below its all-time high. Wow. Indicators improved too.

I am still Neutral – 60% in stocks.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.