https://www.wsj.com/finance/stocks/stocks-on-pace-for-best-two-years-in-a-quarter-century-c5b5f9b3?mod=md_usstk_news

-Tuesday the S&P 500 declined about 0.4% to 5882.

-VIX slipped about 0.4% to 17.35. (Options players don’t seem very worried.)

-The yield on the 10-year Treasury rose (compared to about this time, prior trading day) to 4.573%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

Today, of the 50-Indicators I track, 19 gave Bear-signs and 5 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

As I noted yesterday, a crash is aways coming – we just don’t know when. Looking back, we note that my indicators got me out at or near the top of the Financial Crisis, the Covid pandemic and the 25% decline in 2022. I called the bottoms within days of these crisis’ except for Covid when I waited for a retest of the low that never happened – we learned from that one.

I think the weakness is ending, but then, I predicted this a week ago, too. (Why do you read this blog?)

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

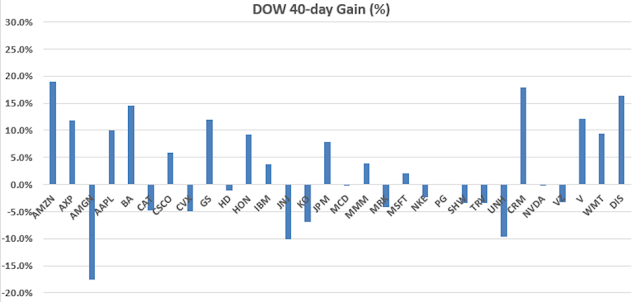

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)