“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“Labor Department data published Thursday showed another surprise decline in weekly unemployment claims...As Wall Street remains laser-focused on the job market, around 216,000 people filed new applications for the week ended Sept. 2...” Story at...

https://www.thestreet.com/investing/stocks/job-market-back-in-focus-as-wage-pressures-bubble-testing-fed-patience

My cmt: Good news is bad news it seems as markets opened lower this morning.

“Nonfarm business sector labor productivity increased 3.5% in Q2 2023, the U.S. Bureau of Labor Statistics reported...”

https://www.floordaily.net/flooring-news/labor-productivity-rose-35-in-q2

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.3 million barrels from the previous week. At 416.6 million barrels, U.S. crude oil inventories are about 4% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

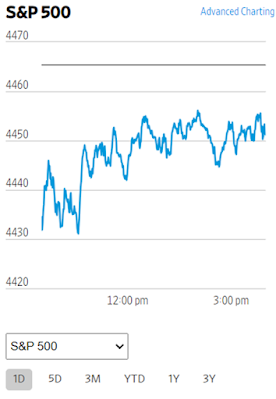

-Thursday the S&P 500 slipped about 0.3% to 4451.

-VIX rose about 0.3% to 14.40.

-The yield on the 10-year Treasury slipped to 4.231%.

-Drop from Top: 7.2%. 25.4% max (on a closing basis).

-Trading Days since Top: 420-days.

The S&P 500 is 6.8% ABOVE its 200-dMA and 0.6% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

XLK – Technology ETF (holding since the October lows).

SPY – I bought a large position in the S&P 500 Friday, 8/14, in my 401k (it has limited choices).

XLY - Consumer Discretionary ETF. (Holding since the October lows - I bought more XLY Monday, 8/21.)

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

Another down day, but at least the daily chart looks somewhat encouraging. It didn’t get back to positive territory, but it was generally up for most of day. Indicators continue to deteriorate, but breadth indicators remain in the green so I am not worried, yet. The Friday summary of indicators will be interesting.

LONG-TERM INDICATOR: The Long Term NTSM indicator remains

HOLD: PRICE is Bullish; SENTIMENT, VIX & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 21 December, 9 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line:, I remain Bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)