“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

PERSONAL INCOME / SPENDING

“Personal income increased $87.6 billion (0.4% at a

monthly rate) in August, according to estimates released by the Bureau of

Economic Analysis...” From...

https://www.floordaily.net/flooring-news/personal-income-and-spending-both-rose-04-in-august

PCE PRICES (Investopedia)

“Consumer prices, as measured by the personal consumption expenditures

(PCE) price index, rose 3.5% over the last 12 months as of August,

up from 3.4% in July and 3.2% in June, the Bureau of Economic Analysis said

Friday. The increase was driven mostly by rising gas prices... “Core” PCE,

which excludes volatile prices for food and energy, rose just 0.1% in August,

making for a 3.9% increase over the year. The yearly change was down from 4.3%

in July and the lowest since May 2021...” Story at...

https://www.investopedia.com/rising-gas-prices-drive-fed-s-favorite-inflation-measure-up-for-a-third-month-8285911

CHICAGO PMI (Advisor Perpectives)

“The latest Chicago Purchasing Manager's Index (Chicago Business

Barometer) fell to 44.1 in September from 48.7 in August. The latest reading is

worse than the 47.6 forecast and marks the 13th straight month in contraction

territory.” Analysis at...

https://www.advisorperspectives.com/dshort/updates/2023/09/29/chicago-pmi-contracts-13-consecutive-months

MARKET REPORT / ANALYSIS

-Friday the S&P 500 dipped about 0.3% to 4288.

-VIX rose about 1% to 17.52.

-The yield on the 10-year Treasury declined to 4.579%.

PULLBACK DATA:

-Drop from Top: 10.6%. 25.4% max (on a closing basis).

-Trading Days since Top: 437-days.

The S&P 500 is 2.1% ABOVE its 200-dMA and 3.7%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

TODAY’S COMMENT:

I heard a discussion on CNBC yesterday by Bob Pisani where

he said that oversold conditions are not a signal to buy, but rather a

condition. For the most part, that’s

true in significant corrections. In a

big downturn, oversold conditions can last a long time. However, in smaller

corrections (as is the one we’re in now), oversold signals from Bollinger

Bands, RSI and other signs can be a good bottom indicator. As such, I think the

markets found a bottom in the 4275 range on 26 September. Today’s intraday low

tested that level and bounced higher, so that was one piece of good news today.

On 1 September, there were 22 Bull-indicators and Zero

Bear-indicators in my Friday summary of indicators. The Index is 5% lower since

then. It’s just a reminder that, for the

most part, indicators don’t foretell the future, they simply give us the direction

of trend in the moment.

We look at a summary of indicators on Friday: The weekly

rundown of indicators increased by 1

more bear signal (now 16-bear and 4-bull). (These indicators tend to be both

long-term and short-term, so they are different than the 20 that I report on

daily.)

BULL SIGNS

-The 100-dMA percentage of issues advancing on

the NYSE (Breadth) is above 50%.

-RSI.

-XLI-ETF (Cyclical Industrials) vs the S&P 500.

-S&P 500 spread vs. Utilities (XLU-ETF) shows the

Index outpacing Utilities.

NEUTRAL

-There 5 Distribution Days since 15 Sept. – Not enough to

send a message.

-There have been 4 Statistically-Significant days (big

moves in price-volume) in the last 15-days.

-Sentiment.

-Bollinger Band Squeeze 28 April - expired.

-Bollinger Bands.

-Overbought/Oversold Index (Advance/Decline Ratio).

-Issues advancing on the NYSE (Breadth) compared to the

S&P 500.

-10 August there was a Bullish Outside Reversal Day.

Expired

-The S&P 500 is 2.1% above its 200-dMA. (Bear

indicator is 12% above the 200-day.)

-The short-term, 10-day EMA, Fosback Hi-Low Logic Index.

-The long-term, 50-dEMA, Fosback Hi-Low Logic Index.

-There were Hindenburg Omen signals 11 & 12 Sept 2023

– expired. The McClellan Oscillator turned positive.

-There have been 4 up-days over the last 10 sessions.

-There have been 9 up-days over the last 20 sessions.

-There was a Zweig Breadth Thrust 31 March. That’s a

rare, very-bullish sign, but the McClellan Oscillator subsequently turned

negative, so this indicator has expired.

-The Calm-before-the-Storm/Panic Indicator flashed a top

warning signal 15 Sept., but it may well have been a bottom signal. But the

signal is partly due to volume from Options expiration. Call it neutral.

