... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

PROPAGANDA WAR ON ISRAEL NEVER STOPS (WSJ)

“Amnesty [International] poses as a fair-minded critic of

Israeli policies, but it tipped its hand in its 2022 report that tried to claim

“this system of apartheid originated with the creation of Israel in May 1948.”

That’s well before any “occupation,” but it reflects the ideological obsession

that treats the Jewish state’s existence, in any borders, as a crime... While

Amnesty uses the casualty figures of the “Gaza-based Ministry of Health,” aka

Hamas, it never mentions that Israel says 17,000 dead Hamas fighters are among

them. It omits the crucial civilian-to-combatant ratio, which would suggest

Israel has done better than most in urban warfare... Amnesty even criticizes

Israel for evacuating civilians from active war zones. This, too, becomes

evidence of “genocidal intent” because it displaces the civilians. But Amnesty

also criticizes Israel as genocidal in cases where it didn’t evacuate civilians.

The game is to twist international law until Israel—or the U.S.—has no way to

fight against terrorists.” Opinion at...

https://www.wsj.com/opinion/amnesty-international-report-israel-genocide-hamas-gaza-811acf05?mod=opinion_lead_pos4

“Conservatives who support Donald Trump’s choice

of Robert F. Kennedy Jr. to lead the Health and Human Services

Department say he will disrupt the healthcare bureaucracy. They may be right.

But he could also disrupt access to life-saving medicines and the innovation

ecosystem that creates them... Who will benefit from RFK Jr.’s agenda? The

trial lawyers and China, which is seeking to surpass the U.S. in biotech

including mRNA. If RFK Jr. were a Democratic nominee, GOP Senators would oppose

him as a threat to public health. If they confirm him, they’d better hope they

won’t need the cures that won’t be developed.” – Editorial Staff, WSJ, at...

https://www.wsj.com/opinion/rfk-jr-health-and-human-services-pharma-drugs-innovation-donald-trump-a9b4eb72?mod=opinion_feat1_editorials_pos1

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 declined about 0.2% to 6075.

-VIX rose about 0.7% to 13.54.

-The yield on the 10-year Treasury declined (compared to

about this time, prior trading day) to 4.182%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

UWM – added 11/11

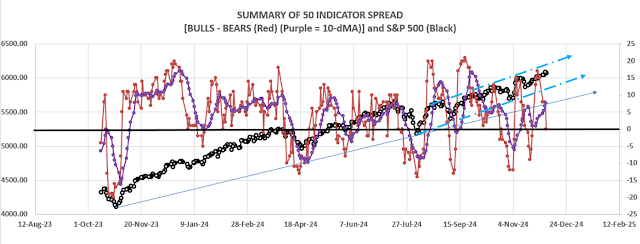

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 11 gave Bear-signs

and 11 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to zero (equal

numbers of Bull and Bear indicators – yesterday’s numbers changed

due to late data).

TODAY’S COMMENT

Yesterday, Wednesday, market internals and spreads

improved into the close pushing my indicators a little higher than they were at

mid-day when I did my market analysis. Yesterday’s 50-Indicator, Bull-Bear

spread was +8 at the close instead of +5.

Today’s Bull-Bear spread of zero is Neutral. The 10-dMA

of the 50-Indicator Spread (purple line in the chart above) is moving higher

today so that is still bullish. The overall 50-Indicator spread signal is

Bullish. (I follow the 10-dMA for trading buy-signals and as an indicator for

sell signals.)

One of the signals that reversed down today (and gave a

bear signal) was the spread between Utilities (XLU) and the S&P 500

Index. When the red line on the chart below,

is above zero, the S&P 500 is advancing faster than the XLU. When it is

below Zero, Utilities are advancing faster.

The indicator tracks the direction (slope) of the curve. As can be seen,

the Index generally tracks higher or lower similarly to the slope of the Moving

Average spread.

The S&P 500 was at a new all-time high again

Wednesday; about 5% of issues on the NYSE made new, 52-week highs today. Breadth

has narrowed, but the number at the close did not give a bear sign. It doesn’t

feel like there is significant trouble ahead, but I’ll be following the

indicators rather than guessing.

There is still only 1 top-indicator warning of a top –

breadth is too far ahead of the S&P 500.

This indicator can be early, so no point in worrying about it yet.

If Bollinger Bands, RSI or other top indicators start

acting up I may be forced to take profits in leveraged positions (SSO, QLD,

& UWM), especially if the S&P 500 is at its upper trend line.

For now, I won’t be making any changes in the portfolio.

A few down days would be good for the markets.

BOTTOM LINE

I’m cautiously bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market Internals

is a decent trend-following analysis that is most useful when it diverges from

the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched. (75% is my max

stock allocation when I am confident that markets will continue higher.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.