Tomorrow will be very busy. I’m not sure when, or if,

there will be a Blog post on Thursday.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

CRUDE INVENTORY (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) increased by 0.5 million barrels from the

previous week. At 430.3 million barrels, U.S. crude oil inventories are about

4% below the five-year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 was unchanged at 5917.

-VIX rose about 5% to 17.16.

-The yield on the 10-year Treasury rose (compared to

about this time, prior trading day) to 4.414%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

UWM – added 11/11

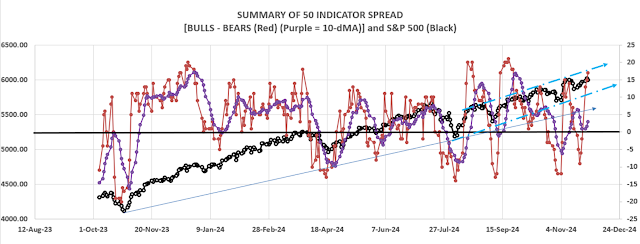

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 15 gave Bear-signs

and 6 were Bullish. The rest are neutral. (It is normal to have a lot of

neutral indicators since many of the indicators are top or bottom indicators

that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) declined to -9 (9 more Bear

indicators than Bull indicators).

TODAY’S COMMENT:

Today’s Bull-Bear spread of -9 is a BEARISH indication.

The 10-dMA of the 50-Indicator Spread (purple line in the

chart above) is falling today so the overall 50-Indicator spread signal is

Bearish. (I follow the 10-dMA for trading buy-signals and as an indicator for

sell signals.)

Looks like the more likely

move for the markets now is down. The 50-dMA is 2.1% below today’s close. That’s

also at the lower trendline. That is my guess where the weakness in the markets

will end. I don’t know of course. Indicators don’t predict the future they just

indicate the trend. And the trend may be due to voter’s remorse as every new day

brings us another rediculous appointment by Trump. Negative indicators persist.

There was another Hindenburg

Omen today...

Hindenburg Omen: (https://www.investopedia.com/terms/h/hindenburgomen.asp).

As we’ve noted before, the Omen sends a lot of false warnings, but there have

been 3 Omens in the last 4 days. Clusters of Omens are supposed to be more

reliable than a single warning.

Further, the short-term Fosback New-high/new-low Logic

indicator that uses a similar analytic approach, is close to giving a sell

warning too. This doesn’t mean there is a crash coming, but more weakness is

suggested.

On a good note, the

S&P 500 finished strongly at the end of the day - it climbed nearly a half

percent in the last hour of trading. That could be the reversal that traders

have been waiting for.

BOTTOM LINE

I’m neutral on the markets. I’ll hold stock positions and

if declines continue, I’ll wait to see if the 50-dMA holds.

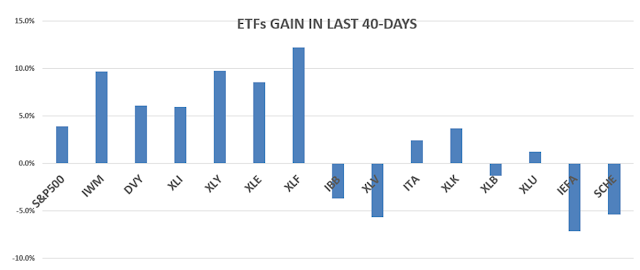

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

Intel and Dow Inc. have been

replaced by Sherwin-Williams and Nvidia Corp. in the Dow Industrials. It will take me a while to make changes to my

programming.

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained SELL. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched. (75% is my max

stock allocation when I am confident that markets will continue higher.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.