-VIX indicator.

-The Smart Money (late-day action).

-There was a 90% down-volume days 21 Sept, but only 1 so

far.

-2.8% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is

no bullish signal for this indicator.) This indicated that the advance was too

narrow and a correction was likely to be >10%. It proved correct, but is now

Expired.

-The graph of the 100-day Count (the 100-day sum of

up-days).

-There was a New-high/new-low reversal 29 September in the

morning, but the signal faded as the markets fell later in the day.

BEAR SIGNS

-The smoothed advancing volume on the NYSE is falling.

-The 10-dMA percentage of issues advancing on

the NYSE (Breadth) is below 50%.

-The 50-dMA percentage of issues advancing on the NYSE

(Breadth) is above 50%

-The 50-dMA percentage of issues advancing on the NYSE

(Breadth) has been below 50%, for more than 3 days in a row.

-MACD of the percentage of issues advancing on the NYSE

(breadth) made a bearish crossover 8 September.

-Smoothed Buying Pressure minus Selling Pressure.

-MACD of S&P 500 price made a bearish crossover 18

Sept.

-My Money Trend indicator is falling.

-Long-term new-high/new-low data.

-Short-term new-high/new-low data.

-Slope of the 40-dMA of New-highs is falling.

-McClellan Oscillator.

-On average, the size of up-moves has been significantly smaller

than the size of down-moves over the last month.

-The 5-10-20 Timer System is SELL.

-The 5-day EMA is below the 10-day EMA, so short-term

momentum is bearish.

-34% of the 15-ETFs that I track have been up over the

last 10-days. (45-55% is neutral.)

On Monday’s update of the Friday summary of indicators (20

December 2021), 9 days before the top of the current 25% correction, there were

21 bear-signs and zero bull-signs. Now there are 16 bear-signs and 4-Bull.

Last week, there were 15 bear-sign and 4 bull-signs.

The daily spread of 20 Indicators (Bulls minus Bears) improved

from -9 to -8 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -67 to -69.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained SELL: VOLUME & PRICE are bearish; SENTIMENT & VIX are neutral.

I’m not selling now. I’d prefer to hang on since I

am still expecting a relatively shallow pullback from August highs and if the

markets haven’t bottomed yet, they are not far from it.

(The important BUY in this indicator was on 21

October, 7-days after the bottom. For my NTSM overall signal, I suggested that

a short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 21 December, 9 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

I am still cautiously optimistic – The S&P 500 may

have bottomed, but I don’t see a confirmation in the indicators. Several indicators

appear to be reversing to the bullish side, but they’re not bullish yet. We’ll

have to see if that trend continues.

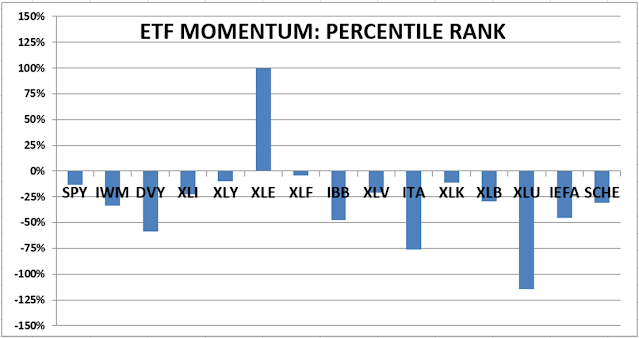

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

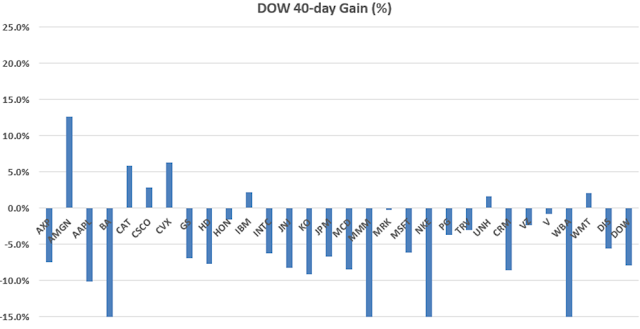

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals

remained SELL. (My basket of Market Internals is a decent trend-following analysis of

current market action, but should not be used alone for short term trading.

They are most useful when they diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“UAW leadership claims GM pays its team members ‘poverty’

wages. This is simply not true.” – Mark Reuss, President General Motors.

...According to Reuss, the latest GM offer would give 85%

of union workers a base pay of $85,000.

"Only in 60% of episodes was inflation brought back

down (or 'resolved') within 5 years. Most unresolved episodes involved

'premature celebrations', where inflation declined initially, only to plateau

at an elevated level or re-accelerate." – Jesse Felder, co-founder of

Aletheia, a multi-billion-dollar hedge fund.

GDP – THIRD ESTIMATE (live mint)

“The real gross domestic product (GDP) of the United

States expanded at an annual rate of 2.1 per cent in the second quarter, the US

Bureau of Economic Analysis' (BEA) final estimate showed on Thursday, September

28. The reading came in line with the previous estimate and expectations by

economists on the Street.” Story at...

https://www.livemint.com/economy/us-real-gdp-grows-at-2-1-annual-rate-in-q2-in-line-with-street-estimates-weekly-jobless-claims-edge-higher-11695911236793.html

JOBLESS CLAIMS (Yahoo Finance)

“U.S. applications for unemployment benefits inched up

modestly this week after reaching their lowest level in eight months the

previous week...Filings for jobless claims rose by 2,000 to 204,000 for the

week ending Sept. 23, the Labor Department reported Thursday. Last week's

figure was the lowest since January.” Story at...

https://finance.yahoo.com/news/slightly-fewer-number-americans-apply-124006237.html

BACKLASH (MishTalk)

“There is an air of surrealism around the climate-change

debate in Britain and in much of Europe. The U.K. has dramatically reduced

carbon emissions over the past 30 years, thanks in significant part to

technological innovation. Its emissions per capita are now down to where they

were in the mid-19th century. The British government could mandate tomorrow the

elimination of all carbon emissions and a return to agrarian subsistence, and,

given the massive and rapidly rising levels of emissions from China, India and

elsewhere, it wouldn’t make the slightest difference to the climate.” Story

at...

https://mishtalk.com/economics/a-huge-backlash-against-climate-change-and-immigration-madness-has-started/

“One of the most significant advantages of an EV is that

they are safer for the environment. But is this true? If you look at the facts,

EVs are not zero-emission. They may have zero tailpipe emissions, but they are

certainly not pollution-free. EV batteries require mining materials like

lithium and cobalt, which harm the environment. EV batteries are also

complicated to recycle and dispose of, and new studies show that EV tires

produce 20% more pollution than gas-car tires. None of this screams “save the environment”

to me.” – Wealth of Geek$

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.6% to 4300.

-VIX dipped about 5% to 17.34.

-The yield on the 10-year Treasury declined to 4.579%.

PULLBACK DATA:

-Drop from Top: 10.4%. 25.4% max (on a closing basis).

-Trading Days since Top: 436-days.

The S&P 500 is 2.4% ABOVE its 200-dMA and 3.5%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes

a new-high; however, evidence suggests the bottom was in the 3600 area and we

called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the October

2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

TODAY’S COMMENT:

The Moving Average (MA) spread between Utilities

and the S&P 500 index indicates that the Index is outpacing Utilities. That’s a bullish sign and we see others, too.

Internals continue to improve. Advancers were twice

decliners and advancing volume was almost 3 times higher than declining volume.

New 52-week lows remained much worse than new 52-week highs, but the spread

between the highs and lows improved. Utilities was the only sector down – a bullish

sign.

The daily spread of 20 Indicators (Bulls minus Bears) improved

from -10 to -9 (a positive number is bullish; negatives are bearish); the

10-day smoothed sum that smooths the daily fluctuations declined from -61

to -67. (The trend direction is more important than the actual number for the

10-day value.) These numbers sometimes change after I post the blog based on

data that comes in late. Most of these 20 indicators are short-term so they

tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

SELL: VOLUME & PRICE are bearish; SENTIMENT & VIX are neutral.

I’m not selling now. I’d prefer to hang on since I

am still expecting a relatively shallow pullback from August highs and if the

markets haven’t bottomed yet, they are not far from it.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 21 December, 9 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

I am still cautiously optimistic – The S&P 500 appears to have bottomed, but I don’t see a confirmation in the indicators, yet.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained SELL. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“I think leaders should endeavor to be honest, ethical,

moral people who try to set standards for themselves and lead by example across

the country. Donald Trump doesn’t try to do any of that. He does the opposite,

frankly. So I just don't think he's fit for the job here...The party that puts

the first fresh face forward wins this election.” - Paul Ryan, Republican,

Former Speaker of the House.

DURABLE ORDERS (Yahoo News)

“Durable

Goods Orders for August...more positive than expected and

in month-over-month comparisons: +0.2% is above the -0.5% consensus and the

downwardly revised -5.6% the previous month. ...now we see four out of five

months stronger... While these are heartening results for the health of the

economy...they do not assist the Fed in deciding that all rate hikes to the Fed

funds are over for the time being.” Story at...

https://finance.yahoo.com/news/durable-goods-orders-increase-august-144700775.html

CRUDE OIL INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 2.2 million barrels from the

previous week. At 416.3 million barrels, U.S. crude oil inventories are about

4% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

TURNING POLUTION INTO RESOURCE (The Cool Down)

“A promising breakthrough in sustainable energy not only aims to

reduce pollution that harms the environment, it also aims to use that

pollution. Researchers from the Illinois Institute of Technology, the

University of Pennsylvania, and the University of Illinois, Chicago, have

developed a system that can convert carbon dioxide pollution into propane... Matteo

Cagnello, an assistant professor of chemical engineering at Stanford who

led similar research in 2019, described the closing of the

carbon cycle at the time, saying: “One can imagine a carbon-neutral cycle that produces

fuel from carbon dioxide and then burns it, creating new carbon dioxide that

gets turned back into fuel.” Story at...

Scientists

make breakthrough turning air pollution into resource for human use: ‘For the

benefit of global users’ (msn.com)

My cmt: The biggest problem with the climate-crisis panic

is that it ignores technologies that will solve the problem, such as the one

above and others like carbon capture, hydrogen fuel cells, advances in fusion

reactors and improvements in batteries. Let’s face it – if batteries were

smaller, lighter weight and more efficient, electric vehicles would be a

realistic competitor to gas powered vehicles (although it is questionable

whether electric vehicles will make any difference in global temperatures).

OIL COULD HIT $150 PER BARREL (NY Post)

“A top oil executive predicted that the price of crude

would continue to soar — climbing to as high as $150 per barrel — unless the government

adopts new policies to encourage more exploration. Doug Lawler — the CEO of

Continental Resources, a shale driller controlled by billionaire Harold Hamm —

warned that crude output in Texas’ Permian Basin oil field could soon peak, as

it already has in rival shale fields like North Dakota’s Bakken Formation and

Texas’ Eagle Ford.” Story at...

Shale

CEO warns oil could hit $150 per barrel (msn.com)

THE HEAT PUMP FARCE (The Telegraph / msn.com)

“The real problem with heat pumps is that they are not

yet effective enough, we have not worked out how to insulate our ageing housing

stock so they generate enough warmth, and even if we fixed those two issues we

most likely won’t generate enough electricity at reasonable cost to keep them

all running through the winter. The solution is very simple. Countries

around the world are developing new heat pump technology, and other “green”

home heating technologies are emerging all the time. Hydrogen might work, or

high-capacity batteries powered by domestic solar panels, or extracting warmer

water from underground. No one can say for sure yet. So we should wait and see.”

Story at...

The

heat pumps farce has reached a new low (msn.com)

My cmt: The US is mandating heat pumps in about half the

states. In Britain (article above), it’s

really crazy. They’re going to fine suppliers for not selling enough heat

pumps.

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 was little changed at 4275.

-VIX dipped about 4% to 18.22.

-The yield on the 10-year Treasury rose to 4.616%, a

continuing worry for the stock market.

PULLBACK DATA:

-Drop from Top: 10.9%. 25.4% max (on a closing basis).

-Trading Days since Top: 435-days.

The S&P 500 is 1.9% ABOVE its 200-dMA and 4.2%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

TODAY’S COMMENT:

Internals are finally improving, not enough to change

indicators much, but improving. Advancers outpaced decliners and advancing

volume was higher than declining volume. New 52-week lows remained much worse

than new 52-week highs, but that is not unusual. New-high/new-low data is

always last to turn.

This correction/bear market has lasted 435 days and

included a 25% drop from peak to trough.

If the bear market ended now (broke to new all-time highs) the closest

bear market in the last 75 years, statistically, would be the 1980-1982 bear

that saw a 28% decline. It lasted 444-days. The gain on the other side was 229%.

That doesn’t mean we’ll see that kind of rally this time, but usually after a

bear market, returns are very good. The average gain is about 85%. The

exception would be 1929 – I don’t even want to think about that possibility. It

is small, but not zero.

It was interesting that a CNBC investor survey showed

that two thirds of respondents thought that the market was in a bear market rally.

That seemed like a high level of bearish sentiment that is actually bullish.

The Russell 2000 was up nearly 1% today – I see that as a

bullish sign, too.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from -6 to -10 (a positive number is bullish; negatives are bearish); the

10-day smoothed sum that smooths the daily fluctuations declined from -56

to -61. (The trend direction is more important than the actual number for the

10-day value.) These numbers sometimes change after I post the blog based on

data that comes in late. Most of these 20 indicators are short-term so they

tend to bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

SELL: VOLUME, PRICE & VIX are bearish; SENTIMENT is neutral.

I’m not selling now. I’d prefer to hang on since I

am still expecting a relatively shallow pullback from August highs and if the

markets haven’t bottomed yet, they are not far from it.

(The important BUY in this indicator was on 21

October, 7-days after the bottom. For my NTSM overall signal, I suggested that

a short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 21 December, 9 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

The S&P 500 dipped to within 1/10% of its 200-dMA

today and bounced higher. I am still cautiously optimistic – I don’t think the

market has too much farther to go and it may have already bottomed.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained SELL. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Is there really a man-made global warming crisis?... Dr.

John Clauser, a renowned physicist and Nobel Prize winner...vehemently opposes

the notion of a man-made climate crisis. In fact, he believes it's all a

deliberate hoax... founder of the Weather Channel, John Coleman. The now-late

veteran weatherman [said]... ‘Climate change is not happening; there is no

significant man-made global warming now, there hasn’t been any in the past, and

there is no reason to expect any in the future.’... Judith Curry...Georgia

Institute of Technology professor emerita...had scathing criticisms of her

colleagues in the science world. She has accused other scientists of

deceptively fueling the man-made climate emergency for ‘fame and fortune.’"

Story at...

Manufactured

Climate Consensus Deemed False By Climate Scientist - 'The Time For Debate Has

Ended' (msn.com)

My cmt: It is reasonably clear that the Earth has warmed

by 1 degree centigrade over the last 100 years.

The warming is due to rising CO2 levels in the atmosphere that are

manmade. (The physics are well understood from examining CO2 and temperatures

on other planets in our solar system.) Predictions suggest more hurricanes,

more tornados, faster sea level rise, high rainfall levels and many more catastrophes. The problem is that those climate changes

have not yet exceeded past variability of the data, thus the current climate

panic seems totally unjustified. Remember, the Intergovernmental Panel on

Climate Change (IPCC) defines climate in 30-year slices. Too often, the news

media reports on weather, not climate. Sadly, it has become so politicized that

we see absurd “climate fixes” like cancelling the Keystone Pipeline, that has

no effect on fossil fuel use, or eliminating gasoline powered cars when even

the DOT states it will have no effect on Global temperatures (in its current

rulemaking on gasoline mileage).

CONSUMER CONFIDENCE (Conference Board)

"Consumer confidence fell again in September 2023, marking two consecutive months of

decline," said Dana Peterson, Chief

Economist at The Conference Board... "Expectations for the next six months

tumbled back below the recession threshold of 80, reflecting less confidence

about future business conditions, job availability,

and incomes.” Press release at...

https://www.prnewswire.com/news-releases/us-consumer-confidence-fell-again-in-september-301938908.html

NEW HOME SALES (CNBC)

“Sales of newly built homes fell 8.7% in August from

July, to a seasonally adjusted annualized pace of 675,000 units, according to

the U.S. Census Bureau. That is the slowest pace since March. Sales were still

5.8% higher than August 2022.”

https://www.cnbc.com/2023/09/26/new-home-sales-fall-in-august.html

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 fell about 1.5% to 4274.

-VIX rose about 14% to 19.24.

-The yield on the 10-year Treasury rose to 4.553%, a

continuing worry for the stock market.

PULLBACK DATA:

-Drop from Top: 10.9%. 25.4% max (on a closing basis).

-Trading Days since Top: 434-days.

The S&P 500 is 1.9% ABOVE its 200-dMA and 4.3%

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

TODAY’S COMMENT:

The markets have been falling all of August and September

with a small peak 31 August. Since the end of August, we could be in a “selling

stampede”; these tend to last 17 – 25 sessions, (the Index is at 17-days now) with

only 1.5- to three-day pauses/throwback rallies, before they exhaust themselves

on the downside. Once the markets get into one of these weekly downside skeins,

they rarely bottom on a Friday. They typically give participants over the

weekend to brood about their losses and then they show up the next Monday in

“sell mode” leading to Turning Tuesday. That’s why I mentioned earlier that we

might have to wait for Turning Tuesday to see a bottom. We didn’t have a turn today;

will we have to wait until next Tuesday for a bottom? Hard to say. Today could have been a bottom.

Today was a statistically significant down-day. That just

means that the price-volume move exceeded my statistical parameters. Statistics

show that a statistically-significant, down-day is followed by an up-day about

60% of the time. Bottoms almost always occur

on or near Statistically-significant, down-days, but not all

statistically-significant, down-days occur at bottoms. Today could be a

short-term bottom. There are 2 bottom indicators that are bullish and we still

see the VIX rate of change indicator in bullish mode. That is not as strong a

signal as we’d like to see, but Mr. Market rarely sends a completely clear

signal and he doesn’t read my blog either. Again, we note that short-term

market moves are difficult to call and involve a lot of luck to get it right.

Although it’s not in my system, the 5-dMA Hi/Lo Logic

Index turned bullish today due to very low new-highs over the last 5-days

suggesting at least a short-term bounce, now or soon.

The RSI and Bollinger Bands for the S&P 500 remains

oversold.

7-Day VIX ROC was 38 today: Per Tom McClellan, "...any

reading above around +20% is a pretty good sign of an oversold bottom for stock

prices, one that is worthy of a bounce...”

Overall though, indicators remain bearish and I haven’t yet

seen a bullish reversal in new-high/new-low data so there is no smoking gun

here. A drop to the 4200-4300 area is

still possible based on chart analysis and the Index 200-dMA, now at 4195.

The daily spread of 20 Indicators (Bulls minus Bears) remained

-6 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations declined from -51 to -56. (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator slipped

to SELL: VOLUME & VIX are bearish; PRICE & SENTIMENT are neutral.

I’m not selling now. I’d prefer to hang on since I

am still expecting a relatively shallow pullback from August highs.

(The important BUY in this indicator was on 21

October, 7-days after the bottom. For my NTSM overall signal, I suggested that

a short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 21 December, 9 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

It looks like the S&P 500 will dip to its 200-dMA. I

am still cautiously optimistic (perhaps I’m thinking too much) – I don’t think

the market has too much farther to go.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained SELL. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“American government officials, working in concert with

big tech companies, defamed and suppressed me and my colleagues for criticizing

official pandemic policies – criticism that has been proven prescient...

...Lawyers in the Missouri v. Biden case took sworn

depositions from many federal officials involved in the censorship efforts,

including Anthony Fauci. During the hours-long deposition, Fauci showed a

striking inability to answer basic questions about his pandemic management,

replying “I don’t recall” over 170 times. Legal discovery unearthed email

exchanges between the government and social media companies showing an

administration willing to threaten the use of its regulatory power to harm

social media companies that did not comply with censorship demands...

...Censorship is the death of science and inevitably

leads to the death of people. America should be a bulwark against it, but it

was not during the pandemic. Though the tide is turning with the Missouri v. Biden case,

we must reform our scientific institutions so what happened during the pandemic

never happens again.” - Dr. Jay Bhattacharya, Professor of

Medicine at Stanford University and a research associate at the National Bureau

of Economics Research

American

Pandemic ‘Samizdat’ | RealClearPolitics

Thursday night the Biden administration lost yet another court battle in its

ongoing jihad against domestic fossil-fuels production...The administration was

trying to put severe restrictions on a lease sale involving millions of acres

in the Gulf of Mexico. Not only had the lease sale already been approved before

earlier Biden attempts to hobble it, but Congress, as part of the (misnamed)

Inflation Reduction Act of 2022, specifically directed that the planned sale be

reinstated... Biden last August lost another Louisiana-based case in which Biden

had tried to halt energy leases in 13 states. And in July of this year, the U.S. Supreme Court allowed the Mountain Valley

Pipeline in West Virginia and Virgina to continue despite Biden’s attempts to stop

it.” Story at...

Judge

is right to rebuke Biden's anti-oil obsession (msn.com)

Repeating an earlier post:

SHOCKING CANDOR ON FUEL STANDARDS (WSJ)

“For decades, bureaucrats in Washington have argued that

fuel-economy mandates pay for themselves... But unlike in previous rulemakings,

the costs are now so comically high that regulators can no longer pretend that

mandating greater fuel economy for passenger cars is good for society... But

the proposed rule says this White House’s not-so-secret password: climate

change. What about it? Without a hint of sarcasm, page 5-39 of the department’s

accompanying environmental assessment estimates that in 2060 the

proposal would reduce average global temperatures by 0.000%... Chinese

Communist Party officials must be reading our wonderful environmental

assessments for comic relief as they ramp up coal production.” - Michael

Buschbacher, partner at

the law firm Boyden Gray PLLC and served in the Justice Department’s

Environment Division (2020-21), and James Conde, counsel at Boyden Gray PLLC.

Commentary at...

https://www.wsj.com/articles/transportation-department-fuel-standards-car-ev-electric-vehicle-auto-industry-climate-change-388d6dd0

My cmt: If Global Temperatures will not be affected by

the above rule that essentially does away with gasoline powered vehicles, what

is the point?

If you would like to read and comment on this proposed

rule, go to...

https://www.regulations.gov/document/NHTSA-2023-0022-0004

The comments I read were all form letters from

Environmental Whackos who stated that “We urge NHTSA to finalize the strongest

rule possible...”

...This proposed rule remains open for comment. Comments are requested on or before October 16,

2023.

PULLBACK ACCELERATES (Heritage Capital)

“While the pieces are coming together nicely for a bottom

and Q4 rally as I have been writing about, it is never easy nor fun to live through.

Declines shakes investors’ faith and they don’t reengage until the best

opportunity has been exhausted. Next week I will be keenly watching for sectors

that are beginning to shape up for a rally. Right now, it’s hard to see.” –

Paul Schatz, President Heritage Capital.

https://investfortomorrow.com/blog/pullback-accelerates/

MARKET REPORT / ANALYSIS

-Monday the S&P 500 rose about 0.4% to 4337.

-VIX fell about 2% to 16.9.

-The yield on the 10-year Treasury rose to 4.537%, a

continuing worry for the stock market.

PULLBACK DATA:

-Drop from Top: 9.6%. 25.4% max (on a closing basis).

-Trading Days since Top: 433-days.

The S&P 500 is 3.4% ABOVE its 200-dMA and 3% BELOW

its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, evidence suggests the bottom was in the 3600 area

and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

XLK – Technology ETF (holding since the October 2022

lows).

XLY - Consumer Discretionary ETF. (Holding since the

October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as

follows:

SPY – I bought a large position in the S&P 500

Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

TODAY’S COMMENT:

On 1 September, there were 22 Bull-indicators and Zero

Bear-indicators. As a result, I went

“all-in” again on the following Monday. The S&P 500 was 4497. The S&P

500 has dropped about 4% since then while indicators have shifted significantly

to the bear side. Friday, the summary of indicators on Friday was a bearish 15-bear

and 4-bull. I remain more than fully invested since several of the bull

indicators are calling for a bottom. As

I’ve noted frequently, calling short-term stock movement is a losing

proposition that is partly or even mostly luck, but I’ll hope for luck. Today’s

late-day, market action was bullish: Utilities were sold; Cyclical industrials

were bought; Consumer Discretionary stocks outpaced the S&P 500 – all are

bullish signs suggesting a possible end of market weakness. These are

just daily moves, but I’ll keep hoping for the luck factor.

I still haven’t seen a bullish reversal in

new-high/new-low data so there is no smoking gun here. A drop to the 4200-4300 area is still

possible based on chart analysis and the Index 200-dMA, now at 4193.

The daily spread of 20 Indicators (Bulls minus Bears) improved

from -7 to -6 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from -44 to -51.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator remains

HOLD: VOLUME is bearish; PRICE, SENTIMENT & VIX are neutral.

(The important BUY in this indicator was on 21

October, 7-days after the bottom. For my NTSM overall signal, I suggested that

a short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 21 December, 9 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

I am cautiously optimistic (perhaps I’m thinking too

much).

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained SELL. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting new,

all-time highs this year. That burns all the cash. I have about 25% of the portfolio in bonds.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. When I see a

definitive bottom, I add a lot more stocks to the portfolio using an S&P

500 ETF as I did back in October.